KY DoR 765-GP 2014 free printable template

Show details

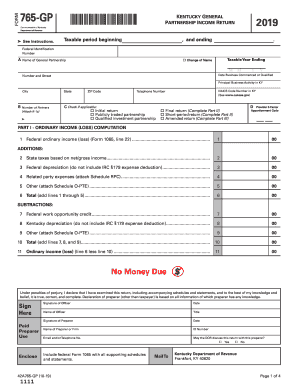

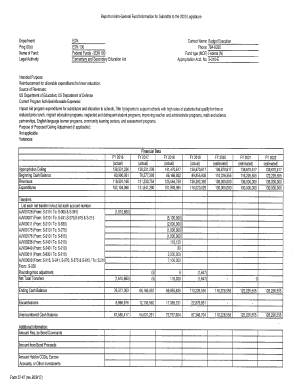

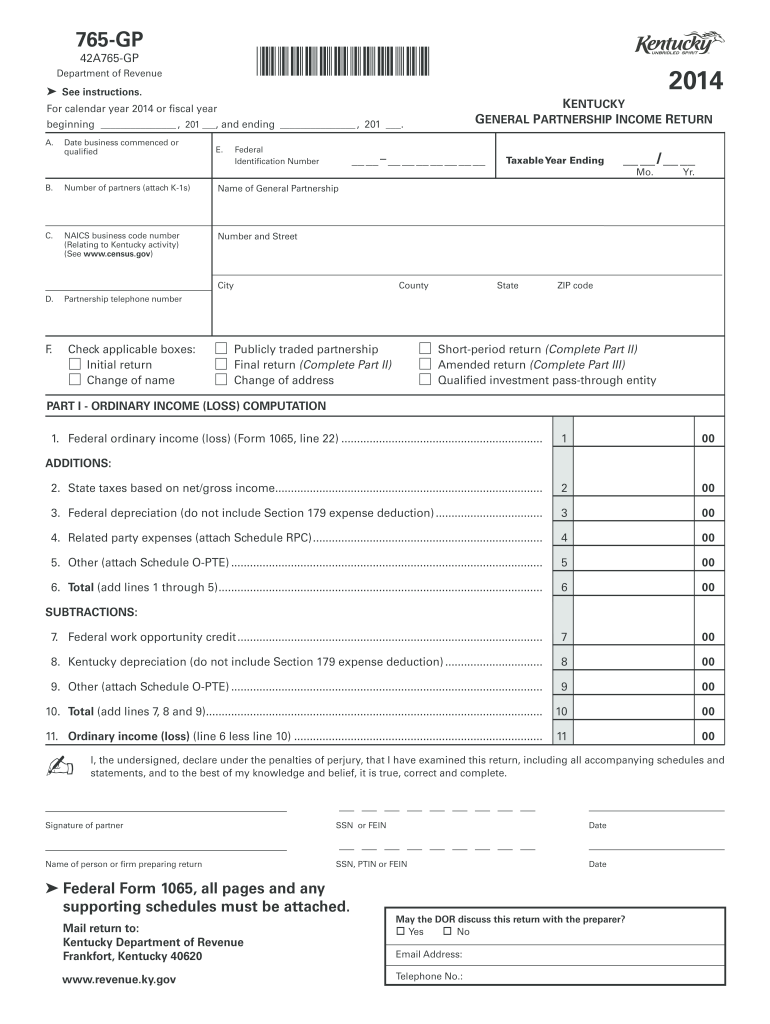

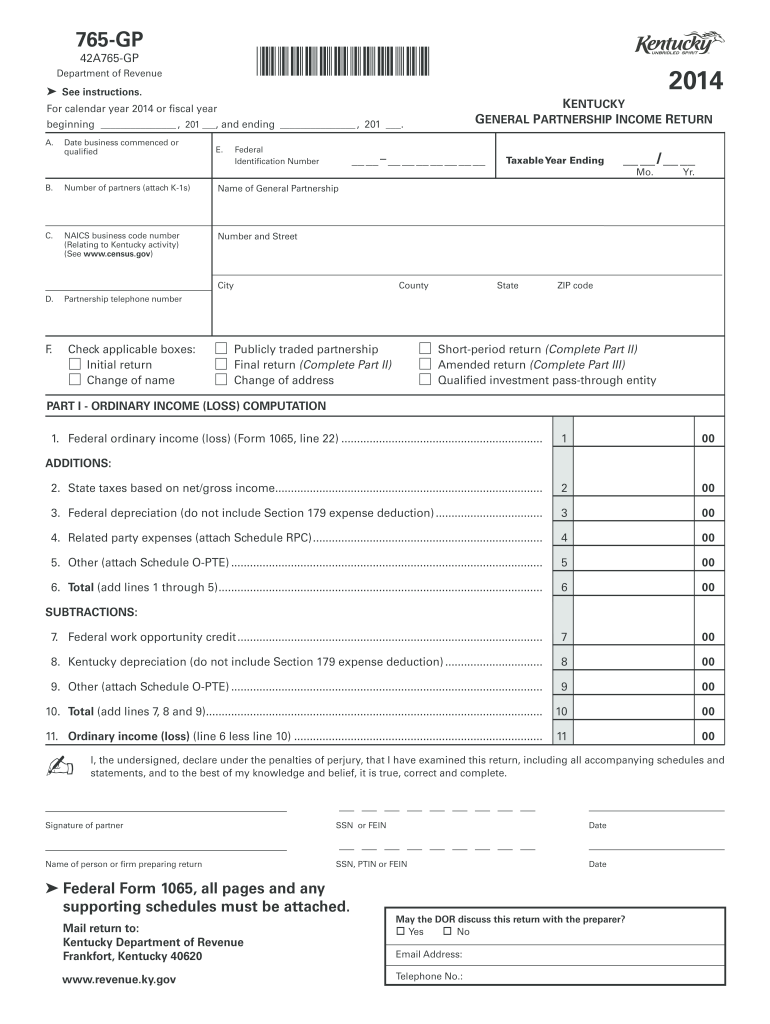

765-GP 1400010034 42A765-GP Department of Revenue See instructions. KENTUCKY GENERAL PARTNERSHIP INCOME RETURN For calendar year 2014 or fiscal year beginning 201 and ending 201. Revenue. ky. gov Telephone No. Page 2 Form 765-GP 2014 Commonwealth of Kentucky DEPARTMENT OF REVENUE 1400010336 PART II EXPLANATION OF FINAL RETURN AND/OR SHORT PERIOD RETURN Ceased operations in Kentucky Change of ownership Successor to previous business Change in filing status Merger Other SCHEDULE Q...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 765-GP

Edit your KY DoR 765-GP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 765-GP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 765-GP online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DoR 765-GP. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 765-GP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 765-GP

How to fill out KY DoR 765-GP

01

Begin by downloading the KY DoR 765-GP form from the Kentucky Department of Revenue website.

02

Fill out the applicant's information including name, address, and contact details at the top section of the form.

03

Indicate the tax year for which you are filing the form.

04

Clearly state the reason for filing the form in the designated section.

05

Provide detailed financial information and any relevant tax data as required on the form.

06

Review all filled-out information for accuracy and completeness.

07

Sign and date the form at the bottom to confirm that the information provided is truthful.

08

Submit the completed form either electronically or through mail to the appropriate Kentucky Department of Revenue office.

Who needs KY DoR 765-GP?

01

Individuals or entities in Kentucky who are seeking a refund or exemption related to certain taxes.

02

Taxpayers who have overpaid taxes and want to request a refund.

03

Businesses that qualify for specific exemptions under Kentucky tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What is the pass-through entity tax in Kentucky?

Kentucky enacts new pass-through entity (PTE) tax election. The new PTE tax election allows owners of entities making the election to benefit from deductions that exceed the current $10,000 limit.

Does Ky require an extension?

Extensions - Kentucky allows an automatic extension of six months if no additional tax is due AND a federal extension has been filed. Any extension granted is for time to file and does NOT extend time to pay. The Kentucky extension application can be e-filed.

