MD Comptroller 502 2018 free printable template

Show details

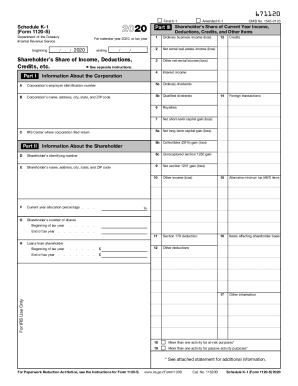

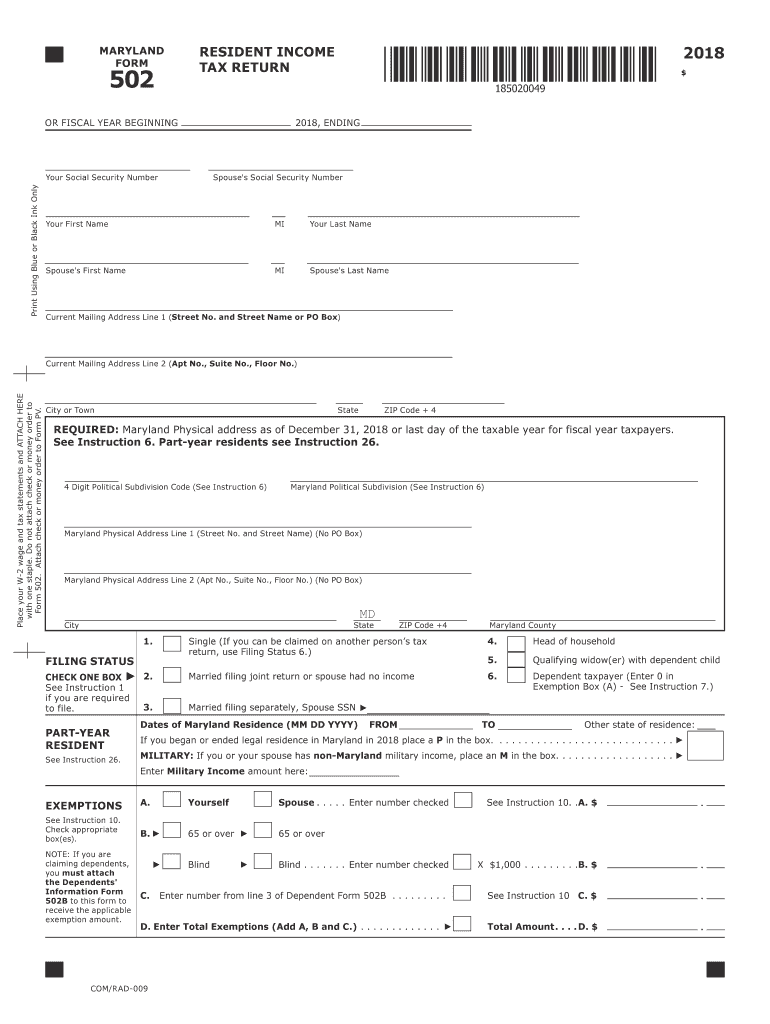

Do not attach check or money order to Form 502. Attach check or money order to Form PV. City or Town State ZIP Code 4 REQUIRED Maryland Physical address as of December 31 2018 or last day of the taxable year for fiscal year taxpayers. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No. and Street Name No PO Box MD City Single If you can be...claimed on another person s tax return use Filing Status 6. MARYLAND FORM OR FISCAL YEAR BEGINNING 2018 ENDING Your Social Security Number Print Using Blue or Black Ink Only RESIDENT INCOME TAX RETURN Spouse s Social Security Number Your First Name MI Your Last Name Spouse s First Name Spouse s Last Name Current Mailing Address Line 1 Street No. and Street Name or PO Box Place your W-2 wage and tax statements and ATTACH HERE with one staple. Do not attach check or money order to Form 502. Attach...check or money order to Form PV. City or Town State ZIP Code 4 REQUIRED Maryland Physical address as of December 31 2018 or last day of the taxable year for fiscal year taxpayers. Do not attach Form PV or check/ money order to Form 502. Place Form PV with attached check/money order on TOP of Form 502 and mail to Payment Processing PO Box 8888. 1a. Wages salaries and/or tips. 1a. 1b. Earned income. 1b. 1c. Capital Gain or loss. 1c. 1d. Taxable Pensions IRAs Annuities Attach Form 502R.. 1d. 1e....Place a Y in this box if the amount of your investment income is more than 3 500. 2. Tax-exempt interest on state and local obligations bonds other than Maryland. 20. 21. Maryland tax from Tax Table or Computation Worksheet Schedules I or II. 21. TAX 23. Poverty level credit See Instruction 18. 23. COMPUTATION 24. Other income tax credits for individuals from Part AA line 12 of Form 502CR Attach Form 502CR.. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision...Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No. and Street Name No PO Box MD City Single If you can be claimed on another person s tax return use Filing Status 6. Married filing joint return or spouse had no income FILING STATUS CHECK ONE BOX if you are required to file. PART-YEAR RESIDENT EXEMPTIONS Check appropriate box es. NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to...receive the applicable exemption amount. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No* and Street Name No PO Box MD City Single If you can be claimed on another person s tax return use Filing Status 6. Married filing joint return or spouse had no income FILING STATUS CHECK ONE BOX if you are required to file. PART-YEAR RESIDENT EXEMPTIONS...Check appropriate box es. NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to receive the applicable exemption amount.

