CT DRS CT-1041 2018 free printable template

Show details

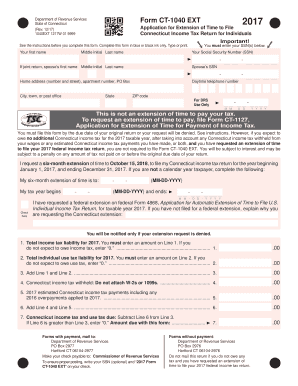

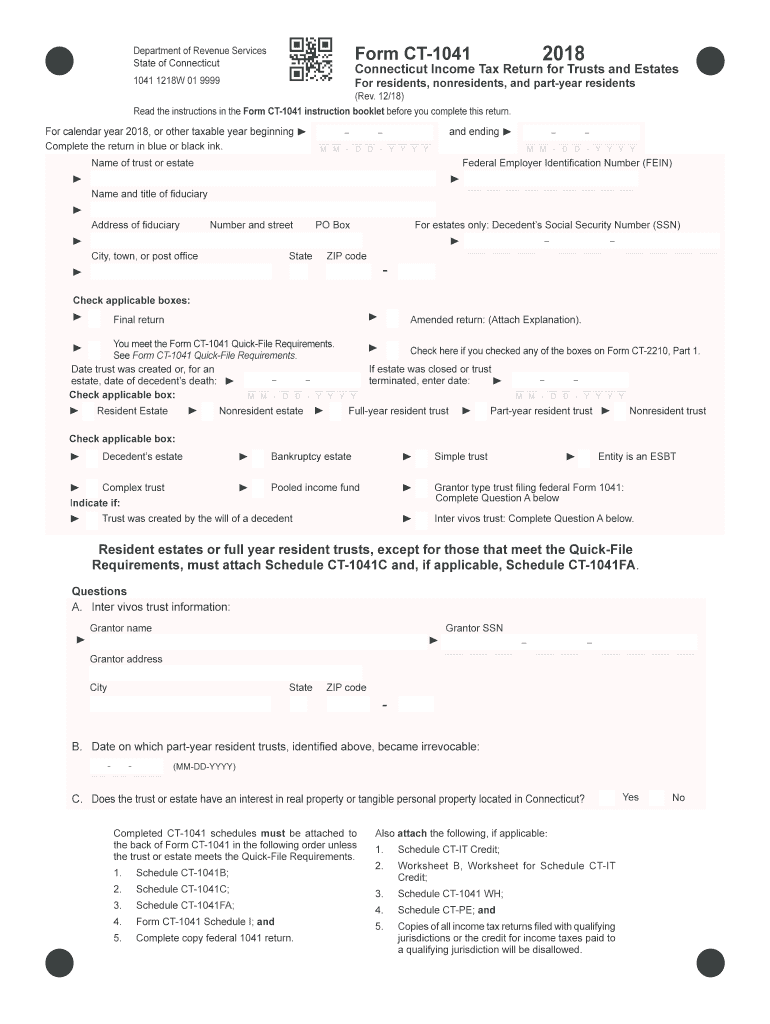

2018Department of Revenue Services State of ConnecticutForm CT10411041 1218W 01 9999For residents, nonresidents, and part year residents Connecticut Income Tax Return for Trusts and Estates(Rev. 12/18)

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 tax form, use a tool like pdfFiller that allows you to upload the form and make necessary changes directly on the document. Ensure all edits adhere to the guidelines set forth by the Connecticut Department of Revenue Services to avoid compliance issues. After editing, review the form carefully to verify that all information is accurate before saving or printing.

How to fill out CT DRS CT-1041

To fill out the CT DRS CT-1041 form, follow these steps:

01

Begin by entering your identification information at the top of the form, including your fiduciary name and address.

02

Complete each section regarding income, deductions, and credits as applicable to your estate or trust.

03

Review your entries for accuracy and completeness before submission.

Be attentive to specific instructions for each line to ensure compliance with state tax laws. Refer to the form's instructions for guidance on more complex entries.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is the Connecticut estate and trust income tax return form used to report income earned by estates and trusts. It is necessary for managing tax liabilities associated with estates or trusts operating within the state of Connecticut.

What is the purpose of this form?

The purpose of the CT DRS CT-1041 form is to calculate and report the income generated by a trust or an estate for the taxable year. This form enables the Connecticut Department of Revenue Services to assess tax owed by estates and trusts accurately.

Who needs the form?

Estates and trusts that earn income in Connecticut must file the CT DRS CT-1041 form. If the estate or trust has a gross income exceeding a specific threshold, filing is mandatory to ensure compliance with state tax regulations.

When am I exempt from filling out this form?

You may be exempt from filing the CT DRS CT-1041 if your estate or trust generates less income than the defined threshold limit for the tax year. Additionally, certain trusts, such as charitable trusts, may also be exempt based on their specific nature and purpose.

Components of the form

The CT DRS CT-1041 form includes various components such as income sections, deduction entries, and areas for credits. Each section is designated for specific types of income and expenses related to the estate or trust, ensuring accurate reporting of all financial activities.

What are the penalties for not issuing the form?

If you fail to issue the CT DRS CT-1041 when required, you may face penalties including fines and interest on any taxes owed. Non-compliance can also lead to legal repercussions and additional scrutiny from tax authorities.

What information do you need when you file the form?

When filing the CT DRS CT-1041, gather the following information:

01

Fiduciary name, address, and identification number.

02

Details regarding income earned by the estate or trust.

03

Information on eligible deductions and credits applicable to your situation.

Maintaining accurate records of financial transactions will facilitate a smoother filing process and reduce the likelihood of errors.

Is the form accompanied by other forms?

Yes, the CT DRS CT-1041 may need to be accompanied by other forms, including supporting schedules that detail various types of income, deductions, and credits claimed. Always check the instructions that accompany the form for specific requirements related to additional documentation.

Where do I send the form?

Submit the completed CT DRS CT-1041 form to the Connecticut Department of Revenue Services. The address can be found in the instructions provided with the form, which may vary depending on your location or the method of return (i.e., mailed or electronically submitted).

See what our users say