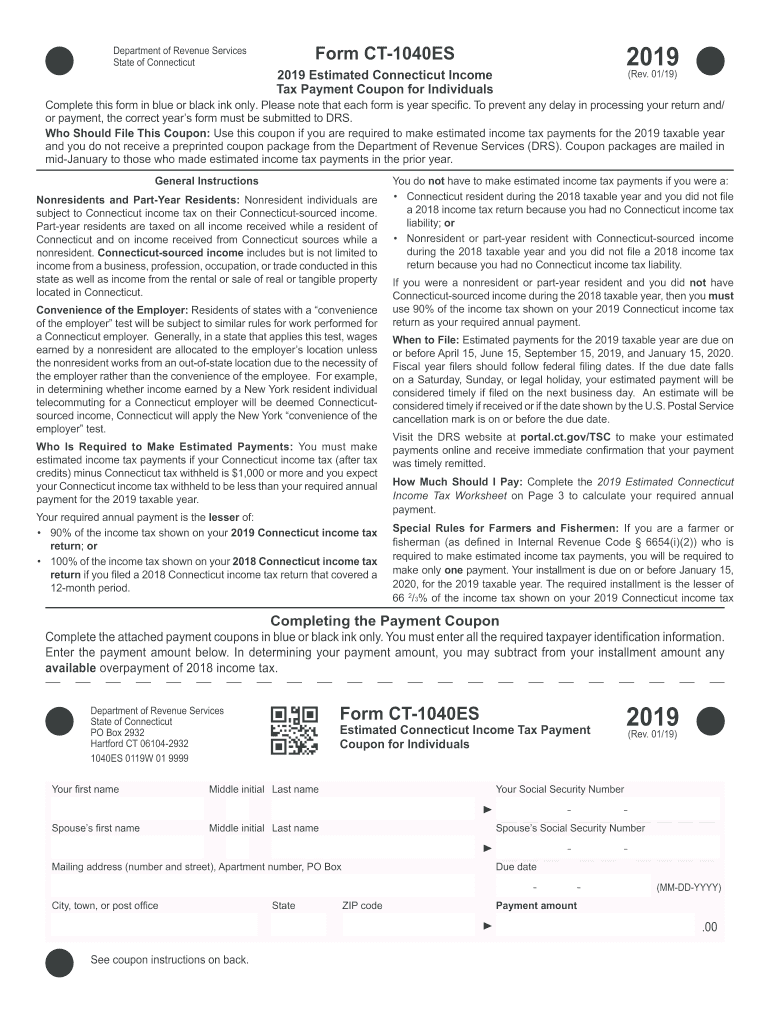

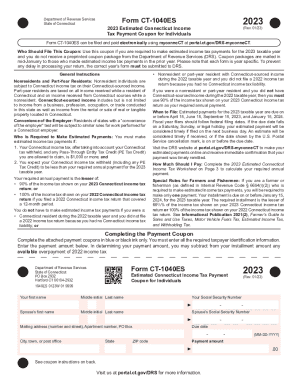

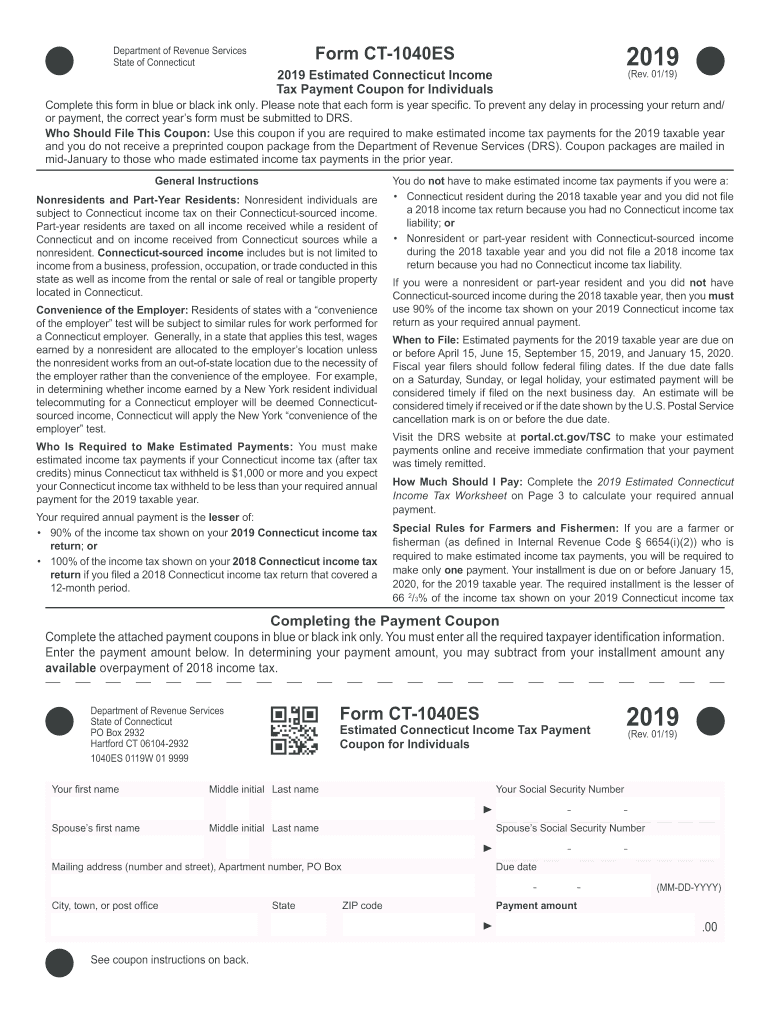

CT DRS CT-1040ES 2019 free printable template

Get, Create, Make and Sign

How to edit ct form online

CT DRS CT-1040ES Form Versions

How to fill out ct form 2019

How to fill out ct form

Who needs ct form?

Video instructions and help with filling out and completing ct form

Instructions and Help about ctforms

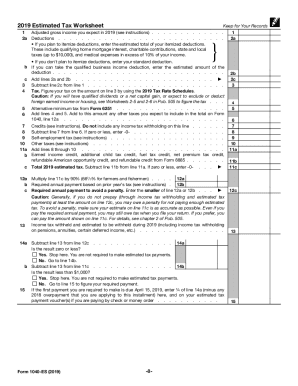

The next topic is quarterly estimated tax payments here right this is the big one right okay this is the big one and just a little background what our quarterly estimated tax payments and when are you required to start submitting quarterly estimated tax payments okay because not everyone is required to submit quarterly estimated tax payments okay so by law the IRS states that if you are estimated to owe more than a thousand dollars in taxes by year-end for your 1099 income not your w-2 okay just for your 1099 income then you are required to start submitting quarterly estimated tax payments and there are four due dates for quarterly estimated tax payments those are April 15 June 15 September 15 and January 15th of the following year okay and the payment method there are several ways you can do it you can mail it in you could pay over the phone okay, or you can pay it online pay it online okay is this a lot easier it's a lot more secure just paid online the IRS has a link on their site to submit court same tax payments the state of Illinois you can pay it online as well so pay it online it's most secure but going back to quarterly estimated tax payments what you pay how do you calculate it right that's the best a million dollar question there are two methods here okay and the two methods that I'm going to give to you guys is to avoid