CA FTB 565 2019 free printable template

Show details

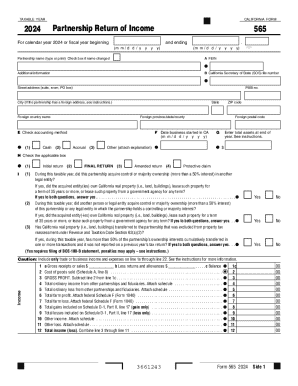

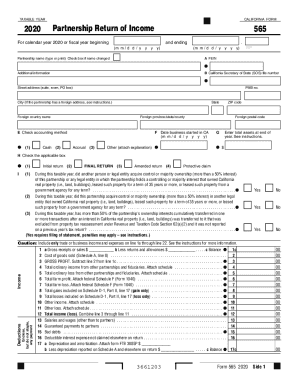

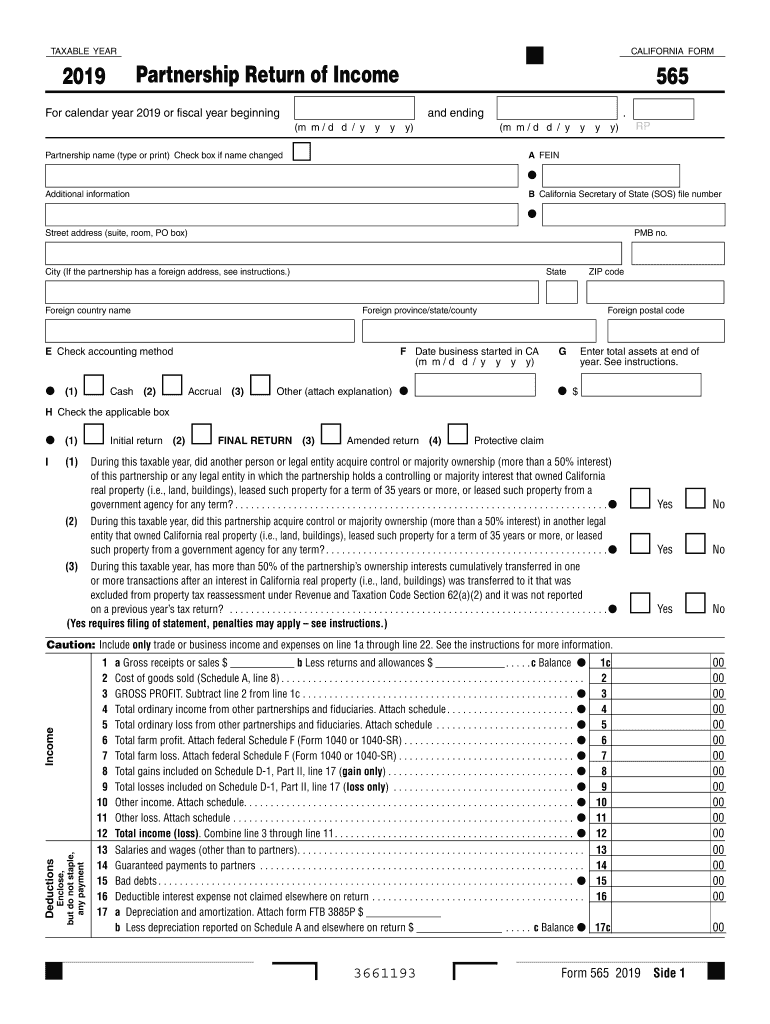

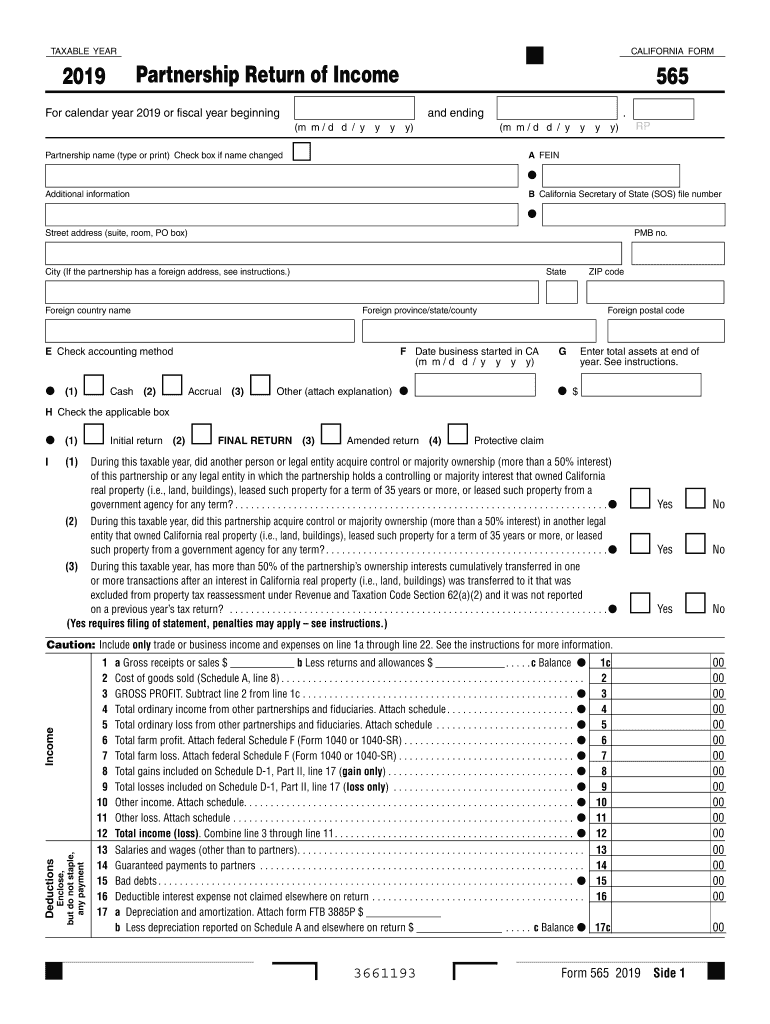

I Yes No For Privacy Notice get form FTB 1131. 3661113 Form 565 C1 2011 Side Schedule A Cost of Goods Sold 1 Inventory at beginning of year. Get 565 Booklet to see the instructions for the 565 Form TAXABLE YEAR CALIFORNIA FORM Partnership Return of Income For calendar year 2011 or fiscal year beginning month day year and ending month day year. Penalties May Apply Side Form 565 C1 2011 Schedule K Partners Shares of Income Deductions Credits etc...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign california 565

Edit your california 565 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california 565 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california 565 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california 565. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 565 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california 565

How to fill out CA FTB 565

01

Obtain the CA FTB 565 form from the California Franchise Tax Board website.

02

Enter the name of the partnership and the federal employer identification number (EIN).

03

Provide the partnership's address, including city, state, and ZIP code.

04

Indicate the date the partnership was formed and the date the tax year ended.

05

List the income, deductions, and credits for the partnership on the relevant sections of the form.

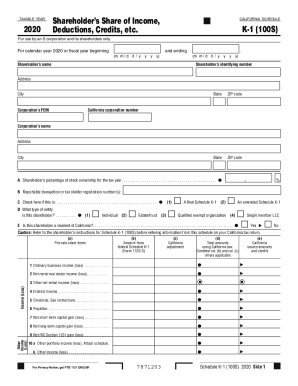

06

Report each partner's share of income, deductions, and credits in the 'Schedule K-1' section of the form.

07

Sign and date the form, ensuring all required information is complete.

08

Submit the completed form and any required attachments to the California Franchise Tax Board by the due date.

Who needs CA FTB 565?

01

Any partnership doing business in California, or that has income from California sources, needs to file CA FTB 565.

02

Partners in a multi-member LLC that elects to be treated as a partnership also need to file CA FTB 565 if they meet the criteria.

Fill

form

: Try Risk Free

People Also Ask about

What is the California 565 form?

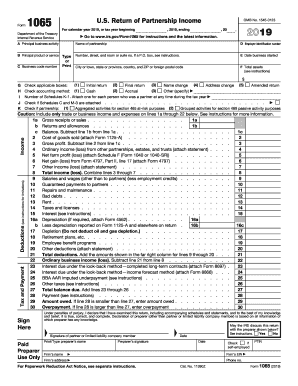

Purpose. Form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

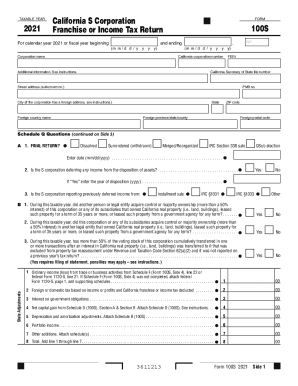

What is the difference between CA form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Can I FedEx my California tax return?

Private express mail/Overnight delivery Overnight your tax return using a private express service, such as FedEx.

What is the California form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

Can I avoid the $800 California franchise tax and still limit personal liability?

Can a single-member LLC in CA avoid $800 CA franchise fees while still keeping liability protection? Generally speaking, no. The only way to avoid the annual $800 California franchise fee is to dissolve your company, file a 'final' income tax return with the FTB and to submit the necessary paperwork.

