CT AU-724 2024-2026 free printable template

Show details

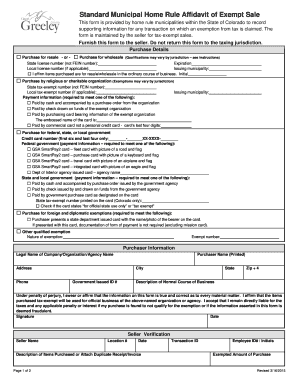

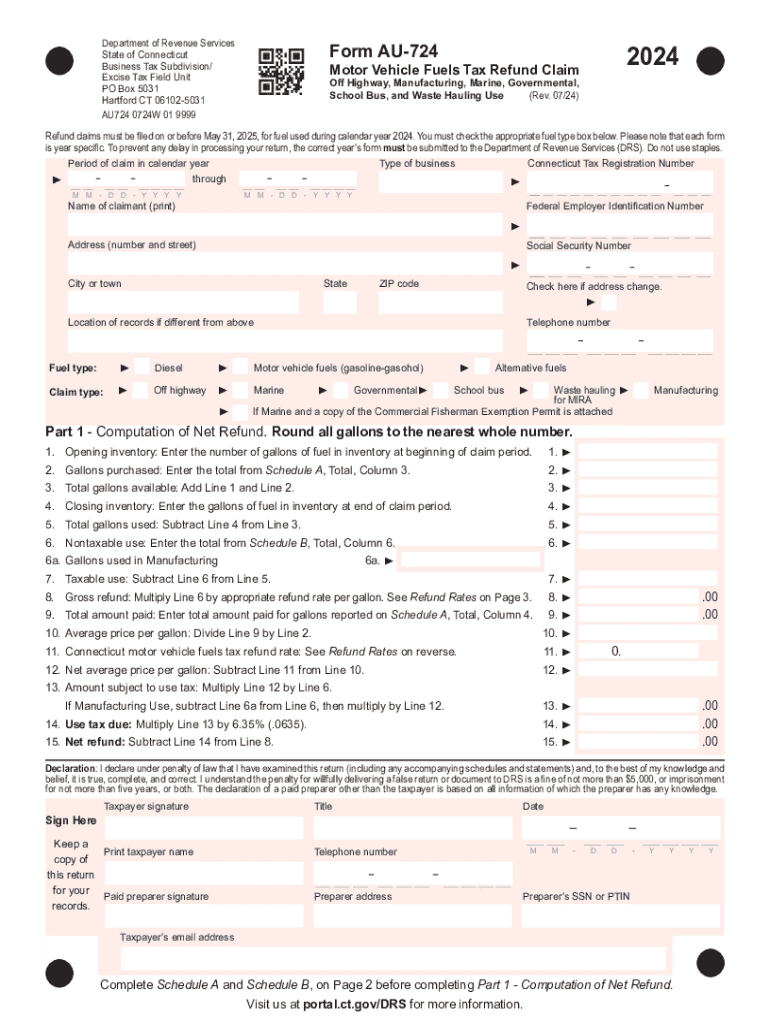

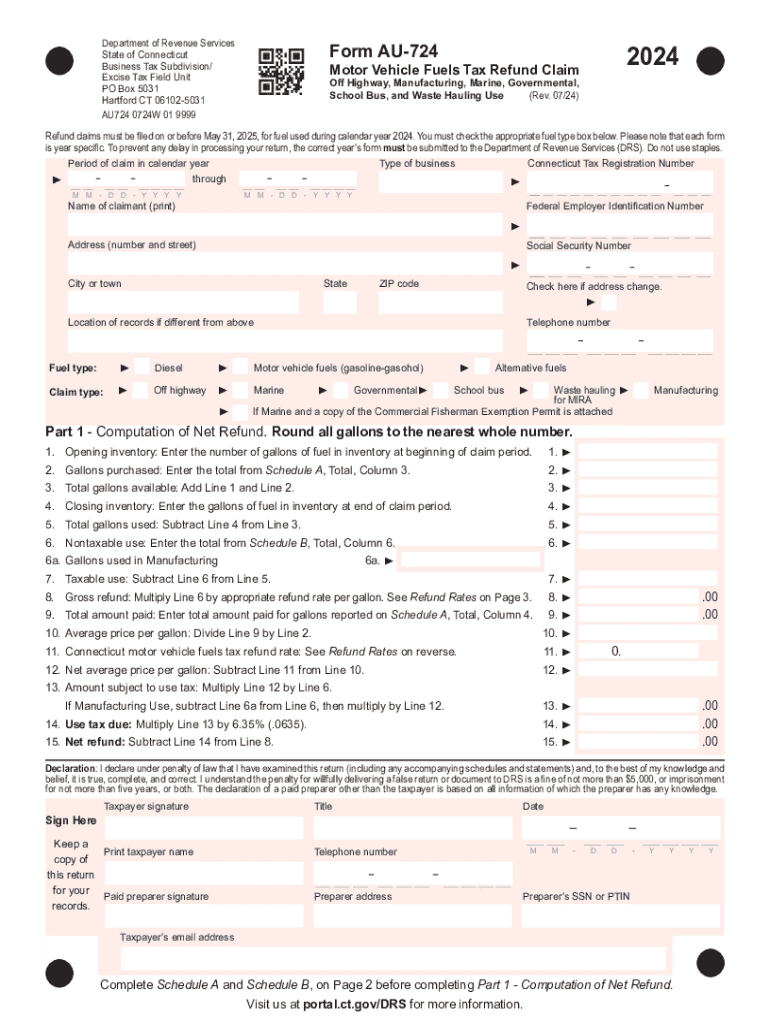

Department of Revenue Services State of Connecticut Business Tax Subdivision/ Excise Tax Field Unit PO Box 5031 Hartford CT 061025031 AU724 0724W 01 9999Form AU7242024Motor Vehicle Fuels Tax Refund

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT AU-724

Edit your CT AU-724 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT AU-724 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT AU-724 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT AU-724. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT AU-724 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT AU-724

How to fill out CT AU-724

01

Gather all necessary financial documents, including income statements and tax returns.

02

Obtain the CT AU-724 form from the Connecticut Department of Revenue Services website or your local office.

03

Fill out the header section of the form with your name, address, and contact information.

04

Provide details about the property in question, including its location and assessment.

05

Calculate your total household income and enter it in the appropriate section.

06

Review the eligibility criteria for the program and ensure compliance.

07

Sign and date the application.

08

Submit the completed form before the application deadline.

Who needs CT AU-724?

01

Anyone who resides in Connecticut and is applying for the tax exemption on the property tax assessment.

02

Property owners who qualify based on their income and meet the necessary criteria.

03

