CT DRS REG-1 2012 free printable template

Show details

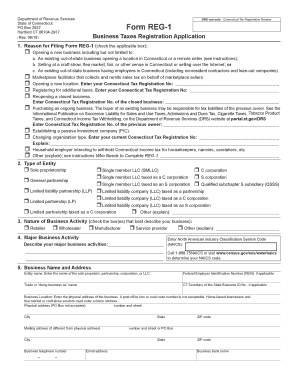

PRINT SAVE Department of Revenue Services State of Connecticut PO Box 2937 Hartford CT 06104-2937 Rev. 12/12 RESET Form REG-1 Business Taxes Registration Application 1. If you register by mail send Form REG-1 with your payment to Department of Revenue Services PO Box 2937 Hartford CT 06104-2937 Registration Fee a. If registering for sales and use taxes or room occupancy tax enter 100. Reason for Filing Form REG-1 Check the applicable box DRS use only Connecticut Tax Registration Number...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS REG-1

Edit your CT DRS REG-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS REG-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS REG-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT DRS REG-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS REG-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS REG-1

How to fill out CT DRS REG-1

01

Begin by downloading the CT DRS REG-1 form from the Connecticut Department of Revenue Services website.

02

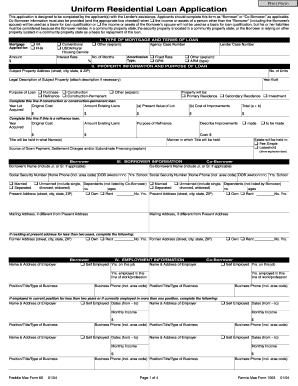

Fill in your personal information at the top, including your name, address, and contact information.

03

Enter your Social Security Number or Federal Employer Identification Number (EIN) in the designated section.

04

Complete the section regarding your business type, including whether you are an individual, corporation, or partnership.

05

Provide details about your business activities, including the type of goods or services you offer.

06

Review the sales tax section, ensuring that you indicate the expected sales and the type of tax you are registering for.

07

If applicable, fill out additional information regarding any previous registrations or tax exemptions.

08

Finally, sign and date the form at the bottom before submitting it as instructed in the guidelines.

Who needs CT DRS REG-1?

01

Individuals or businesses that are starting or operating in Connecticut and need to register for sales tax.

02

New business owners intending to sell goods or services that require sales tax collection.

03

Franchises or out-of-state businesses planning to do business in Connecticut.

04

Anyone making wholesale purchases or needing exemptions from certain taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file form 1310?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

What is a Reg 1 form in CT?

Purpose of Form REG-1 Use Form REG-1, Business Taxes Registration Application, to obtain a Connecticut tax registration number or to register for additional tax types under a previously obtained Connecticut tax registration. Use Form REG-1 to register for any of the taxes listed below.

What is a 1310 form in CT?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

Who must file a Connecticut partnership return?

Every PE that does business in Connecticut or has income derived from or connected with sources within Connecticut must file Form CT‑1065/CT‑1120SI regardless of the amount of its income or loss.

Does an executor have to file form 1310?

If you were named Executor or Administrator by the Register of Wills, then you are a “court appointed or certified personal representative” as defined by Form 1310. As a result, you must submit documentation that you are the personal representative of the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CT DRS REG-1 online?

With pdfFiller, it's easy to make changes. Open your CT DRS REG-1 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in CT DRS REG-1 without leaving Chrome?

CT DRS REG-1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out CT DRS REG-1 on an Android device?

Use the pdfFiller app for Android to finish your CT DRS REG-1. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is CT DRS REG-1?

CT DRS REG-1 is a form used by certain businesses in Connecticut to register with the Department of Revenue Services (DRS) for various tax purposes.

Who is required to file CT DRS REG-1?

Businesses that are starting operations in Connecticut or those who are making changes to their existing structure or tax obligations are required to file CT DRS REG-1.

How to fill out CT DRS REG-1?

To fill out CT DRS REG-1, you need to provide information such as your business name, address, type of ownership, and the specific taxes for which you are registering.

What is the purpose of CT DRS REG-1?

The purpose of CT DRS REG-1 is to ensure that businesses are properly registered for state taxes and to facilitate compliance with Connecticut tax laws.

What information must be reported on CT DRS REG-1?

CT DRS REG-1 requires the reporting of business information including the legal name, trade name, business address, type of organization, and the taxes the business intends to collect or pay.

Fill out your CT DRS REG-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS REG-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.