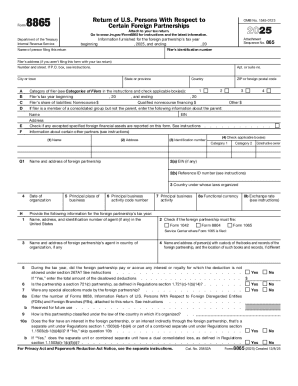

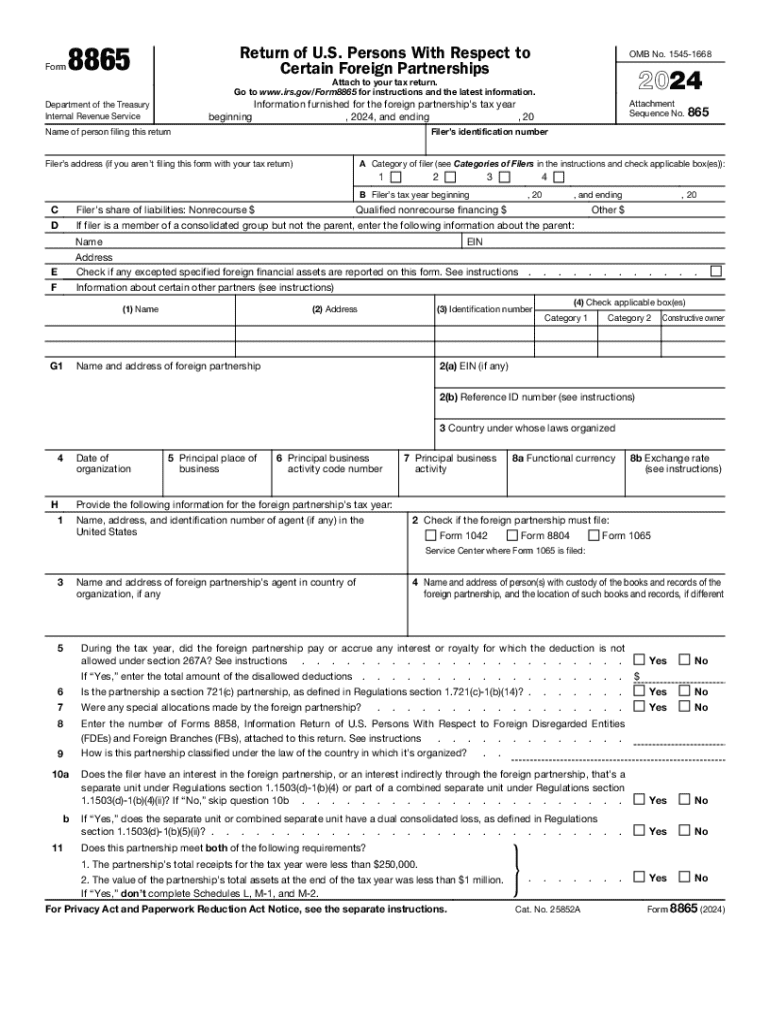

IRS 8865 2024 free printable template

Instructions and Help about IRS 8865

How to edit IRS 8865

How to fill out IRS 8865

About IRS 8 previous version

What is IRS 8865?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8865

What should I do if I realize I made a mistake on my IRS 8865 after filing?

If you find an error after submitting your IRS 8865, you can file an amended return to correct it. It's important to provide the necessary documentation to support the changes you're making. Keep a record of the original and amended submissions for your files.

How can I verify if the IRS has received my IRS 8865?

You can check the status of your IRS 8865 by contacting the IRS directly or using the online tools available for tracking your submission. It’s crucial to keep copies of your submission for reference, especially in case of any discrepancies.

What should I do if I receive a notice from the IRS regarding my submission of IRS 8865?

If you receive an IRS notice concerning your IRS 8865, carefully review it to understand the reason behind it. Prepare any necessary documentation to respond, and ensure you meet deadlines specified in the notice to avoid penalties.

Are there common mistakes I should avoid when filing the IRS 8865?

Yes, common mistakes include failing to include all required information, using incorrect forms, and not signing the documents. To avoid these, double-check your entries and ensure compliance with the latest IRS guidelines.

What should I consider when choosing software for e-filing IRS 8865?

When selecting software for e-filing IRS 8865, consider its compatibility with your devices, ease of use, and technical support availability. Ensure the software complies with IRS e-filing requirements to facilitate a smooth submission.