CT DRS REG-1 2006 free printable template

Show details

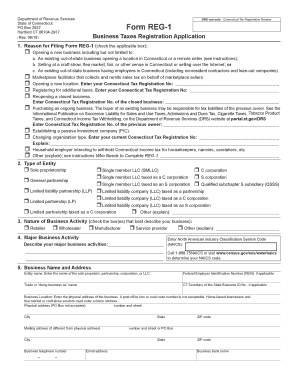

Department of Revenue Services State of Connecticut PO Box 2937 Hartford CT 06104-2937 (Rev. 05/06) Form REG-1 Business Taxes Registration Application DRS Use Only Connecticut Tax Registration Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS REG-1

Edit your CT DRS REG-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS REG-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS REG-1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS REG-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS REG-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS REG-1

How to fill out CT DRS REG-1

01

Obtain the CT DRS REG-1 form from the Connecticut Department of Revenue Services website or local office.

02

Fill in the business information, including the legal name, address, and contact information.

03

Indicate the type of business entity (e.g., corporation, partnership, etc.) on the form.

04

Provide the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as required.

05

Complete the section regarding the type of tax registration you are applying for.

06

Review all information for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the Connecticut Department of Revenue Services by mail or online as applicable.

Who needs CT DRS REG-1?

01

Any business that is conducting or planning to conduct business activities in Connecticut and needs to register for state taxes.

02

New businesses that require a tax registration before they can legally operate in the state.

03

Existing businesses that need to update their tax registration information or add new tax types.

Fill

form

: Try Risk Free

People Also Ask about

Where is my Connecticut State refund?

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463(Connecticut calls outside the Greater Hartford calling area only) or 860-297-5962(from anywhere).

How do I contact CT Revenue Services?

The Connecticut Department of Revenue Services (DRS) offers a variety of fast and convenient taxpayer service options. Business Hours: Monday through Friday 8:30 a.m. – 4:30 p.m. By Phone: 860-297-5962.

How long are CT refunds taking?

Your Connecticut refund status is available via phone: 800-382-9463 from anywhere, or in the Greater Hartford calling area call +1 860-297-5962. Generally, it takes 10 to 12 weeks to process paper returns and a shorter time to process e-filed returns.

What is CT DRS sales and use tax?

While the general sales and use tax rate is 6.35%, other rates are imposed under Connecticut law as follows: 1%

What does CT DRS stand for?

Connecticut State Department of Revenue Services.

When can I expect my CT state tax refund?

Connecticut state income tax refunds are generally issued within 10-12 weeks from the date that a paper return is received. Tax Refunds for electronically filed, WebFiled or Telefiled returns generally are issued within 4 business days of the receipt of the return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS REG-1 to be eSigned by others?

Once your CT DRS REG-1 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my CT DRS REG-1 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your CT DRS REG-1 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete CT DRS REG-1 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your CT DRS REG-1. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is CT DRS REG-1?

CT DRS REG-1 is a tax registration form used in Connecticut for individuals and businesses to register for business taxes with the Department of Revenue Services.

Who is required to file CT DRS REG-1?

Any individual or business entity planning to conduct business activities in Connecticut and require a tax registration must file CT DRS REG-1.

How to fill out CT DRS REG-1?

To fill out CT DRS REG-1, you should provide your business name, address, type of ownership, social security number or federal employer identification number, and the specific taxes you wish to register for.

What is the purpose of CT DRS REG-1?

The purpose of CT DRS REG-1 is to register businesses for various tax obligations in Connecticut, ensuring compliance with state tax laws.

What information must be reported on CT DRS REG-1?

The information that must be reported on CT DRS REG-1 includes the business name, address, owner's contact information, type of ownership, federal and state tax identification numbers, and the specific tax types for which the business seeks registration.

Fill out your CT DRS REG-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS REG-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.