CT AU-724 2018 free printable template

Show details

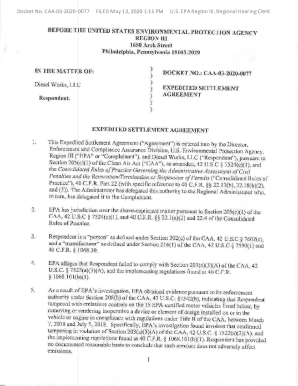

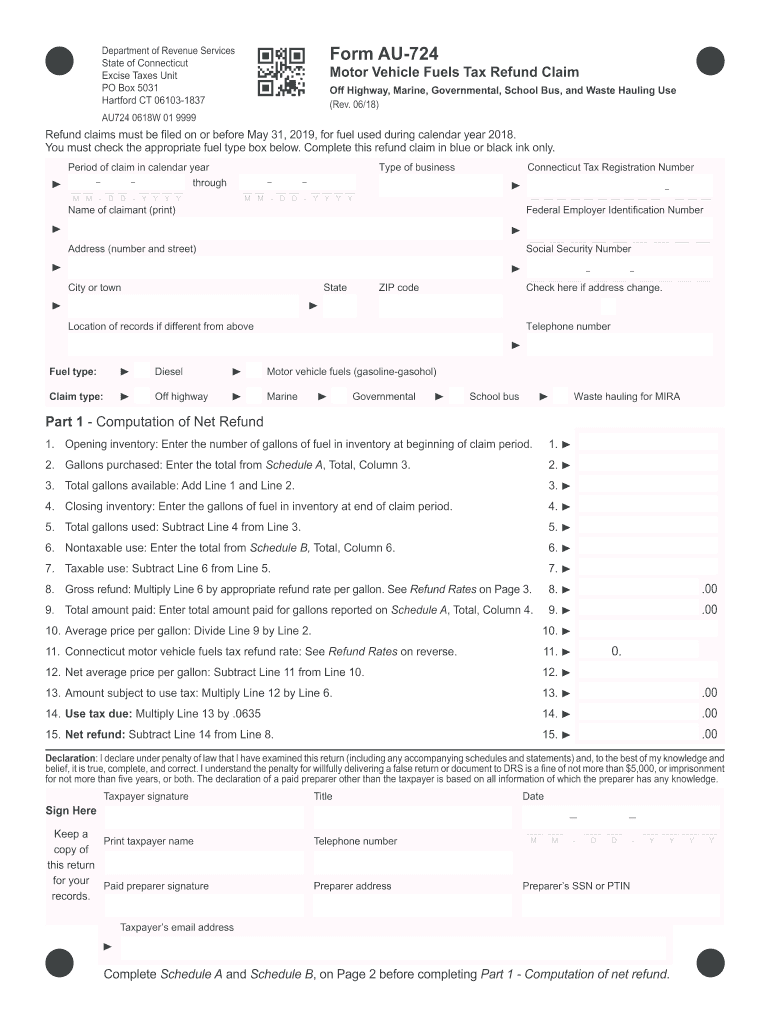

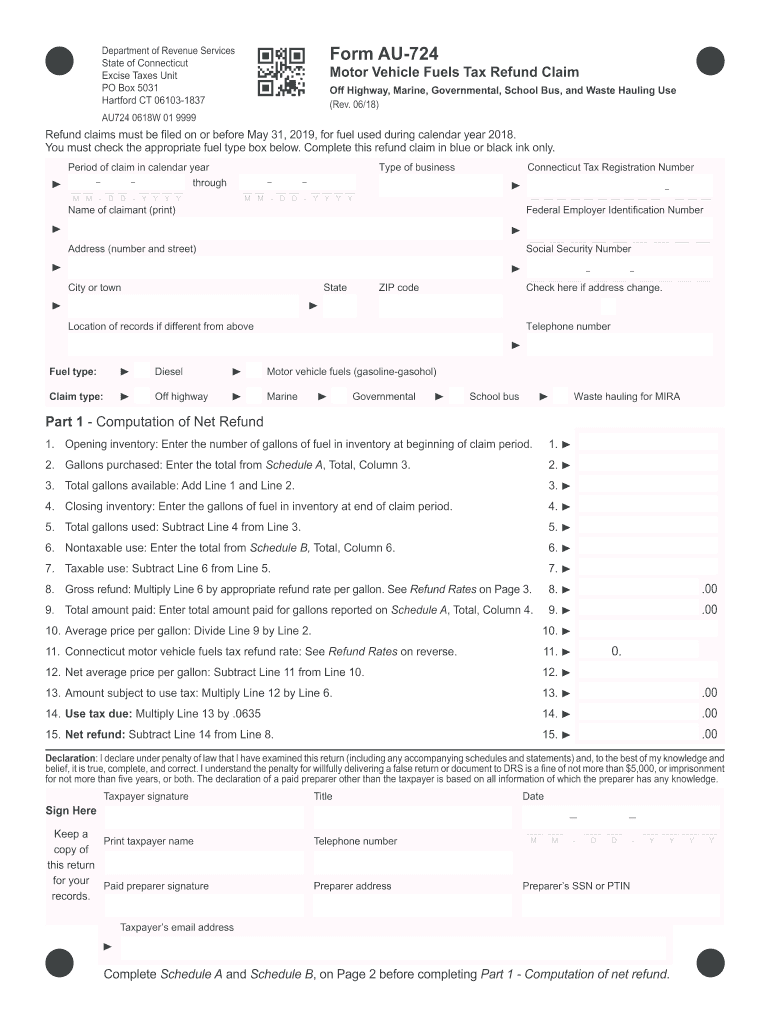

Form AU724Department of Revenue Services

State of Connecticut

Excise Taxes Unit

PO Box 5031

Hartford CT 061031837Motor Vehicle Fuels Tax Refund Claim

Off Highway, Marine, Governmental, School Bus,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT AU-724

