ID Form 41 2019 free printable template

Show details

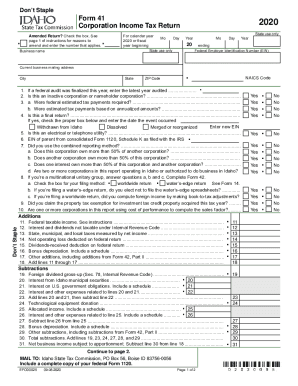

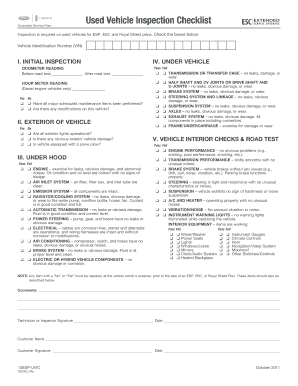

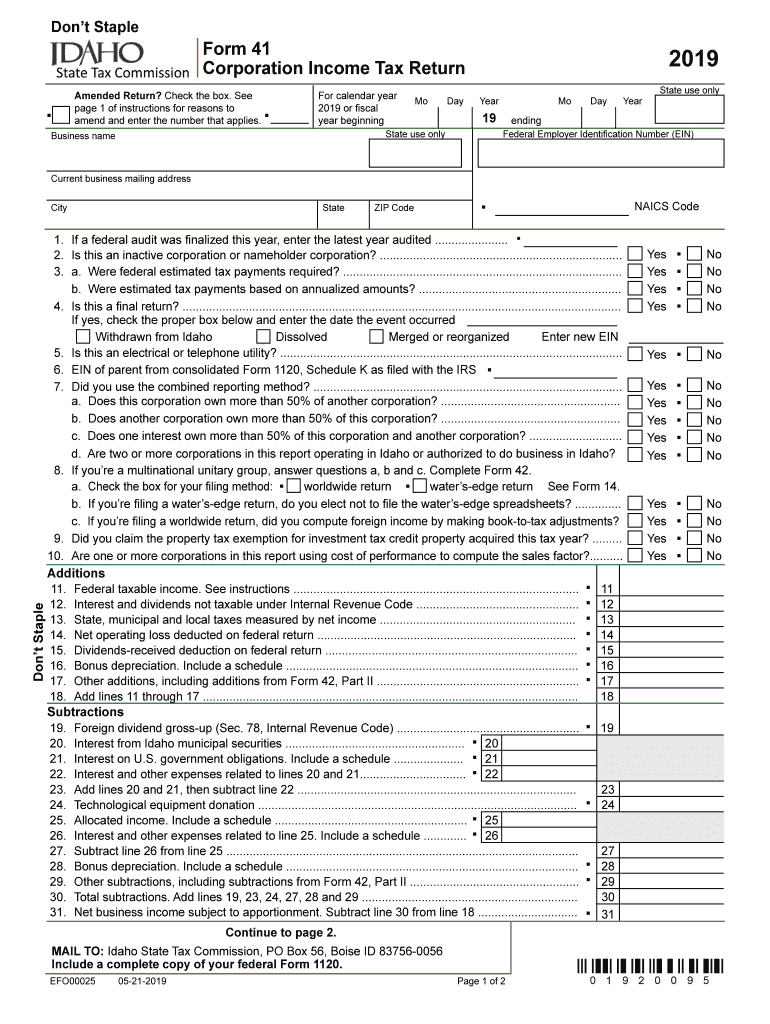

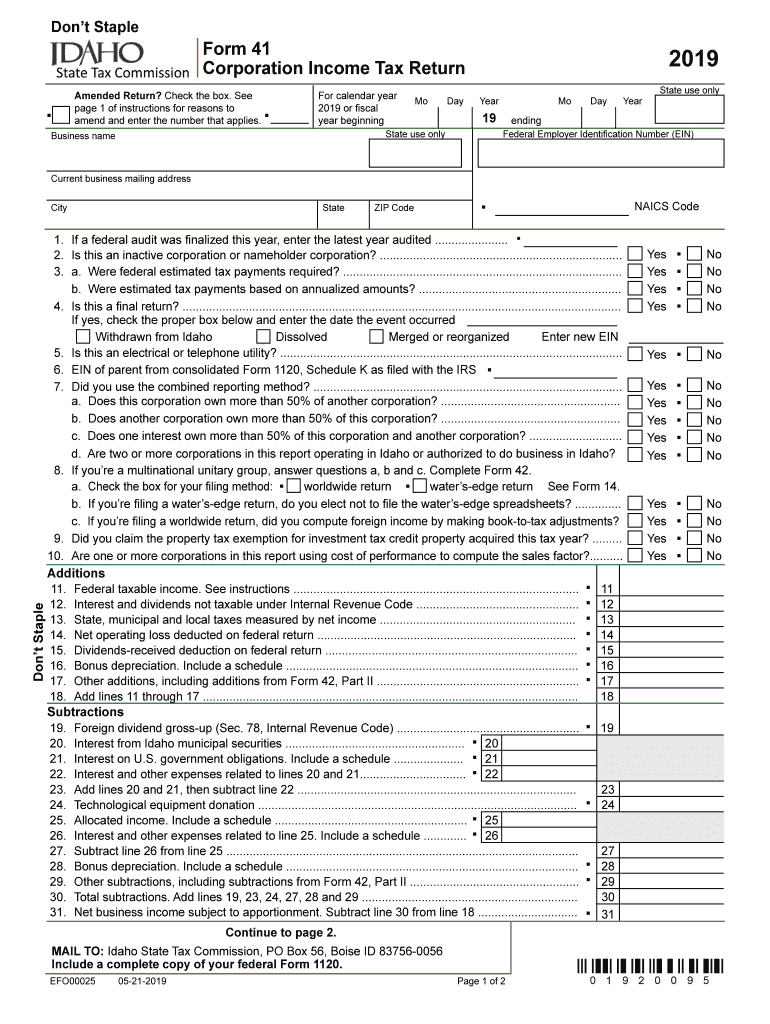

Don't Tapeworm 41 Corporation Income Tax ReturnAmended Return? Check the box. See page 1 of instructions for reasons to amend and enter the number that applies. For calendar year 2019 or fiscal year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Form 41

Edit your ID Form 41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Form 41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID Form 41 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ID Form 41. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Form 41 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Form 41

How to fill out ID Form 41

01

Begin by obtaining ID Form 41 from the appropriate agency or website.

02

Fill out the personal information section, including your full name, date of birth, and address.

03

Provide your identification numbers, such as Social Security number or passport number, as required.

04

If applicable, complete the section regarding your citizenship or immigration status.

05

Review any additional questions or sections specific to your situation.

06

Sign and date the form at the designated areas.

07

Submit the completed form according to the submission guidelines provided.

Who needs ID Form 41?

01

Individuals applying for a specific identification card or document.

02

People needing to update their personal information in official records.

03

Individuals who were issued an ID that is lost or needs to be replaced.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an Idaho employer account number?

Your account number can be found on your quarterly tax form, by logging in to send a secure message to the Tax Department, or by calling Employer Accounts at (208) 332-3576 or (800) 448-2977. Q: Do I need to report a new employee who quit before I reported the employee as a new hire?

How many Idaho allowances should I claim?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

What is the income tax rate in Idaho?

Income tax rates for 2022 range from 1% to 6% on Idaho taxable income. Individual income tax is graduated. This means that Idaho taxes higher earnings at a higher rate.

What are the tax changes for Idaho in 2023?

Idaho Tax Changes Effective January 1, 2023. Under H.B. 1, enacted in September 2022, Idaho will move to a flat individual income tax structure at a rate of 5.8 percent, down from the current top marginal rate of 6 percent.

How much tax does an LLC pay in Idaho?

LLCs taxed as C-corp C-corps will file Form 1120 with the IRS, and they'll pay the 21% federal corporate income tax as well as Idaho's 6% corporate income tax. Consult a tax professional before you even think about changing your LLC's tax status. Learn how to apply for C-corp status as an LLC.

What is the tax rate in Idaho 2023?