Individuals seeking financial assistance through local tax relief programs.

Fill

form

: Try Risk Free

People Also Ask about

Did CT reinstate the gas tax?

30, 2022, the state's tax on retail gasoline sales was suspended in April as gas prices hit record highs amid soaring inflation. Lawmakers extended the suspension until Dec. 31, with the tax then reinstated in five cent monthly increments until it hits 25 cents a gallon on May 1, 2023.

Do all 50 states have a gas tax?

All states have taxes. Some states have significantly higher taxes than other states. Types of taxes include: property taxes, income taxes, and sales and excise tax.

Does Texas have the highest gas tax?

Plus, see which states have the highest and lowest excise tax rates. Jump to a topic below: Gas tax by state.Gas tax by state. StateTexasGasoline Tax$0.20 / gallonUndyed Diesel Tax$0.20 / gallonAviation Fuel Tax$0.20 / gallonJet Fuel Tax$0.20 / gallon50 more columns

Which state in the US out of the 50 states currently has the highest gasoline tax per gallon including state and federal excise taxes )?

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg). The lowest state gas tax rates can be found in Alaska at 14.98 cents per gallon, followed by Missouri (17.42 cpg) and Mississippi (18.79 cpg).

What state has the highest fuel tax?

California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon. CharacteristicGas taxGas price------8 more rows • Aug 2, 2022

What state has the highest gas price currently?

Data as of June 30, 2022. Western and Pacific states face the most costly gas in the nation, as the five states with the highest prices are California, Hawaii ($5.60), Alaska ($5.57), Nevada ($5.57) and Oregon ($5.49).

