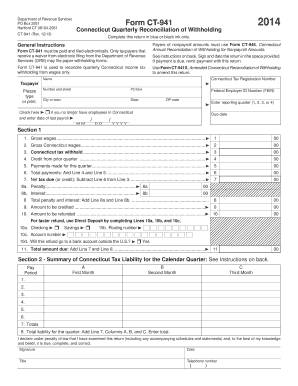

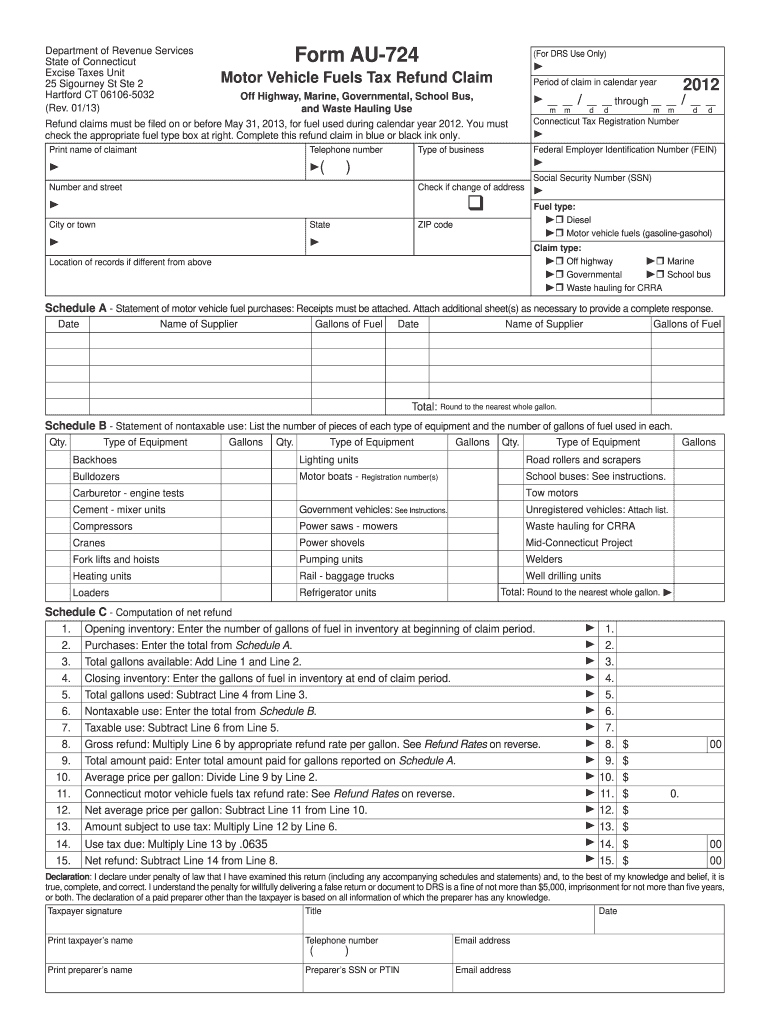

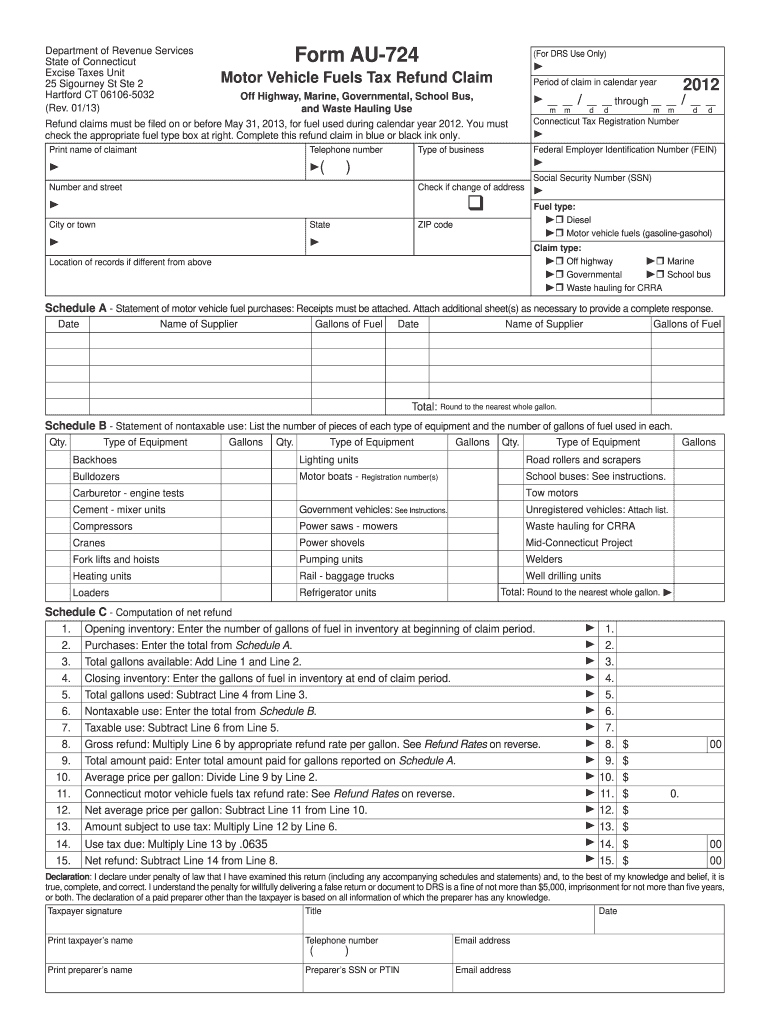

CT AU-724 2012 free printable template

Show details

29 per gallon You must le a separate Form AU-724 for each fuel type and each claim type in effect between January 1 2012 and June 30 2012. Taxpayer signature Title Print taxpayer s name Print preparer s name Email address Preparer s SSN or PTIN Form AU-724 Instructions General Instructions Use Form AU-724 Motor Vehicle Fuels Tax Refund Claim to le a motor vehicle fuels tax refund claim for diesel or motor vehicle fuels gasoline and gasohol Used b...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT AU-724

Edit your CT AU-724 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT AU-724 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT AU-724 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT AU-724. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT AU-724 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT AU-724

How to fill out CT AU-724

01

Obtain CT AU-724 form from the Connecticut Department of Revenue Services website or local office.

02

Fill in your personal information, including name, address, and taxpayer identification number.

03

Indicate the type of property being claimed for use in the assessment.

04

Complete the sections regarding the owner's assertions and any relevant details.

05

Provide any supporting documentation required for the property type.

06

Review the completed form for accuracy and completeness.

07

Submit the form by mail to the appropriate office or online if applicable.

Who needs CT AU-724?

01

