CA FTB 565 2018 free printable template

Show details

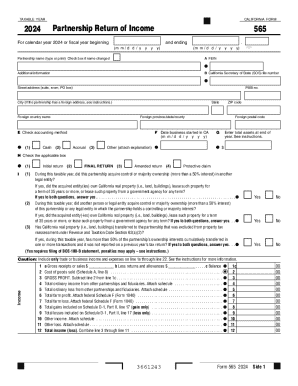

I Yes No For Privacy Notice get form FTB 1131. 3661113 Form 565 C1 2011 Side Schedule A Cost of Goods Sold 1 Inventory at beginning of year. Get 565 Booklet to see the instructions for the 565 Form TAXABLE YEAR CALIFORNIA FORM Partnership Return of Income For calendar year 2011 or fiscal year beginning month day year and ending month day year. Penalties May Apply Side Form 565 C1 2011 Schedule K Partners Shares of Income Deductions Credits etc...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2018 form 565

Edit your 2018 form 565 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 form 565 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2018 form 565 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2018 form 565. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 565 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2018 form 565

How to fill out CA FTB 565

01

Obtain a copy of the CA FTB 565 form from the California Franchise Tax Board website.

02

Start with completing the basic identification information, including the name of the partnership, address, and entity number.

03

Fill in the fiscal year dates for the partnership's accounting period.

04

Report the total income of the partnership on the appropriate line.

05

Detail any deductions taken by the partnership, ensuring accuracy.

06

Calculate the partnership's total tax liability if applicable.

07

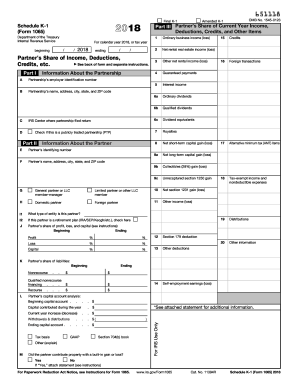

Complete Schedule B to report partner information and their individual shares.

08

Review all entries for accuracy before signing the form.

09

Submit the completed form by the due date, either electronically or by mail.

Who needs CA FTB 565?

01

Any partnership doing business in California or receiving income from California sources needs to file CA FTB 565.

02

Partners in a partnership are usually required to file if they receive pass-through income or have taxable income attributed to the partnership.

Fill

form

: Try Risk Free

People Also Ask about

What is the California 565 form?

Purpose. Form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is the difference between CA form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Can I FedEx my California tax return?

Private express mail/Overnight delivery Overnight your tax return using a private express service, such as FedEx.

What is the California form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

Can I avoid the $800 California franchise tax and still limit personal liability?

Can a single-member LLC in CA avoid $800 CA franchise fees while still keeping liability protection? Generally speaking, no. The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

What happens if you don't pay $800 California LLC tax?

California Franchise Tax is the annual tax for conducting business in California. For noncorporate entities, it is a flat fee of $800. For corporate entities, the fee is a minimum of $800. Failure to pay the franchise tax will result in a minimum penalty of 5% and a maximum penalty of 25% of the unpaid tax.

What is the California Form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is Form 565 2018?

Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is the difference between Form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Who needs to file form 565?

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of “doing business” in General Information A, Important Information.

Why did I get a letter from the Franchise Tax Board?

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What is the due date of CA Form 565?

When and Where to File. A partnership must file Form 565 and pay the $800 annual tax (if required) by the 15th day of the 3rd month (fiscal year) or March 15, 2022 (calendar year), following the close of its taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2018 form 565 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2018 form 565 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out 2018 form 565 using my mobile device?

Use the pdfFiller mobile app to fill out and sign 2018 form 565 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit 2018 form 565 on an iOS device?

Create, modify, and share 2018 form 565 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is CA FTB 565?

CA FTB 565 is a California tax form used to report income, deductions, and credits related to partnerships and limited liability companies (LLCs) operating in California.

Who is required to file CA FTB 565?

Partnerships and limited liability companies (LLCs) that have income or conduct business in California are required to file CA FTB 565.

How to fill out CA FTB 565?

To fill out CA FTB 565, the entity must provide basic information such as the partnership's name, address, and federal employer identification number (FEIN), and report income, deductions, and other relevant financial information as specified in the instructions for the form.

What is the purpose of CA FTB 565?

The purpose of CA FTB 565 is to report the income and activities of partnerships and LLCs to the California Franchise Tax Board for tax computation and compliance purposes.

What information must be reported on CA FTB 565?

CA FTB 565 requires reporting of information such as total income, deductions, partner contributions, distributions, and other financial data relevant to the operation of the partnership or LLC.

Fill out your 2018 form 565 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Form 565 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.