What state has the highest excise tax on gasoline?

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States.

What state has the highest taxes?

Here's a roundup of the highest and lowest taxes by state. The states with the highest income tax for 2021 include California 13.3%, Hawaii 11%, New Jersey 10.75%, Oregon 9.9%, and Minnesota 9.85%.

What is the federal tax on gasoline in the United States?

The federal gasoline excise tax rate is 18.4 cents per gallon. It's 24.4 cents per gallon of diesel. This tax pays for infrastructure projects and mass transportation costs and includes a .

What state has the largest gas tax?

ing to data from the American Petroleum Institute, Alaska has the lowest total per-gallon gas tax at 33.53 cents per gallon, while California tops the list, with drivers paying a total of 86.55 cents per gallon.

Who has the second highest gas tax?

Here are the 10 states with the highest gas taxes: Washington - 52 cents. New Jersey - 41 cents. New York - 40 cents. Illinois - 39 cents. Ohio - 39 cents. Maryland - 37 cents. North Carolina - 36 cents. Oregon - 36 cents.

Which state has the highest gas prices 2022?

On September 7, 2022, the price of regular gasoline was highest in Hawaii at around 5.3 U.S. dollars per gallon. U.S. gas prices increased significantly as a result of the Russian invasion of Ukraine in February 2022. CharacteristicU.S. dollars per gallon--12 more rows • Sep 7, 2022

Which state in the US out of the 50 States currently has the highest gasoline tax per gallon including state and federal excise taxes )?

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg). The lowest state gas tax rates can be found in Alaska at 14.98 cents per gallon, followed by Missouri (17.42 cpg) and Mississippi (18.79 cpg).

Who has the second highest gas tax?

Key Facts. Pennsylvania has the highest state gas taxes in the nation at 57.6 cents per gallon, ing to data from IGEN tax software company. The other states with the highest tax rates are California (51.1 cents), Washington (49.4), New Jersey (42.1) and Illinois (39.2).

What state has the highest gas gas tax?

California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

How much is gasoline tax in Texas?

Gas tax by state StateGasoline TaxJet Fuel TaxTexas$0.20 / gallon$0.20 / gallonUtah$0.319 / gallonBetween 0.025 - $0.090 / gallonVermont$0.3636 / gallonNo Fuel TaxVirginia$0.28/ gallon$0.05 / gallon47 more rows

Which state has the lowest gas tax?

Alaska has by far the lowest tax rate at 8.95 cents per gallon, followed by Hawaii (16), New Mexico (17), Mississippi (18) and Arizona (18).

How much is Connecticut fuel tax?

Gas tax by state StateGasoline TaxUndyed Diesel TaxConnecticut$0.0 / gallon***$0.492 / gallon***Delaware$0.23 / gallon$0.22 / gallonDistrict of Columbia$0.342 / gallon$0.342 / gallonFlorida$0.33425 / gallon$0.19 / gallon47 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CT AU-724?

The editing procedure is simple with pdfFiller. Open your CT AU-724 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit CT AU-724 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign CT AU-724 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete CT AU-724 on an Android device?

Use the pdfFiller app for Android to finish your CT AU-724. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is CT AU-724?

CT AU-724 is a form used in Connecticut for reporting income, expenses, and relevant financial information for businesses that are not subject to the corporate income tax.

Who is required to file CT AU-724?

Businesses and entities that are not subject to the corporate income tax and meet certain criteria, such as LLCs and partnerships, are required to file CT AU-724.

How to fill out CT AU-724?

CT AU-724 should be filled out with accurate financial data, including information on gross receipts, expenses, and other financial details as specified in the form's instructions.

What is the purpose of CT AU-724?

The purpose of CT AU-724 is to provide the Connecticut Department of Revenue Services with necessary financial information about businesses that need to report income but are not subject to corporate taxes.

What information must be reported on CT AU-724?

CT AU-724 requires reporting of business gross receipts, allowable expenses, net income, and other pertinent financial information as guided by the form's instructions.

Fill out your CT AU-724 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT AU-724 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.