Individuals or businesses in Connecticut who are claiming exemptions on property taxes.

02

Property owners seeking tax relief based on specific eligibility criteria.

03

Those who need to report changes in property status that affect tax assessments.

Fill

form

: Try Risk Free

People Also Ask about

Did CT reinstate the gas tax?

30, 2022, the state's tax on retail gasoline sales was suspended in April as gas prices hit record highs amid soaring inflation. Lawmakers extended the suspension until Dec. 31, with the tax then reinstated in five cent monthly increments until it hits 25 cents a gallon on May 1, 2023.

Do all 50 states have a gas tax?

All states have taxes. Some states have significantly higher taxes than other states. Types of taxes include: property taxes, income taxes, and sales and excise tax.

Does Texas have the highest gas tax?

Plus, see which states have the highest and lowest excise tax rates. Jump to a topic below: Gas tax by state.Gas tax by state. StateTexasGasoline Tax$0.20 / gallonUndyed Diesel Tax$0.20 / gallonAviation Fuel Tax$0.20 / gallonJet Fuel Tax$0.20 / gallon50 more columns

Which state in the US out of the 50 states currently has the highest gasoline tax per gallon including state and federal excise taxes )?

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg). The lowest state gas tax rates can be found in Alaska at 14.98 cents per gallon, followed by Missouri (17.42 cpg) and Mississippi (18.79 cpg).

What state has the highest fuel tax?

California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon. CharacteristicGas taxGas price------8 more rows • Aug 2, 2022

What state has the highest gas price currently?