penalties okay because what happens is if you under pay during a given year, and you owe taxes when you report your e-file your 1040 the next year there's going to be interested in penalties for under payment okay so how do you avoid under payment because I always stress avoiding penalties and interest in under paying versus overpaying the government giving them an interest-free loan so why pay them more money get a refund right a refund is not a good thing everyone thinks that a refund is something that a CPA or Turbo Tax conjures up for you, it is not bad right it's not magic it's basically you overpaid in taxes right, but I would rather have each one of you have that money during the year rather than you're just getting a lump sum at the end of the year right it's called the safe harbor rule okay and what that is you pay 100 of your prior your taxes that were due okay what does that mean you're going to need your prior your tax return okay so your 1040 you look on page 2 line 63 okay line 63 on page 200 1040 will show you total tax due for that year okay you take that number you divide it by four okays you pay that number in for in those four quarterly due dates by those four due dates that I mentioned you know April June September and January 15 pay those in for equal assignments and even if you at the end of the year let's say you had a better year than the prior year even though you technically underpaid you won't be trying to interest in penalties because you paid 100 of your prior taxes so that but one thing I do want to tell you is that like I'm a big advocate of paying real time taxes right so that the end...

Fill income tax form for connecticut : Try Risk Free

People Also Ask about ct form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ct form 2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.