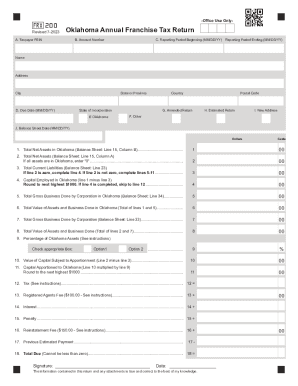

OK FRX 200 2021 free printable template

Get, Create, Make and Sign OK FRX 200

Editing OK FRX 200 online

Uncompromising security for your PDF editing and eSignature needs

OK FRX 200 Form Versions

How to fill out OK FRX 200

How to fill out OK FRX 200

Who needs OK FRX 200?

Instructions and Help about OK FRX 200

If you don't have a Web file account, view our how to create a Web file account video to learn how to sign up. If you already have an account, let's continue. Are you an outlet or list filer who needs to file a sales tax return? This video explains how to file using Web file. Remember, you can pause this video at any time. Let's get started. Enter your user ID and password and select login. From the systems' menu, select Web file pay taxes and fees. Select the 11 digit taxpayer number link next to the sales and use tax account you previously assigned. If your account is not listed, you will need to add it to your profile. Enter the 11 digit taxpayer number and select continue to add additional available taxes/fees. Let's get started filing your sales and use tax return. Select the radio button next to file original return and select continue. Now, select the period for which you are filing. If you are filing monthly, you will see the period in your year/month format. For example, the numbers 1410 represent October 2014. If you are set up to file quarterly, you will see the period in year/quarter format. For example, 143 represents the Third quarter of 2014. Selecting this period means you are filing for July through September 2014. If you are set up to file yearly, you will see the period as the year. Select a period and then select continue. The first part of your return is the credits taken page. Answer the questions about the credits taken on taxable purchases and licensed custom broker exported sales. You must answer both questions before continuing. These questions are for informational purposes only and do not affect the calculation of the return. Select Continue. If you have not donated inventory or used inventory for personal use answer, no to the credits taken on a taxable purchase question and proceed to the exported sales question. If answering yes to this question, enter the amount of tax credit being taken on this return for taxable purchases. Do not include prepayment or overpayments from other report periods. Enter the date for the oldest transaction for this report period for which you paid tax in error. If you are not a licensed customs broker, answer no and continue. If answering yes to this question, enter the amount refunded for this return for items exported outside the United States from all Texas licensed custom broker certificates. Once you have answered the questions about credits taken and exported sales, select continue. Now let's complete the total sales, taxable sales and taxable purchases section. Enter the amounts in this section in whole dollars only. For example, $100.96 would be entered as 101 or 100. Enter zero if you have no sales to report. The first field you must complete is total sales. Enter the total amount, not including tax, of all sales services, leases and rentals of tangible personal property including all related charges made during the reporting period. The second field you must complete is...

People Also Ask about

Who Must File Texas franchise tax return?

What is franchise tax Return?

What is a franchise tax filing?

What is Oklahoma form 512 S?

How much is franchise tax in Oklahoma?

Do I have to file a Texas franchise tax return?

Who has to file a franchise tax return in Oklahoma?

Can you e file Oklahoma franchise tax Return?

Who is responsible for paying franchise tax?

Does an LLC pay franchise tax in Oklahoma?

How do franchises file taxes?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the OK FRX 200 form on my smartphone?

How do I complete OK FRX 200 on an iOS device?

How do I complete OK FRX 200 on an Android device?

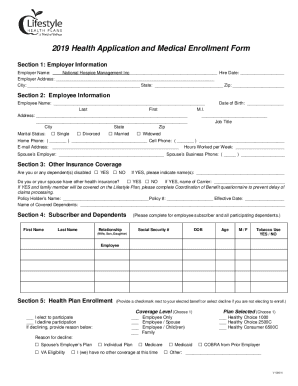

What is OK FRX 200?

Who is required to file OK FRX 200?

How to fill out OK FRX 200?

What is the purpose of OK FRX 200?

What information must be reported on OK FRX 200?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.