What form does a partnership file in Kentucky?

A Kentucky Form 4562 must be filed for each year even though a federal Form 4562 may not be required.

What is the extension form for PTE in Kentucky?

To extend a filing date, use Form 720EXT, Extension of Time to File Kentucky Corporation/LLET Return. Extensions—Extensions are for extending the filing date only; late payment penalties and interest apply to payments made after the original due date.

Does Ky accept federal extension for partnerships?

For Partnership The businesses operating as partnerships in Kentucky need to file Form 720EXT with the state to obtain a 6-month extension of time to file their partnership income tax return Form 765 with the state. Or else, You can submit a copy of the federal extension to the return when filed.

Does federal extension cover states?

If you are requesting a federal extension, you are most likely going to need a state extension as well, and the procedures that you must follow vary widely from state to state. Nearly all states follow the federal government's lead and allow an automatic six-month extension of time to prepare and file your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KY DoR 765-GP from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including KY DoR 765-GP. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the KY DoR 765-GP electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your KY DoR 765-GP in seconds.

Can I create an electronic signature for signing my KY DoR 765-GP in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your KY DoR 765-GP directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is KY DoR 765-GP?

KY DoR 765-GP is a tax form used in the state of Kentucky for reporting General Partnership income for state tax purposes.

Who is required to file KY DoR 765-GP?

General Partnerships operating in Kentucky are required to file KY DoR 765-GP if they have income, deductions, or credits that need to be reported for the tax year.

How to fill out KY DoR 765-GP?

To fill out KY DoR 765-GP, partnerships must provide income and expense information, adjustments, and tax credits, and ensure to sign and date the form before submission.

What is the purpose of KY DoR 765-GP?

The purpose of KY DoR 765-GP is to report the income and expenses of a general partnership to calculate the tax owed to the state of Kentucky.

What information must be reported on KY DoR 765-GP?

KY DoR 765-GP requires reporting of gross income, deductible expenses, any adjustments for tax credits, and partner distributions.

Fill out your KY DoR 765-GP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 765-GP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.