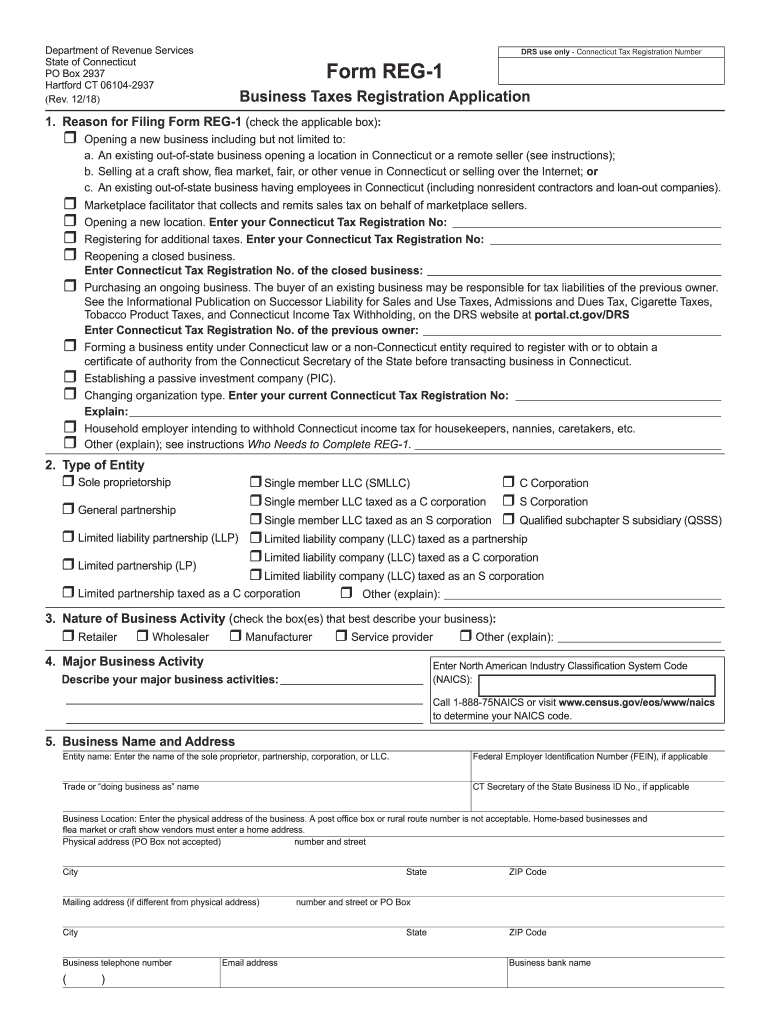

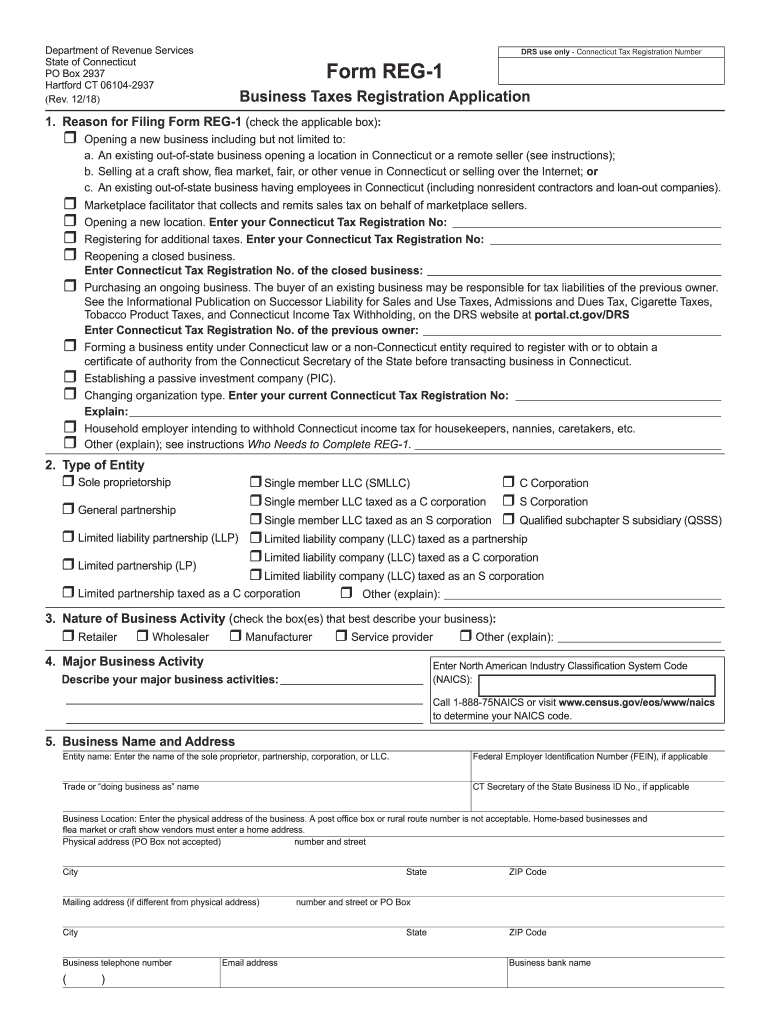

CT DRS REG-1 2018 free printable template

Get, Create, Make and Sign CT DRS REG-1

How to edit CT DRS REG-1 online

Uncompromising security for your PDF editing and eSignature needs

CT DRS REG-1 Form Versions

How to fill out CT DRS REG-1

How to fill out CT DRS REG-1

Who needs CT DRS REG-1?

Instructions and Help about CT DRS REG-1

Save time and get access to DSS 24 hours a day seven days a week online with my account, and now you can report changes and upload supporting verification documents to your DSS account if you don't have my account you can create one by clicking here if you already have an account associated with your DSS client ID number just log in using your username and password to access your account on the top of the page look for the report change link these are some changes you can make you can change your income information your address and telephone number someone in your household started or change jobs remember any change in income over a hundred dollars a month must be reported choose the item you have to change if you select more than one item you will be taken through each change in this example lets see how to report the change in address and phone number select your address and phone number change and click Next this page shows the current information DSS has on file to change your address just select and delete the old address and input the new address you next you have to answer the question about your living arrangements these are some options well check rent like yes or no if you have housing assistance will select now this section is for clients who have a mailing address different from their home address if this does not apply to you leave it blank now change your telephone number delete the OF number and input the new one if there is no change in your cell phone number leave the number listed if you have and change your email address you can fill the new