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

How to fill out MD Comptroller 502

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

To edit the MD Comptroller 502 Tax Form, obtain a copy of the form from the Maryland State Comptroller's website. Utilize a PDF editor like pdfFiller to make changes directly on the form. Ensure that all edits comply with the requirements stipulated by the Maryland Comptroller’s office to avoid potential filing errors.

How to fill out MD Comptroller 502

Filling out the MD Comptroller 502 requires accurate input of your information. Start by gathering necessary documentation such as tax identification numbers and any relevant payment records. Complete each section of the form step-by-step as outlined: enter your name and address, provide business details if applicable, and specify the nature of the income or payment.

01

Gather required documents.

02

Fill in personal and business information.

03

Specify type of payment and amounts.

04

Review the completed form for accuracy.

About MD Comptroller previous version

What is MD Comptroller 502?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 502?

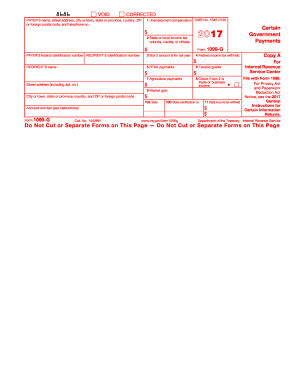

MD Comptroller 502 is a tax form used in the state of Maryland for reporting specific payments made to individuals or businesses. This form helps ensure compliance with tax laws and accurately documents financial transactions for both the payer and the payee.

What is the purpose of this form?

The purpose of MD Comptroller 502 is to report income payments made to non-employees. This may include payments for services rendered, rent, or other compensations that fall under specific reporting requirements. Using this form helps the state track income for tax purposes and assists payees in fulfilling their tax obligations.

Who needs the form?

Individuals or businesses that make payments to independent contractors, freelancers, or certain vendors may need to file MD Comptroller 502. It is particularly relevant if the payments total $600 or more within a calendar year. Understanding who qualifies for reporting is essential to comply with Maryland regulations.

When am I exempt from filling out this form?

You may be exempt from filling out MD Comptroller 502 if your payments do not meet the $600 threshold within the tax year or if they are for certain types of payments such as medical or legal services that are reported differently. Always check the specific instructions provided by the Maryland Comptroller’s office for any exceptions.

Components of the form

MD Comptroller 502 consists of several key components, including sections for payer information, payee information, payment amounts, and a summary of the type of payments made. Each section must be completed accurately to ensure proper processing by the Maryland tax authorities.

What are the penalties for not issuing the form?

Failing to issue MD Comptroller 502 when required may lead to penalties such as fines imposed by the Maryland State Comptroller's office. These penalties can vary based on the severity of the omission and the amounts involved. It is advisable to adhere strictly to the filing requirements to avoid any potential legal or financial consequences.

What information do you need when you file the form?

When filing MD Comptroller 502, you should have the following information ready: your tax identification number, the payee's tax identification number, payment details, and any documentation that supports the reported payments. Collecting all necessary information ahead of time can streamline the filing process.

Is the form accompanied by other forms?

MD Comptroller 502 can be accompanied by other related forms depending on the type of payments being reported. For instance, if the payments include interest or distributions, additional forms such as the 1099 series might also be necessary. Review the Maryland Comptroller's instructions to verify if accompanying forms are required for your filing.

Where do I send the form?

Completed MD Comptroller 502 forms should be sent to the Maryland State Comptroller’s office at the address specified in the filing instructions. It is crucial to send the form to the correct location and ensure that it is submitted by the due date to avoid penalties.

See what our users say