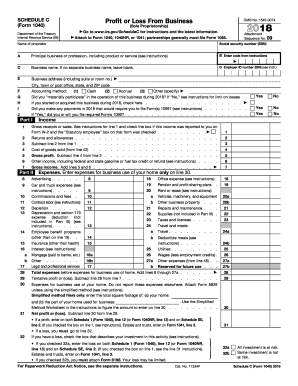

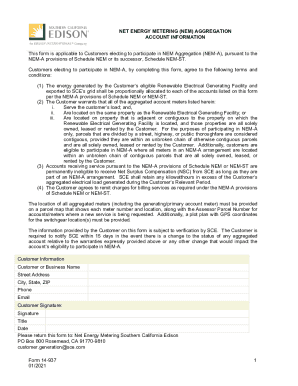

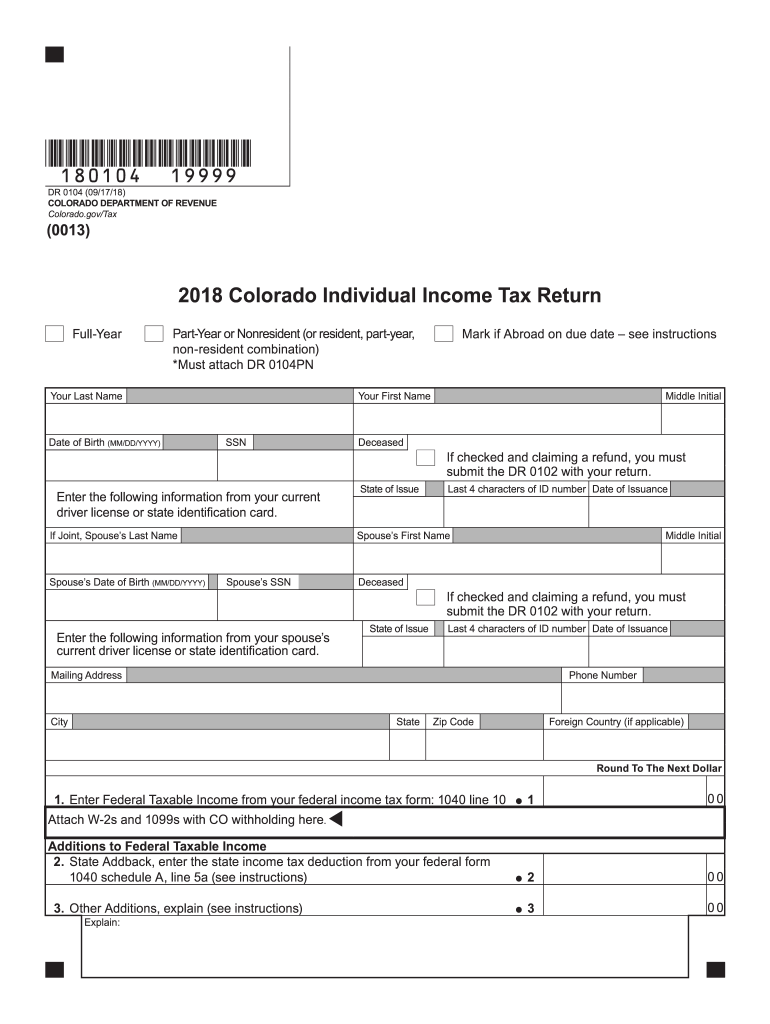

CO DoR 104 2018 free printable template

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

About CO DoR previous version

What is CO DoR 104?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

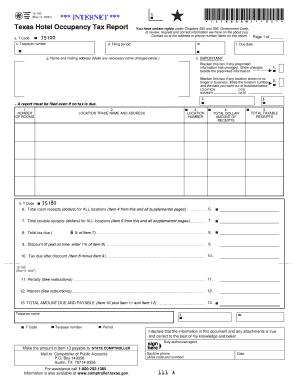

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about CO DoR 104

What should I do if I realize there’s an error on my filed colorado income tax forms?

If you discover an error on your filed colorado income tax forms, you should submit an amended return using Form DR 0104X. This process will correct your original filing and must be completed promptly to avoid additional penalties or interest.

How can I track the status of my colorado income tax forms after submission?

To track the status of your submitted colorado income tax forms, you can use the Colorado Department of Revenue's online tools. You will need to provide your personal information to verify the status of your return and ascertain if it has been processed or if any issues need addressing.

What are the common reasons for e-file rejection of colorado income tax forms?

Common reasons for e-file rejection of colorado income tax forms include mismatched information such as name or Social Security number discrepancies. It's essential to double-check all fields for accuracy before re-submitting to avoid delays.

Are there specific requirements for e-signatures on colorado income tax forms?

Yes, e-signatures on colorado income tax forms are acceptable if they comply with the standards established by the Colorado Department of Revenue. Ensure your e-signature method adheres to privacy and security protocols to protect your data.

What should I do if I receive a notice from the Colorado Department of Revenue regarding my tax forms?

If you receive a notice from the Colorado Department of Revenue concerning your filed tax forms, carefully review the notice for specific instructions. Prepare any necessary documentation or responses promptly to address the issues raised in the notice.

See what our users say