CT DRS CT-1040ES 2016 free printable template

Show details

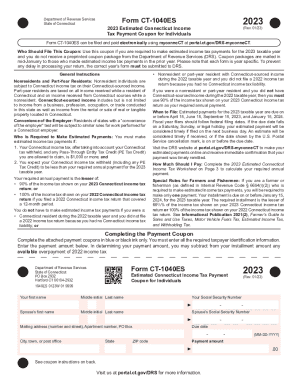

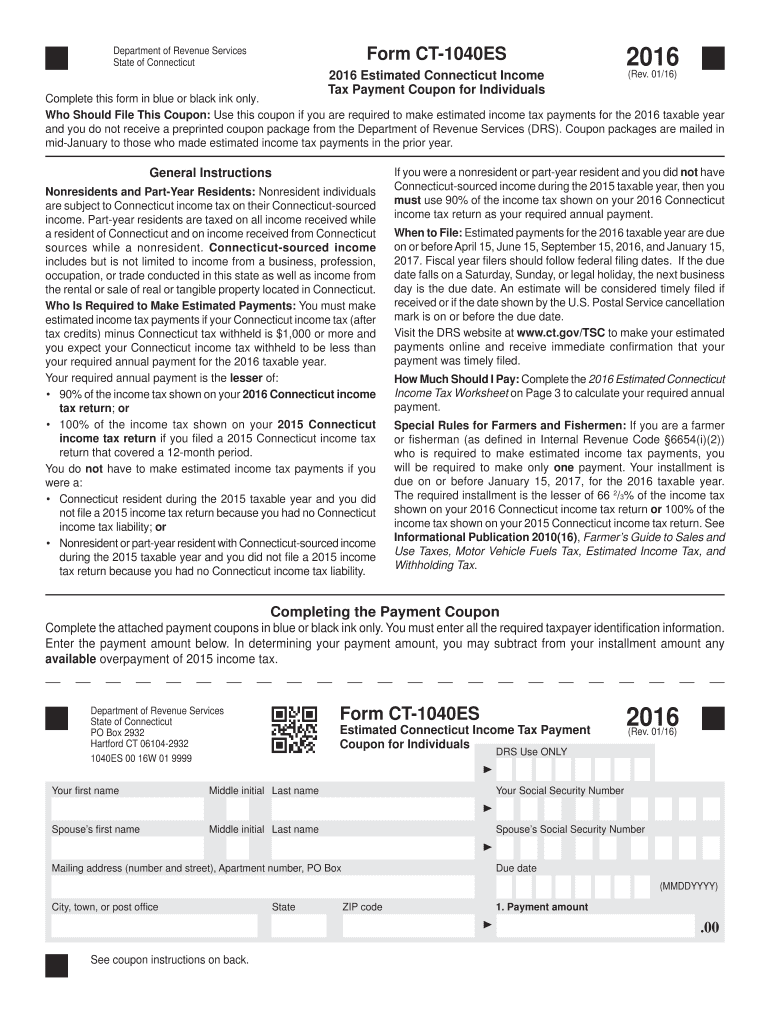

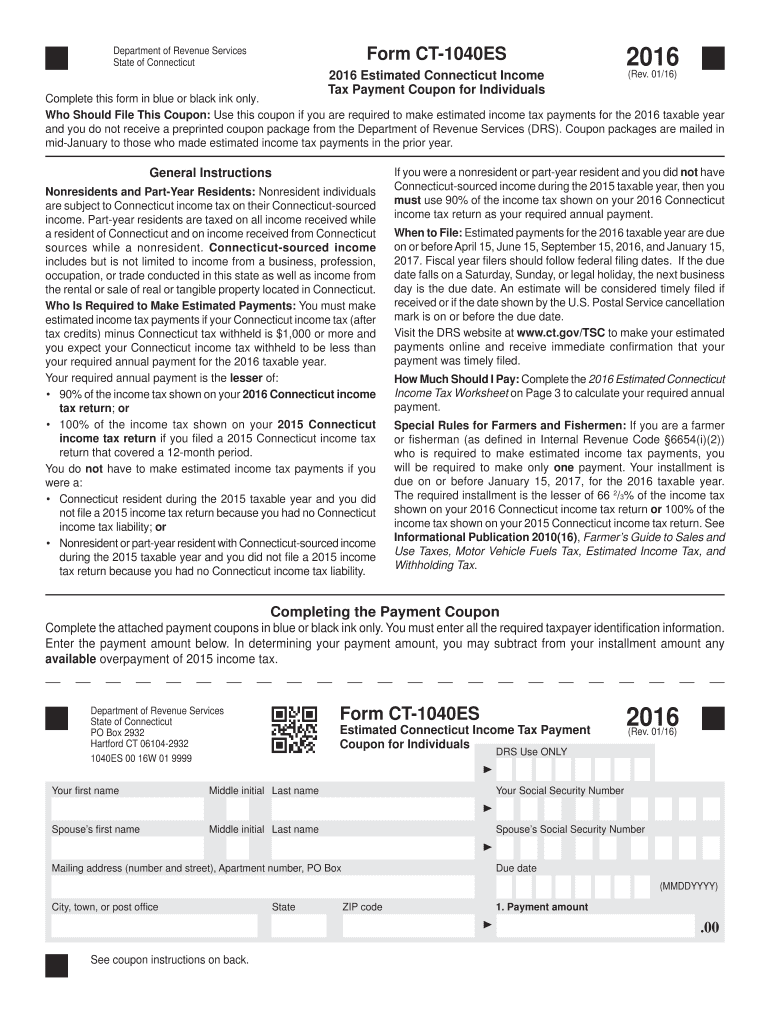

Do not mail Form CT-1040ES if you make your payment by credit card or debit card. Your payment will be effective on the date you make the charge. DRS may submit your check to your bank electronically. To ensure proper posting write your SSN s optional and 2016 Form CT-1040ES on your check. To ensure your payment is applied to your account write 2016 Form CT-1040ES and your Social Security Number SSN optional on the front of your check. Department of Revenue Services State of Connecticut Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 1040es 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 1040es 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 1040es 2016 form online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ct 1040es 2016 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

CT DRS CT-1040ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct 1040es 2016 form

01

Ensure you have the necessary information and documents: Before filling out the CT 1040ES 2016 form, gather all the required information and documents. This includes your social security number, income statements, deductions, and any other relevant information that would be necessary for accurately completing the form.

02

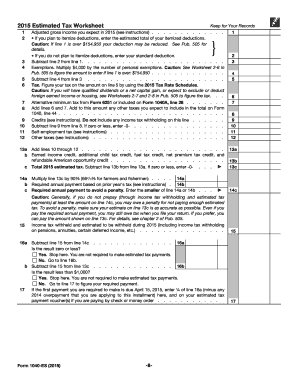

Determine your estimated tax liability: The CT 1040ES 2016 form is used to make estimated tax payments for the 2016 tax year. To fill it out, you need to calculate your estimated tax liability for the year. This can be done by using your prior year's tax return as a reference or by using the instructions provided with the form.

03

Fill out the personal information section: Start by filling out your personal information section. Include your name, address, social security number, and filing status. Double-check the accuracy of the information to avoid any errors or delays in processing.

04

Estimate your income: In the next section, estimate your total income for the year. This includes wages, self-employment income, interest, dividends, and any other sources of income. Go through each line carefully, ensuring that you include all relevant income sources and provide accurate figures.

05

Calculate your deductions: Deductions can help lower your taxable income. Deductions could include expenses such as student loan interest, mortgage interest, or contributions to retirement accounts. Follow the instructions provided with the form to accurately calculate your deductions and determine your taxable income.

