KY DoR 765-GP 2017 free printable template

Show details

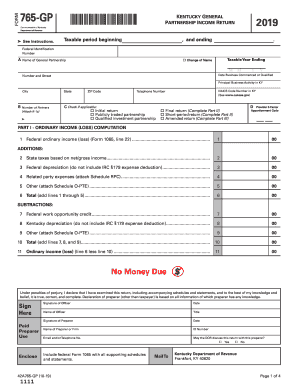

FORM 765-GP Commonwealth of Kentucky Department of Revenue See instructions. Federal Identification Number KENTUCKY GENERAL PARTNERSHIP INCOME RETURN 1700030034 Taxable period beginning 201 and ending 201. 42A765-GP 6SEP17 Mail To Kentucky Department of Revenue P. O. Box 856905 Louisville KY 40285-6905 Page 1 of 4 FORM 765-GP 1700030336 PART II EXPLANATION OF FINAL RETURN AND/OR SHORT PERIOD RETURN Ceased operations in Kentucky Change of ownership Successor to previous business Change...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 765-GP

Edit your KY DoR 765-GP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 765-GP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 765-GP online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DoR 765-GP. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 765-GP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 765-GP

How to fill out KY DoR 765-GP

01

Download the KY DoR 765-GP form from the Kentucky Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the details of the property for which you are submitting the form, including its location and type.

04

Indicate the reason for the exemption request in the appropriate section, clearly explaining your eligibility.

05

Attach any required supporting documents, such as proof of ownership or tax exemption status.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form to the relevant county property valuation administrator or the Kentucky Department of Revenue.

Who needs KY DoR 765-GP?

01

Individuals or businesses seeking tax exemptions for specific properties in Kentucky.

02

Property owners who qualify for exemptions due to charitable, religious, or educational purposes.

03

Organizations that need to file for a property tax exemption under Kentucky state law.

Fill

form

: Try Risk Free

People Also Ask about

What is the pass-through entity tax in Kentucky?

Kentucky enacts new pass-through entity (PTE) tax election. The new PTE tax election allows owners of entities making the election to benefit from deductions that exceed the current $10,000 limit.

Does Ky require an extension?

Extensions - Kentucky allows an automatic extension of six months if no additional tax is due AND a federal extension has been filed. Any extension granted is for time to file and does NOT extend time to pay. The Kentucky extension application can be e-filed.

What form does a partnership file in Kentucky?

A Kentucky Form 4562 must be filed for each year even though a federal Form 4562 may not be required.

What is the extension form for PTE in Kentucky?

To extend a filing date, use Form 720EXT, Extension of Time to File Kentucky Corporation/LLET Return. Extensions—Extensions are for extending the filing date only; late payment penalties and interest apply to payments made after the original due date.

Does Ky accept federal extension for partnerships?

For Partnership The businesses operating as partnerships in Kentucky need to file Form 720EXT with the state to obtain a 6-month extension of time to file their partnership income tax return Form 765 with the state. Or else, You can submit a copy of the federal extension to the return when filed.

Does federal extension cover states?

If you are requesting a federal extension, you are most likely going to need a state extension as well, and the procedures that you must follow vary widely from state to state. Nearly all states follow the federal government's lead and allow an automatic six-month extension of time to prepare and file your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KY DoR 765-GP to be eSigned by others?

Once you are ready to share your KY DoR 765-GP, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit KY DoR 765-GP in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing KY DoR 765-GP and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit KY DoR 765-GP on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing KY DoR 765-GP right away.

What is KY DoR 765-GP?

KY DoR 765-GP is a form used by taxpayers in Kentucky to report and pay the state's gross receipts tax for certain businesses.

Who is required to file KY DoR 765-GP?

Businesses that have gross receipts that meet or exceed the threshold for reporting under Kentucky law are required to file KY DoR 765-GP.

How to fill out KY DoR 765-GP?

To fill out KY DoR 765-GP, businesses must provide information about their gross receipts, any deductions or exemptions, and calculate the tax due before submitting the form to the Kentucky Department of Revenue.

What is the purpose of KY DoR 765-GP?

The purpose of KY DoR 765-GP is to collect data on gross receipts for taxation purposes and ensure compliance with Kentucky's tax laws.

What information must be reported on KY DoR 765-GP?

The information that must be reported on KY DoR 765-GP includes the total gross receipts, any applicable deductions, the tax calculated, and the taxpayer's identification information.

Fill out your KY DoR 765-GP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 765-GP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.