Edit your CT AU-724 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT AU-724 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

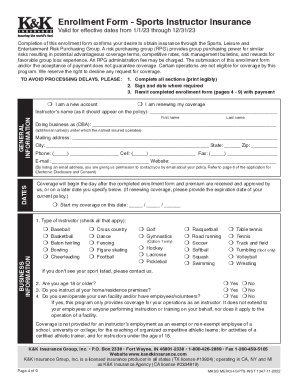

Editing CT AU-724 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT AU-724. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT AU-724 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT AU-724

How to fill out CT AU-724

01

Obtain the CT AU-724 form from the Connecticut Department of Revenue Services website.

02

Fill in your personal information including your name, address, and Social Security number.

03

Provide details regarding the property for which you are filing, including the address and type of property.

04

Indicate the reason for filing the form, such as a change in ownership or a property tax exemption.

05

Complete any additional sections as required based on your specific situation.

06

Double-check all entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form via mail or online as per the submission guidelines provided.

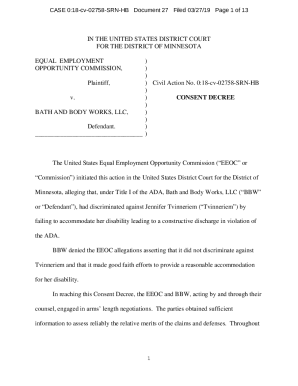

Who needs CT AU-724?

01

Property owners in Connecticut seeking to file for property tax exemption or report changes in ownership.

02

Individuals or entities that have recently acquired property in Connecticut and must update their tax records.

03

Those who have experienced significant changes that may affect their property tax assessment.

Fill

form

: Try Risk Free

People Also Ask about

How long is CT gas tax suspended?

28, legislators adopted a plan to gradually phase it out. The full 25-cents-per-gallon tax was waived through Dec. 31, 2022. Motorists will pay a nickel per gallon in tax through January — and then the rate will rise incrementally until May 1, when it returns to 25 cents per gallon.

Has the CT gas tax been reinstated?

Highlights of the Incremental Reinstatement of the Motor Vehicle Fuels Tax on Gasoline and Gasohol: The motor vehicle fuels tax on gasoline and gasohol will be incrementally reinstated from January of 2023 through May of 2023 as follows: January 1, 2023 – January 31, 2023.

What is the CT gas tax form?

You must file a separate Form AU‑724 for each motor vehicle fuel type, claim type, or for any rate change listed. Your motor vehicle fuels tax refund claim for fuel used during calendar year 2022 must be filed with DRS on or before May 31, 2023; and must involve at least 200 gallons of fuel eligible for tax refund.

How much is excise tax in CT?

Passenger vehicles and light duty trucks purchased from private owners (not a dealership) are subject to sales tax of 6.35% (or 7.75% for vehicles over $50,000). Connecticut Sales and Use Tax is based on the NADA average trade-in value or bill of sale value (whichever is higher).

What is the CT DRS diesel tax?

The Commissioner utilized the statutorily prescribed formula and calculated the motor vehicle fuels tax rate applicable to the sale or use of diesel fuel for the period from July 1, 2022, through June 30, 2023, to be 49.2¢. Claim, Commuter Vans.

Did Connecticut reinstate the gas tax?

On Jan. 1, Connecticut began gradually restoring the 25-cents-per-gallon tax it imposes on gasoline sales at the retail level, which the General Assembly suspended in March 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CT AU-724 online?

Completing and signing CT AU-724 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit CT AU-724 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing CT AU-724.

How do I fill out the CT AU-724 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CT AU-724 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CT AU-724?

CT AU-724 is a form used for certain tax-related purposes in the state of Connecticut, often associated with reporting the sale or transfer of tangible personal property.

Who is required to file CT AU-724?

Individuals or entities engaged in the sale or transfer of tangible personal property in Connecticut are required to file CT AU-724.

How to fill out CT AU-724?

To fill out CT AU-724, you need to provide information about the seller, buyer, the nature of the transaction, and any relevant details about the property being sold or transferred.

What is the purpose of CT AU-724?

The purpose of CT AU-724 is to ensure proper reporting of sales or transfers of tangible personal property for tax purposes in Connecticut.

What information must be reported on CT AU-724?

The information that must be reported on CT AU-724 includes details about the transaction, such as the names and addresses of the parties involved, a description of the property, and the sale or transfer price.

Fill out your CT AU-724 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT AU-724 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.