What happens if you don't pay $800 California LLC tax?

California Franchise Tax is the annual tax for conducting business in California. For noncorporate entities, it is a flat fee of $800. For corporate entities, the fee is a minimum of $800. Failure to pay the franchise tax will result in a minimum penalty of 5% and a maximum penalty of 25% of the unpaid tax.

What is the California Form 565 for 2018?

Purpose. Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is Form 565 2018?

Form 565 is an information return for calendar year 2018 or fiscal years beginning in 2018. Use Form 565 to report income, deductions, gains, losses, etc., from the operation of a partnership.

What is the difference between Form 565 and 568?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Who needs to file form 565?

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of “doing business” in General Information A, Important Information.

Why did I get a letter from the Franchise Tax Board?

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What is the due date of CA Form 565?

When and Where to File. A partnership must file Form 565 and pay the $800 annual tax (if required) by the 15th day of the 3rd month (fiscal year) or March 15, 2022 (calendar year), following the close of its taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california 565 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your california 565 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send california 565 for eSignature?

Once you are ready to share your california 565, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit california 565 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your california 565 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is CA FTB 565?

CA FTB 565 is a tax form used by California to report income, deductions, and other tax-related information for partnerships and limited liability companies (LLCs) treated as partnerships for state tax purposes.

Who is required to file CA FTB 565?

Partnerships and LLCs that do business in California or have income from California sources are required to file CA FTB 565.

How to fill out CA FTB 565?

To fill out CA FTB 565, partnerships must provide information about the partnership's income, deductions, credits, and partner details, and must follow the specific instructions provided by the California Franchise Tax Board.

What is the purpose of CA FTB 565?

The purpose of CA FTB 565 is to report the financial activities of partnerships and LLCs, ensuring compliance with California tax laws and facilitating the accurate calculation of taxes owed by the entity and its partners.

What information must be reported on CA FTB 565?

Information that must be reported on CA FTB 565 includes the partnership’s or LLC's total income, deductions, adjustments, partner information, and any tax credits applicable to the entity.

Fill out your california 565 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California 565 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.