Idaho. Idaho enacted legislation in 2022 replacing its graduated tax rates ranging from 1% to 6% with a flat 5.8% tax rate. The new rate is effective for tax years beginning on or after January 3, 2023.

What is the permanent building fund tax in Idaho?

1) Every person and corporation required to file a tax return a return pays a tax of ten dollars (Section 63-3082, Idaho Code), which is credited to the Permanent Building Fund (Section 57-1110, Idaho Code).

What is my employer account number Idaho?

Your account number can be found on your quarterly tax form, by logging in to send a secure message to the Tax Department, or by calling Employer Accounts at (208) 332-3576 or (800) 448-2977.

How do I find my Idaho state tax ID number?

Find Your Idaho Tax ID Numbers and Rates You can find your Withholding Account Number on any mail you have received from the Idaho State Tax Commission. If you're unsure, contact the agency at (208) 334-7660.

Who must file Idaho tax return?

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

Who must pay Idaho Permanent Building Fund tax?

1) Every person and corporation required to file a tax return a return pays a tax of ten dollars (Section 63-3082, Idaho Code), which is credited to the Permanent Building Fund (Section 57-1110, Idaho Code).

Who is required to file an Idaho tax return?

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ID Form 41 online?

Completing and signing ID Form 41 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the ID Form 41 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ID Form 41 in seconds.

How do I complete ID Form 41 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your ID Form 41. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is ID Form 41?

ID Form 41 is a tax form used by individuals and entities to report certain financial information to the tax authorities, specifically regarding their income and deductions.

Who is required to file ID Form 41?

Individuals and entities that meet specific income thresholds or have particular financial activities, as defined by the tax authority, are required to file ID Form 41.

How to fill out ID Form 41?

To fill out ID Form 41, individuals and entities must gather required financial documents, accurately complete all sections of the form, and ensure that all relevant income and deductions are reported, followed by submitting it to the appropriate tax authority.

What is the purpose of ID Form 41?

The purpose of ID Form 41 is to ensure proper reporting of income and expenses for tax calculation, aiding in income assessment and compliance with tax regulations.

What information must be reported on ID Form 41?

ID Form 41 requires reporting of personal identification information, total income, allowable deductions, tax credits, and other relevant financial details depending on the specific requirements set by the tax authority.

Fill out your ID Form 41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Form 41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.