OK FRX 200 2015 free printable template

Show details

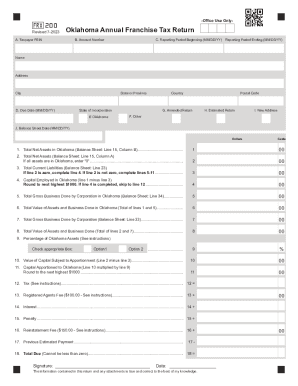

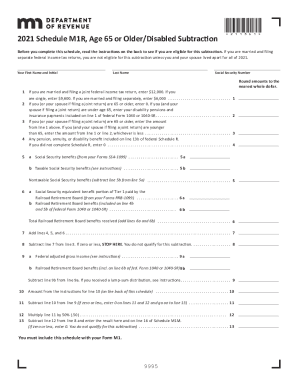

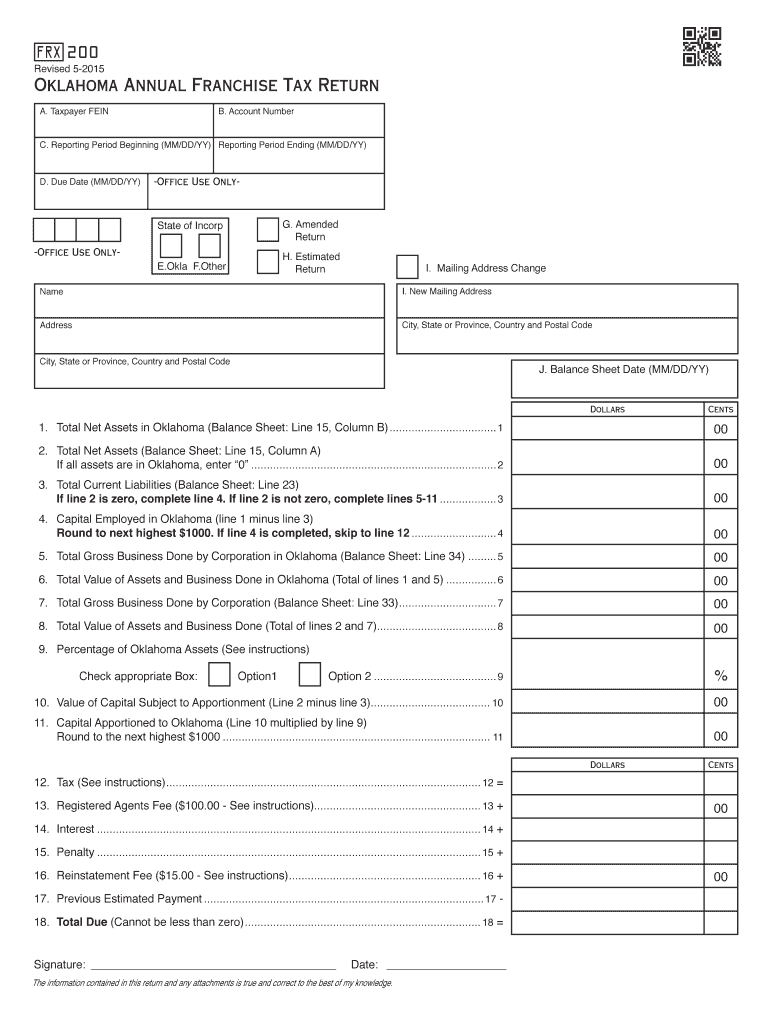

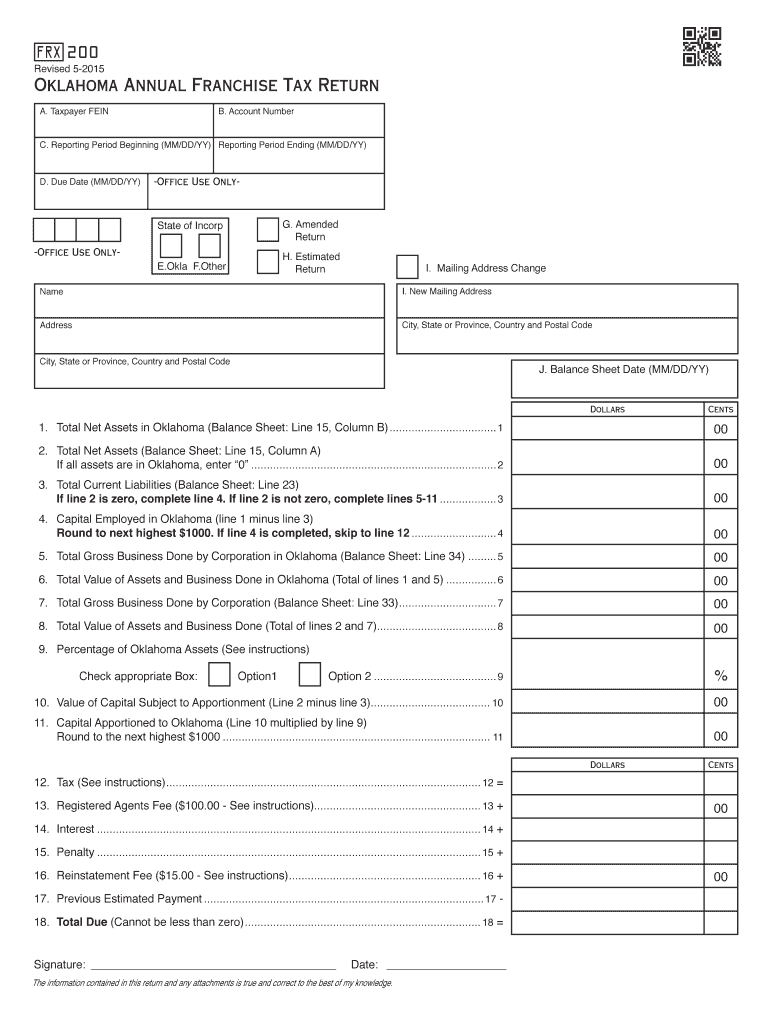

FRX 200

Revised 5-2015

Oklahoma Annual Franchise Tax Return

B. Account Number

A. Taxpayer FEIN

C. Reporting Period Beginning (MM/DD/YY) Reporting Period Ending (MM/DD/YY)

D. Due Date (MM/DD/YY)

-Office

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK FRX 200

Edit your OK FRX 200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK FRX 200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK FRX 200 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK FRX 200. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK FRX 200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK FRX 200

How to fill out OK FRX 200

01

Gather all necessary financial documents.

02

Start with the basic information section, filling in the entity's name and contact details.

03

Enter the fiscal period for which you are reporting.

04

Fill out the income section, listing all sources of income and their amounts.

05

Complete the expense section, detailing all business expenses incurred during the period.

06

Calculate the net profit or loss by subtracting total expenses from total income.

07

Review any additional required sections, such as assets and liabilities.

08

Ensure all figures are accurate and cross-verified with supporting documents.

09

Sign and date the document upon completion.

Who needs OK FRX 200?

01

Business owners and entrepreneurs reporting their financial performance.

02

Accountants preparing financial statements for clients.

03

Tax professionals assisting with compliance and tax filing.

04

Financial analysts and institutions evaluating business financial health.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Texas franchise tax return?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

What is franchise tax Return?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

What is a franchise tax filing?

The term franchise tax refers to a tax paid by certain enterprises that want to do business in some states. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

How much is franchise tax in Oklahoma?

Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Do I have to file a Texas franchise tax return?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Who has to file a franchise tax return in Oklahoma?

