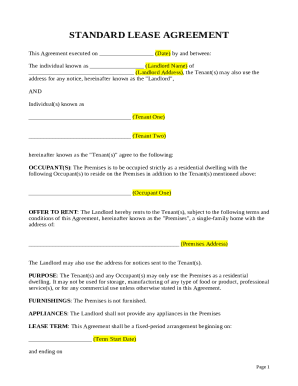

OK FRX 200 2017 free printable template

Show details

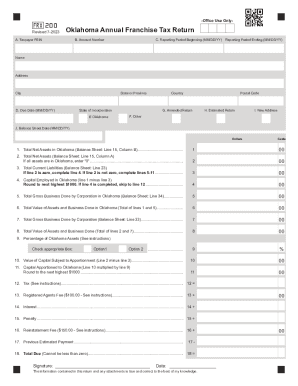

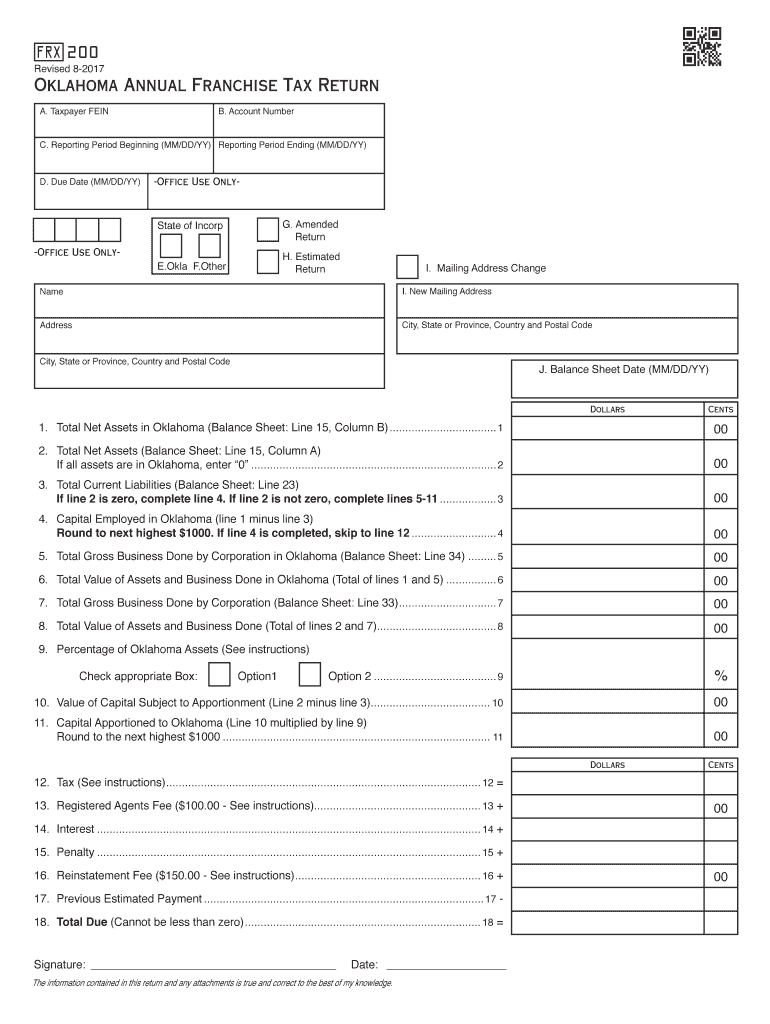

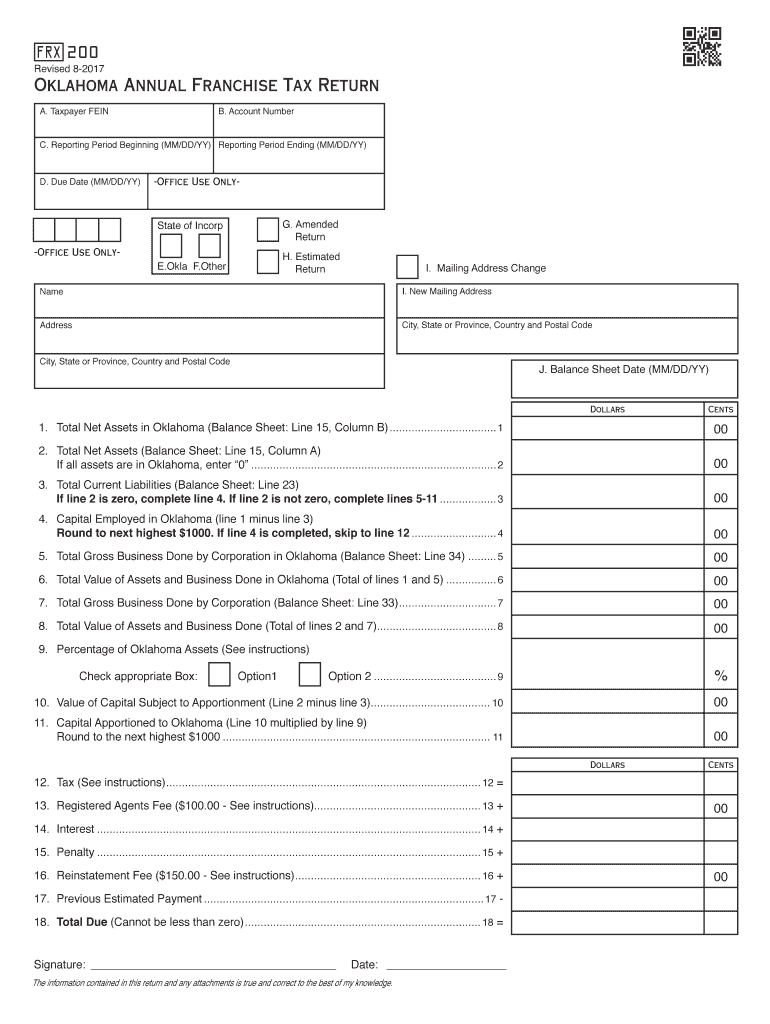

FIX 200Revised 82017Oklahoma Annual Franchise Tax Return

B. Account Number. Taxpayer FEINT. Reporting Period Beginning (MM/DD/BY) Reporting Period Ending (MM/DD/BY)

D. Due Date (MM/DD/BY)Office Use

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK FRX 200

Edit your OK FRX 200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK FRX 200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK FRX 200 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OK FRX 200. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK FRX 200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK FRX 200

How to fill out OK FRX 200

01

Obtain the OK FRX 200 form from the appropriate regulatory authority or website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information in the designated sections, including your name, address, and contact information.

04

Provide any necessary identification details and documentation as requested.

05

Complete the financial sections by inputting the required financial data accurately.

06

Review the entire form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the completed form according to the submission guidelines provided.

Who needs OK FRX 200?

01

Individuals or businesses that require financial reporting compliance.

02

Entities mandated by law to file financial documents.

03

Tax professionals assisting clients with financial disclosures.

04

Anyone involved in corporate governance or financial management.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Texas franchise tax return?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is franchise tax Return?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

What is a franchise tax filing?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

How much is franchise tax in Oklahoma?

Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Do I have to file a Texas franchise tax return?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Who has to file a franchise tax return in Oklahoma?

The franchise tax applies solely to corporations with capital of $201,000 or more. Eligible entities are required to annually remit the franchise tax. In Oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. Corporations reporting zero franchise tax liability must still file an annual return.