Data as of June 30, 2022. Western and Pacific states face the most costly gas in the nation, as the five states with the highest prices are California, Hawaii ($5.60), Alaska ($5.57), Nevada ($5.57) and Oregon ($5.49).

What state has the highest excise tax on gasoline?

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States.

What state has the highest taxes?

Here's a roundup of the highest and lowest taxes by state. The states with the highest income tax for 2021 include California 13.3%, Hawaii 11%, New Jersey 10.75%, Oregon 9.9%, and Minnesota 9.85%.

What is the federal tax on gasoline in the United States?

The federal gasoline excise tax rate is 18.4 cents per gallon. It's 24.4 cents per gallon of diesel. This tax pays for infrastructure projects and mass transportation costs and includes a .

What state has the largest gas tax?

ing to data from the American Petroleum Institute, Alaska has the lowest total per-gallon gas tax at 33.53 cents per gallon, while California tops the list, with drivers paying a total of 86.55 cents per gallon.

Who has the second highest gas tax?

Here are the 10 states with the highest gas taxes: Washington - 52 cents. New Jersey - 41 cents. New York - 40 cents. Illinois - 39 cents. Ohio - 39 cents. Maryland - 37 cents. North Carolina - 36 cents. Oregon - 36 cents.

Which state has the highest gas prices 2022?

On September 7, 2022, the price of regular gasoline was highest in Hawaii at around 5.3 U.S. dollars per gallon. U.S. gas prices increased significantly as a result of the Russian invasion of Ukraine in February 2022. CharacteristicU.S. dollars per gallon--12 more rows • Sep 7, 2022

Which state in the US out of the 50 States currently has the highest gasoline tax per gallon including state and federal excise taxes )?

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg). The lowest state gas tax rates can be found in Alaska at 14.98 cents per gallon, followed by Missouri (17.42 cpg) and Mississippi (18.79 cpg).

Who has the second highest gas tax?

Key Facts. Pennsylvania has the highest state gas taxes in the nation at 57.6 cents per gallon, ing to data from IGEN tax software company. The other states with the highest tax rates are California (51.1 cents), Washington (49.4), New Jersey (42.1) and Illinois (39.2).

What state has the highest gas gas tax?

California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

How much is gasoline tax in Texas?

Gas tax by state StateGasoline TaxJet Fuel TaxTexas$0.20 / gallon$0.20 / gallonUtah$0.319 / gallonBetween 0.025 - $0.090 / gallonVermont$0.3636 / gallonNo Fuel TaxVirginia$0.28/ gallon$0.05 / gallon47 more rows

Which state has the lowest gas tax?

Alaska has by far the lowest tax rate at 8.95 cents per gallon, followed by Hawaii (16), New Mexico (17), Mississippi (18) and Arizona (18).

How much is Connecticut fuel tax?

Gas tax by state StateGasoline TaxUndyed Diesel TaxConnecticut$0.0 / gallon***$0.492 / gallon***Delaware$0.23 / gallon$0.22 / gallonDistrict of Columbia$0.342 / gallon$0.342 / gallonFlorida$0.33425 / gallon$0.19 / gallon47 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CT AU-724?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CT AU-724 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the CT AU-724 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your CT AU-724 and you'll be done in minutes.

How do I edit CT AU-724 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like CT AU-724. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CT AU-724?

CT AU-724 is a specific tax form used in Connecticut for reporting information related to the use tax liability of businesses and individuals who have purchased goods for use within the state.

Who is required to file CT AU-724?

Any business or individual who has purchased taxable items for use in Connecticut without having paid the appropriate sales tax is required to file CT AU-724.

How to fill out CT AU-724?

To fill out CT AU-724, taxpayers must provide details regarding the purchases made, the date of purchase, the cost of the items, and any applicable sales tax that should have been paid.

What is the purpose of CT AU-724?

The purpose of CT AU-724 is to report and pay the use tax owed to the state of Connecticut on purchases where sales tax has not been collected.

What information must be reported on CT AU-724?

CT AU-724 must report the purchaser's information, details of the goods purchased, dates of purchase, amounts paid, and the calculated use tax that is owed.

Fill out your CT AU-724 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT AU-724 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.