06

Calculate your estimated tax liability: Using the information from steps 4 and 5, calculate your estimated tax liability for the year by applying the appropriate tax rates and brackets. Be sure to follow the instructions provided with the CT 1040ES 2016 form to correctly calculate the total amount you owe in estimated taxes.

07

Complete the payment vouchers: The CT 1040ES 2016 form includes payment vouchers that you can detach and use to submit your estimated tax payments. Fill out the payment vouchers with your personal information, estimated tax liability, and the payment amount. Detach and keep the payment voucher copy for your records.

08

Make your estimated tax payments: Mail your completed payment vouchers along with your payment to the address provided on the form. Ensure that you include the appropriate payment method, such as a check or money order made payable to the Connecticut Department of Revenue Services.

Who needs CT 1040ES 2016 form?

01

Individuals who expect to owe taxes: The CT 1040ES 2016 form is typically used by individuals who anticipate owing taxes for the 2016 tax year. It helps them make estimated tax payments throughout the year to avoid penalties and interest on underpayment.

02

Self-employed individuals or freelancers: If you are self-employed or work as a freelancer, you may need to fill out the CT 1040ES 2016 form to make estimated tax payments on your income that is not subject to withholding taxes.

03

Individuals with significant investment income: If you have significant investment income, such as interest, dividends, or capital gains, and anticipate owing taxes, you may be required to fill out the CT 1040ES 2016 form to make estimated tax payments.

It is important to note that tax laws and requirements can vary. It is recommended to consult with a tax professional or refer to the specific guidelines provided by the Connecticut Department of Revenue Services to ensure accuracy and compliance with the latest regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ct 1040es 2016 form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ct 1040es 2016 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get ct 1040es 2016 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ct 1040es 2016 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the ct 1040es 2016 form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ct 1040es 2016 form.

Fill out your ct 1040es 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.