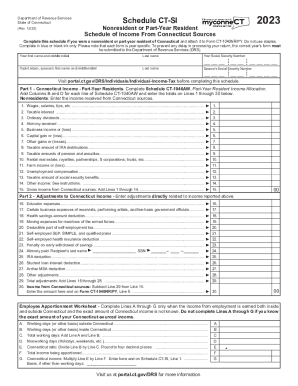

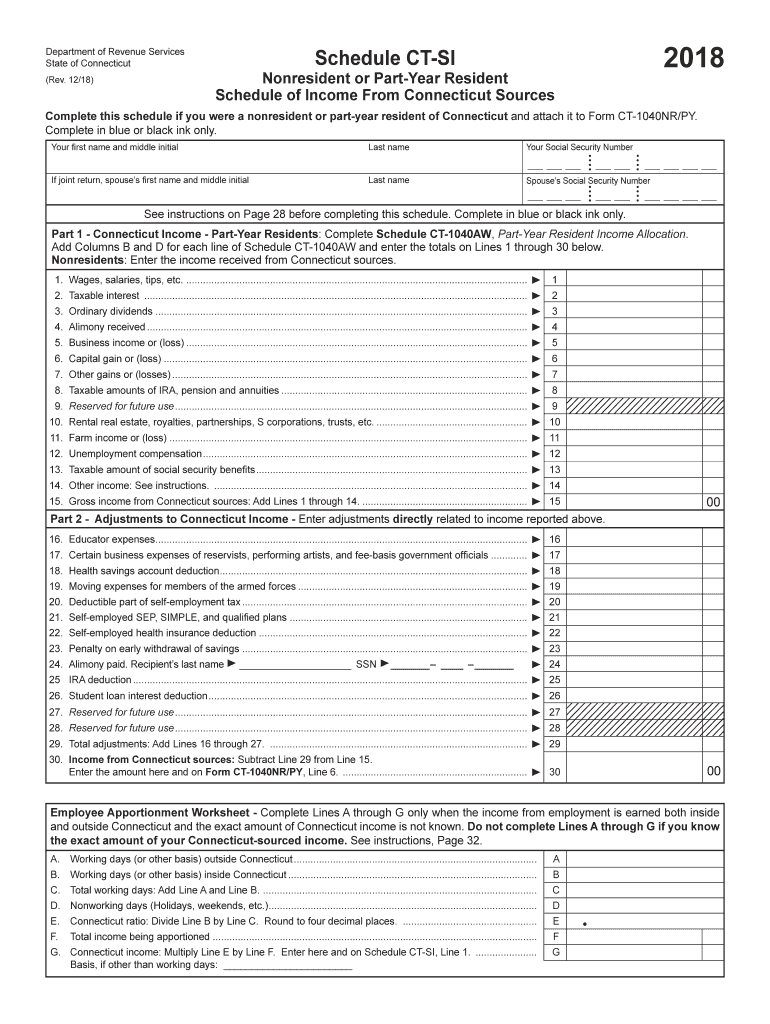

CT DRS Schedule CT-SI 2018 free printable template

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

How to fill out CT DRS Schedule CT-SI

About CT DRS Schedule CT-SI 2018 previous version

What is CT DRS Schedule CT-SI?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about CT DRS Schedule CT-SI

What should I do if I discover an error after submitting my connecticut si?

If you find an error after filing your connecticut si, you can submit an amended form to correct it. Ensure you clearly indicate the changes and provide any necessary documentation to support your amendment. Timely filing of corrections helps avoid potential penalties or discrepancies.

How can I track the status of my connecticut si after submission?

To track the status of your connecticut si, check the state's online system where you submitted the form. This system typically allows you to verify receipt and processing updates. If issues or rejections arise, common error codes may be provided for troubleshooting.

Are e-signatures acceptable when filing the connecticut si?

Yes, e-signatures are generally acceptable for the connecticut si. However, ensure that the e-signature complies with the state's legal requirements to maintain the validity of the form. Keep records of the electronic submission for your future references.

What if I am filing the connecticut si on behalf of someone else?

When filing the connecticut si for another individual or an entity, you must have Power of Attorney (POA) documentation or authorization to act on their behalf. Ensure you include all relevant information to avoid complications during processing.

What are common errors to watch for when completing the connecticut si?

Common errors when completing the connecticut si include missing signatures, incorrect taxpayer identification numbers, and failure to report all required payments. Reviewing the form thoroughly before submission helps prevent these mistakes and ensures compliance with state regulations.