one in here if you do not have an email address registered you can add one in this section click Next here is the information of your address and phone number that you just input if you need to go back and make changes you can click this icon and go back make any necessary changes and click Next again if you're ready to send the information you entered click Submit once you do this the information will be sent electronically you may be asked to provide proof of some changes you've told us about you do not need to call the benefit center to tell them about the changes you're about to report through connect CT click Submit this page lists the information you submitted it provides a tracking number for this submission it also provides a link for you to download a document with the information you submitted that you can view and print click Next this page is for verification and document submission here is your tracking number and the date of this change on the verification section there is a list of the documents needed to complete the change reporting process to set a proof through the US mail you must print a cover sheet by clicking on the cover sheet button Trade to include a cover she will delay the processing time the cover sheet provides the mailing address you can also submit documents online here show click the Browse button this will open into your computer drive find and select the...

People Also Ask about

How do I get a resale certificate in CT?

How to file CT state taxes for free?

How do I register for CT withholding tax?

Do I need to register with DRS CT?

What does CT DRS stand for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CT DRS REG-1?

How do I edit CT DRS REG-1 online?

How do I complete CT DRS REG-1 on an iOS device?

What is CT DRS REG-1?

Who is required to file CT DRS REG-1?

How to fill out CT DRS REG-1?

What is the purpose of CT DRS REG-1?

What information must be reported on CT DRS REG-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.