Can you e file Oklahoma franchise tax Return?

Pursuant to OAC 710:50-17-1, the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically. Refunds must be made by direct deposit.

Who is responsible for paying franchise tax?

A corporation or other business entity always has to pay the franchise tax in its home state. It may also have pay franchise taxes in other states in which it does business or owns property. Many corporations and other business entities have to pay franchise taxes in multiple states.

Does an LLC pay franchise tax in Oklahoma?

A penalty of 10% with 1.25% interest per month is due on payments made after the due date. What is the Oklahoma Annual Certificate? Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate.

How do franchises file taxes?

Understanding Franchise Taxes Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OK FRX 200 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your OK FRX 200 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete OK FRX 200 online?

pdfFiller has made it easy to fill out and sign OK FRX 200. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit OK FRX 200 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share OK FRX 200 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is OK FRX 200?

OK FRX 200 is a form used for reporting certain financial transactions and activities to the relevant regulatory authorities in the jurisdiction of the organization.

Who is required to file OK FRX 200?

Organizations and individuals engaged in specific financial activities or types of transactions as mandated by regulations in their jurisdiction are required to file OK FRX 200.

How to fill out OK FRX 200?

To fill out OK FRX 200, gather the necessary financial data, complete each section of the form accurately, and ensure all required signatures are present before submission.

What is the purpose of OK FRX 200?

The purpose of OK FRX 200 is to provide regulatory bodies with comprehensive financial information necessary for monitoring compliance with financial regulations and ensuring transparency in financial reporting.

What information must be reported on OK FRX 200?

Information that must be reported on OK FRX 200 typically includes financial transaction details, party identification, transaction dates, amounts, and any other relevant disclosures as specified by regulatory requirements.

Fill out your OK FRX 200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK FRX 200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.