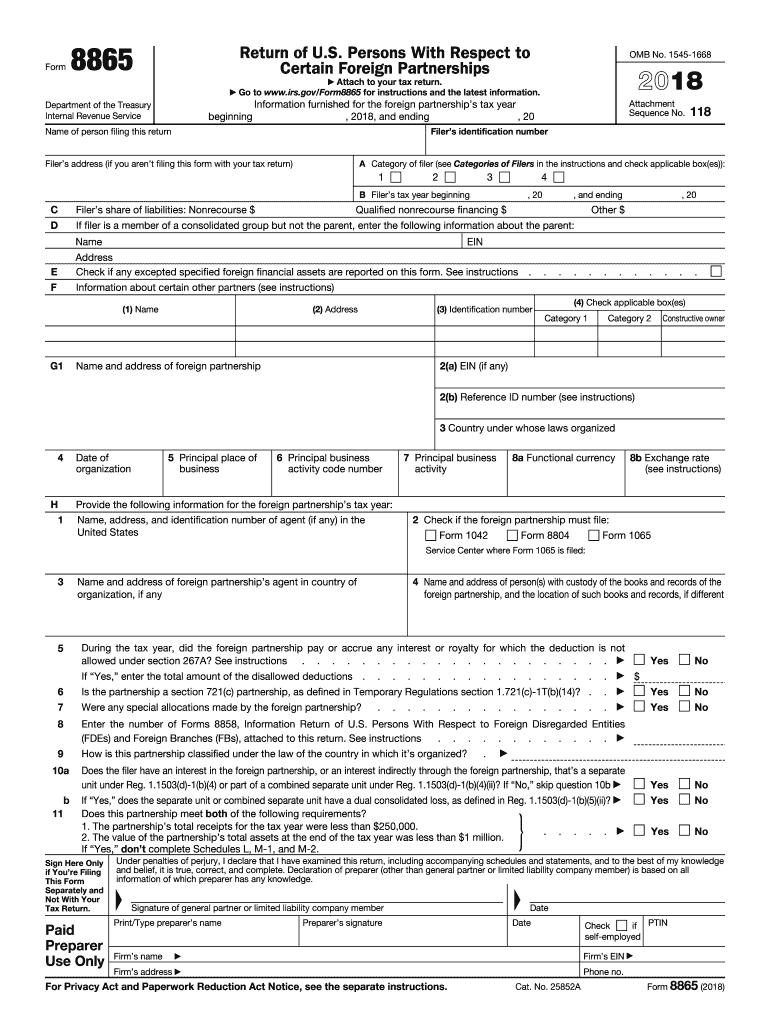

Who Needs Form 8865?

Form 8865 is a Return in U.S. Persons with Respects to Certain Foreign Partnerships is designed for partnerships that function abroad but are controlled by partners from the USA. A partner from the US owning 10% interest in the partnership must file Form 8865. The U.S. partner may also be an entity that was elected to be taxed as partnership.

What is Form 8865 for?

Form 8865 shows the financial status of the partnership and reports its earnings for the year. The form also serves to report different transactions between partners and partnership.

Is Form 8865 Accompanied by Other Forms?

Form 8865 must be filed together with the partner's tax return. A foreign corporation with many owners that is taxed as a disregarded entity must fill out Form 8865 and Form K-1 for each partner.

When is Form 8865 Due?

Since Form 8865 must be attached to the partner’s tax return, it must be filed together with tax returns with all the time extensions included.

How do I Fill out Form 8865?

Form 8865 is a long and bulky form consisting of six pages with several Schedules that need to be completed. It is required to enter the net profits, capital gains, the balance sheet that shows the financial situation of the partnership at the beginning and at the end of the year and a separate page for all the transactions that a partnership and partners were involved in.

The form also requires basic information such as the taxpayer’s ID, name and address and the changes in the amount of partner's’ interest if any.

Where do I Send Form 8865?

Once completed, Form 8865 is sent to the IRS together with the tax return.