CT DRS CT-1040ES 2019 free printable template

Show details

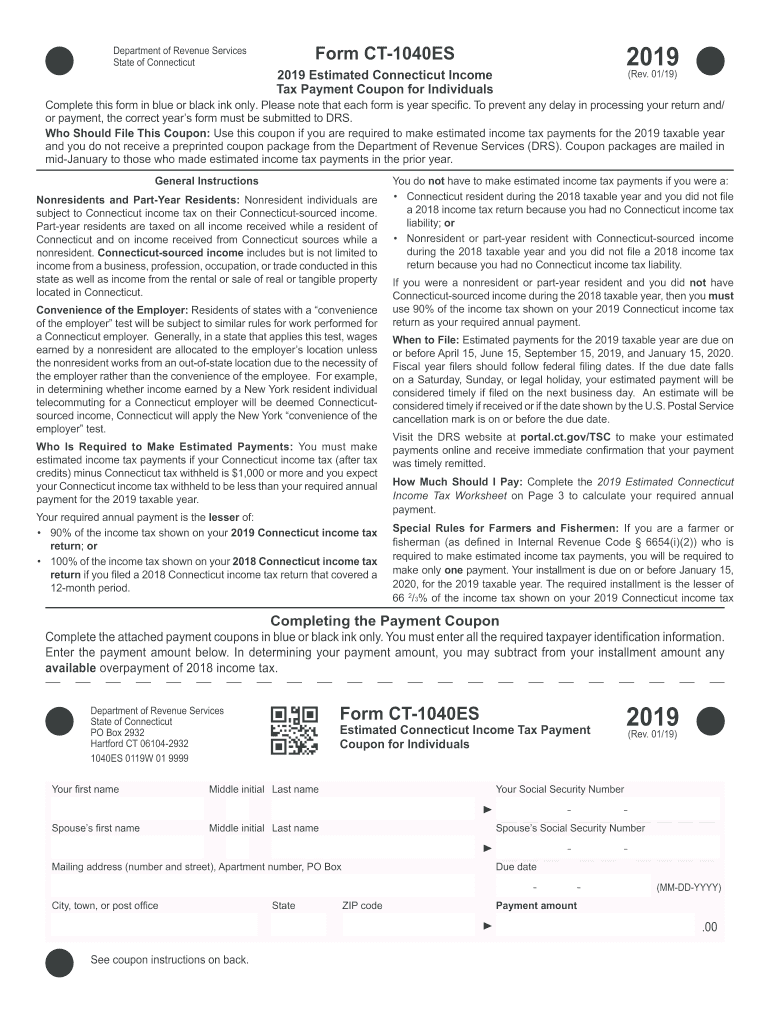

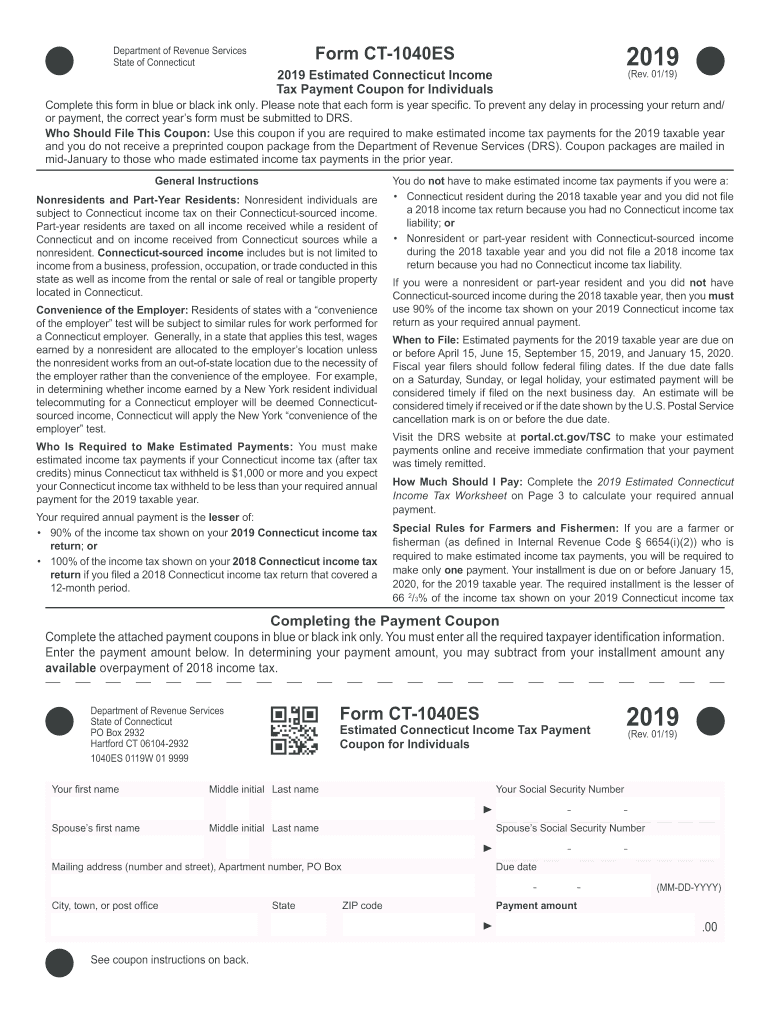

Department of Revenue Services

State of Connecticut2019Form CT1040ES2019 Estimated Connecticut Income

Tax Payment Coupon for Individuals(Rev. 01/19)Complete this form in blue or black ink only. Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1040ES

Edit your CT DRS CT-1040ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1040ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-1040ES online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT DRS CT-1040ES. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1040ES Form Versions

Version

Form Popularity

Fillable & printabley

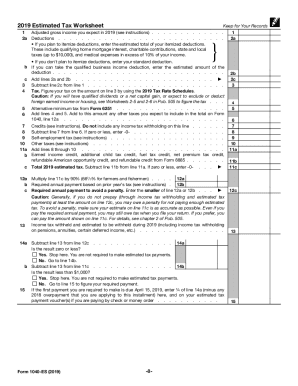

How to fill out CT DRS CT-1040ES

How to fill out CT DRS CT-1040ES

01

Obtain the CT DRS CT-1040ES form from the Connecticut Department of Revenue Services website or your local tax office.

02

Provide your name, address, and Social Security number at the top of the form.

03

Indicate the tax year for which you are submitting the estimated payment.

04

Calculate your estimated tax liability for the year based on your expected income.

05

Divide your total estimated tax by four to determine the amount due for each quarter.

06

Fill in the amount due for each quarter in the corresponding boxes on the form.

07

Review all provided information for accuracy.

08

Sign and date the form as required.

09

Send the completed form along with your payment to the address provided in the instructions.

Who needs CT DRS CT-1040ES?

01

Individuals or entities who expect to owe more than $1,000 in Connecticut income tax for the current tax year.

02

Taxpayers who are self-employed or have income not subject to withholding.

03

Individuals looking to make estimated tax payments to avoid underpayment penalties.

Fill

form

: Try Risk Free

People Also Ask about

Should you drink lots of water before a CT scan?

