CA FTB 565 2021 free printable template

Show details

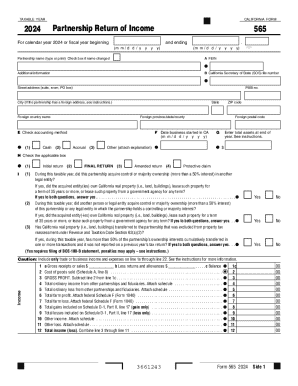

TAXABLE YEARCALIFORNIA FORMPartnership Return of Income2021565For calendar year 2021 or fiscal year beginning and ending (m × d / partnership name (type or print) Check box if name changed×. ’m

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ftb 565

Edit your ftb 565 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 565 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 565 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ftb 565. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 565 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ftb 565

How to fill out CA FTB 565

01

Download the CA FTB 565 form from the California Franchise Tax Board website.

02

Fill in the name and address of the partnership at the top of the form.

03

Enter the partnership's federal employer identification number (FEIN).

04

Complete the respective sections for each partner, including their name, address, and taxpayer identification number.

05

Report the partnership's income, deductions, and credits as required.

06

Fill out the Schedule of Partners' Shares of Income, Deductions, Credits, etc.

07

Sign and date the form at the bottom, and ensure it is submitted by the due date.

08

Attach any necessary documentation as instructed in the form guidelines.

Who needs CA FTB 565?

01

Any partnership doing business in California.

02

Business entities classified as partnerships for federal tax purposes.

03

Partners in a partnership who need to report their share of income, deductions, and credits.

Fill

form

: Try Risk Free

People Also Ask about

What is the California 565 form?

Purpose. Form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is the difference between CA form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Can I FedEx my California tax return?

Private express mail/Overnight delivery Overnight your tax return using a private express service, such as FedEx.

What is the California form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

Can I avoid the $800 California franchise tax and still limit personal liability?

Can a single-member LLC in CA avoid $800 CA franchise fees while still keeping liability protection? Generally speaking, no. The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

What happens if you don't pay $800 California LLC tax?

California Franchise Tax is the annual tax for conducting business in California. For noncorporate entities, it is a flat fee of $800. For corporate entities, the fee is a minimum of $800. Failure to pay the franchise tax will result in a minimum penalty of 5% and a maximum penalty of 25% of the unpaid tax.

What is the California Form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is Form 565 2018?

Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is the difference between Form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Who needs to file form 565?

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of “doing business” in General Information A, Important Information.

Why did I get a letter from the Franchise Tax Board?

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What is the due date of CA Form 565?

When and Where to File. A partnership must file Form 565 and pay the $800 annual tax (if required) by the 15th day of the 3rd month (fiscal year) or March 15, 2022 (calendar year), following the close of its taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ftb 565 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ftb 565, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit ftb 565 on an iOS device?

Create, modify, and share ftb 565 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out ftb 565 on an Android device?

Use the pdfFiller Android app to finish your ftb 565 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is CA FTB 565?

CA FTB 565 is a tax form used by partnerships to report income, deductions, gains, losses, and other information to the California Franchise Tax Board.

Who is required to file CA FTB 565?

Partnerships that conduct business in California, or derive income from California sources, are required to file CA FTB 565.

How to fill out CA FTB 565?

To fill out CA FTB 565, partnerships must provide information such as partnership details, income, deductions, and the allocated shares for each partner by following the instructions provided on the form.

What is the purpose of CA FTB 565?

The purpose of CA FTB 565 is to facilitate the reporting of partnership income and related tax information to ensure compliance with California tax laws.

What information must be reported on CA FTB 565?

Information required on CA FTB 565 includes partnership name and address, federal employer identification number (FEIN), income details, deductions, and the individual partner's share of income, deductions, and credits.

Fill out your ftb 565 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 565 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.