The franchise tax applies solely to corporations with capital of $201,000 or more. Eligible entities are required to annually remit the franchise tax. In Oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. Corporations reporting zero franchise tax liability must still file an annual return.

Can you e file Oklahoma franchise tax Return?

Pursuant to OAC 710:50-17-1, the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically. Refunds must be made by direct deposit.

Who is responsible for paying franchise tax?

A corporation or other business entity always has to pay the franchise tax in its home state. It may also have pay franchise taxes in other states in which it does business or owns property. Many corporations and other business entities have to pay franchise taxes in multiple states.

Does an LLC pay franchise tax in Oklahoma?

A penalty of 10% with 1.25% interest per month is due on payments made after the due date. What is the Oklahoma Annual Certificate? Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate.

How do franchises file taxes?

Understanding Franchise Taxes Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit OK FRX 200 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign OK FRX 200 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out OK FRX 200 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your OK FRX 200 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit OK FRX 200 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute OK FRX 200 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is OK FRX 200?

OK FRX 200 is a specific form used for financial reporting purposes in the state of Oklahoma.

Who is required to file OK FRX 200?

Businesses and individuals engaged in certain financial activities that meet the regulatory thresholds are required to file OK FRX 200.

How to fill out OK FRX 200?

To fill out OK FRX 200, individuals or businesses must provide accurate financial information, including income, expenses, and other relevant data, following the guidelines provided in the form instructions.

What is the purpose of OK FRX 200?

The purpose of OK FRX 200 is to collect financial data from businesses and individuals for regulatory oversight and statistical reporting in Oklahoma.

What information must be reported on OK FRX 200?

OK FRX 200 requires reporting of financial details such as total revenue, operating expenses, net profit, and any other pertinent financial metrics as specified on the form.

Fill out your OK FRX 200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK FRX 200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.