The day before and the day of the test you should stay very well hydrated. Drink lots of water, but avoid all other drinks especially anything containing caffeine, as they tend to dehydrate you. If you are having a CT with a contrast injection or barium please be sure drink plenty of water before and after the exam.

How long does a CT scan take from start to finish?

You can expect your CT scan appointment to last approximately 15 minutes start to finish. If you are having a CT scan with oral contrast, it could take as long as an hour and 15 minutes. Once the CT scan is complete, a radiologist will study the images and share the results with your doctor.

What is the liquid you drink before a scan?

Take oral contrast or IV contrast. For some CT scans, you will be asked to drink a special liquid called an oral contrast between 60–90 minutes before your test. This liquid contains barium sulfate and will help your doctor get a better picture of your abdomen. Alternatively, you may receive contrast dye through an IV.

What is the stuff you have to drink before a CT scan?

This is to allow time for you to drink barium sulfate before your exam and to ensure that the barium fluid completely coats your gastrointestinal tract. The barium helps to highlight body areas for the CT scan.

What to expect during the process of having a CT scan?

CT scans are painless and fast. You will lie on a long narrow table that slides you into a donut-shaped machine that is open on both sides. A Velcro strap will be placed around you for safety. When indicated, use of a contrast material could be necessary for your exam.

How long does a CT a scan take?

Typically a CT scan appointment will last approximately 15 minutes. For a CT scan with oral contrast, it could take up to 1 hour and 15 minutes.

What should you not do before a CT scan?

If your doctor ordered a CT scan with contrast, do not eat anything three hours prior to your CT scan. You are encouraged to drink clear liquids. You may also take your prescribed medications prior to your exam. DIABETICS: Diabetics should eat a light breakfast or lunch three hours prior to the scan time.

How long does it take to recover from a CT scan?

