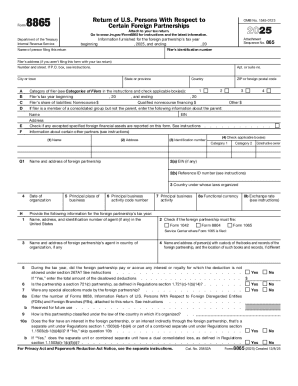

What is IRS 8865?

IRS Form 8865, also known as the "Return of U.S. Persons With Respect to Certain Foreign Partnerships," is a tax form required for reporting specific information regarding foreign partnerships. The form is primarily used by U.S. persons who own an interest in a foreign partnership to ensure compliance with U.S. tax reporting requirements.

Who needs the form?

U.S. persons who have a direct ownership interest in a foreign partnership must file Form 8865. This includes individuals, corporations, partnerships, estates, and trusts. Additionally, U.S. persons who are partners in a foreign partnership or who receive foreign partnership distributions or income must also complete this form.

Components of the form

IRS Form 8865 consists of several key parts, including:

01

Identifying information about the taxpayer and the foreign partnership.

02

The partner's ownership percentage in the partnership.

03

Financial information like partnership assets, liabilities, income, and deductions.

04

Details about any transactions between the U.S. person and the partnership.

Completing each component accurately ensures comprehensive reporting, aiding the IRS in evaluating your tax obligations.

What information do you need when you file the form?

When filing Form 8865, it is essential to have the following information on hand:

01

Your personal identification details, including name and TIN.

02

Complete details about the foreign partnership, including its name, address, and EIN.

03

Specific information on your ownership percentage and the nature of partnership transactions.

Having this information prepared will streamline the filing process and reduce the likelihood of errors.

What is the purpose of this form?

The purpose of IRS Form 8865 is to gather information about the activities and financial condition of foreign partnerships in which a U.S. person has an interest. By requiring this information, the IRS can ensure accurate enforcement of tax compliance and facilitate the collection of taxes from U.S. taxpayers involved in foreign transactions.

When am I exempt from filling out this form?

Exemptions from filing Form 8865 may apply in certain situations, such as when a U.S. person owns an interest in a foreign partnership solely for passive investment purposes, or if the partnership meets specific criteria that allows for exemption under IRS guidelines. It is crucial to assess the partnership structure and previous filings to determine eligibility for exemption.

What are the penalties for not issuing the form?

Failing to file IRS Form 8865 when required can result in substantial penalties. The IRS may impose a penalty of up to $10,000 for each form that is not filed in a timely manner. Additionally, if the form is not filed, there may be further repercussions, including increased scrutiny during audits and associate penalties for failure to furnish required information.

Is the form accompanied by other forms?

IRS Form 8865 may be accompanied by several other forms depending on the situation. Commonly, Schedule K-1 and other related forms may need to be filed simultaneously. This is important for ensuring proper reporting of income and distributions from the partnership.

Where do I send the form?

The completed IRS Form 8865 should be submitted to the appropriate IRS office as indicated on the form's instructions. Generally, the form is filed with your annual tax return. Ensure that you check the most current filing instructions to direct your submission appropriately.