You shouldn't experience any after-effects from a CT scan and can usually go home soon afterwards. You can eat and drink, go to work and drive as normal. If a contrast was used, you may be advised to wait in the hospital for up to an hour to make sure you don't have a reaction to it.

What do I need to do before a CT scan?

How you prepare Take off some or all of your clothing and wear a hospital gown. Remove metal objects, such as a belt, jewelry, dentures and eyeglasses, which might interfere with image results. Refrain from eating or drinking for a few hours before your scan.

Do I have to remove my clothes for a CT scan?

You will need to take off all or most of your clothes, depending on which area is studied. You may be able to wear your underwear for some scans. You will be given a gown to use during the test. During the test, you will lie on a table that is attached to the CT scanner, which is a large doughnut-shaped machine.

Do you wear clothes for a CT scan?

Wear comfortable, loose-fitting clothing to your exam. You may be given a gown to wear during the scan. Metal objects including jewelry, eyeglasses, dentures and hairpins may affect the CT images and should be left at home or removed prior to your exam.

What to expect when you get a CT scan?

CT scans are painless and fast. You will lie on a long narrow table that slides you into a donut-shaped machine that is open on both sides. A Velcro strap will be placed around you for safety. When indicated, use of a contrast material could be necessary for your exam.

How do I prepare for a CT scan?

How you prepare Take off some or all of your clothing and wear a hospital gown. Remove metal objects, such as a belt, jewelry, dentures and eyeglasses, which might interfere with image results. Refrain from eating or drinking for a few hours before your scan.

What is the stuff you drink before CT scan?

You will swallow the barium liquid or paste just before a CT scan or x-ray. Your doctor may tell you not to eat or drink anything the night before your test. Barium will work better if your stomach and bowels are empty. It is important to drink plenty of liquids during and after the test.

How is a CT scan done?

During a CT scan, you lie in a tunnel-like machine while the inside of the machine rotates and takes a series of X-rays from different angles. These pictures are then sent to a computer, where they're combined to create images of slices, or cross-sections, of the body.

What do you wear when having a CT scan?

Depending on the part of the body to be examined, we may ask you to remove some clothing and put on an examination gown in a changing cubicle before the scan. We will let you know when you arrive. If you can wear loose fitting clothes with no metal fastenings like zips, poppers and hooks and eyes.

How long do you stay in a CT scan?

Typically, you should plan for an hour for a CT scan. Most of that time is for preparation. The scan itself takes between 10 and 30 minutes or less. Generally, you can resume your activities after a healthcare provider says it is safe to do so — usually after they complete the scan and verify clear images.

How long does a CT scan take?

Typically a CT scan appointment will last approximately 15 minutes. For a CT scan with oral contrast, it could take up to 1 hour and 15 minutes. If you are receiving CT scan IV contrast, do not eat or drink 4 hours prior your exam. You may continue to drink water if you prefer.

What is the prep for a CT scan?

If your doctor ordered a CT scan with contrast, do not eat anything three hours prior to your CT scan. You are encouraged to drink clear liquids. You may also take your prescribed medications prior to your exam. DIABETICS: Diabetics should eat a light breakfast or lunch three hours prior to the scan time.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CT DRS CT-1040ES in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your CT DRS CT-1040ES and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit CT DRS CT-1040ES straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing CT DRS CT-1040ES.

How do I complete CT DRS CT-1040ES on an Android device?

Use the pdfFiller mobile app and complete your CT DRS CT-1040ES and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CT DRS CT-1040ES?

CT DRS CT-1040ES is a form used by individuals in Connecticut to report estimated income tax payments to the state's Department of Revenue Services.

Who is required to file CT DRS CT-1040ES?

Individuals who expect to owe Connecticut income tax of $1,000 or more for the tax year are required to file CT DRS CT-1040ES.

How to fill out CT DRS CT-1040ES?

To fill out CT DRS CT-1040ES, you need to provide your name, address, Social Security number, the estimated tax year, and the amounts for each estimated payment period.

What is the purpose of CT DRS CT-1040ES?

The purpose of CT DRS CT-1040ES is to allow taxpayers to make estimated tax payments on income that is not subject to withholding, ensuring they meet their tax obligations.

What information must be reported on CT DRS CT-1040ES?

CT DRS CT-1040ES requires reporting of personal information such as name and SSN, estimated taxable income, deductions, and the amount of estimated tax due for each payment period.

Fill out your CT DRS CT-1040ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1040es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.