CT W-1QMB 2009 free printable template

Show details

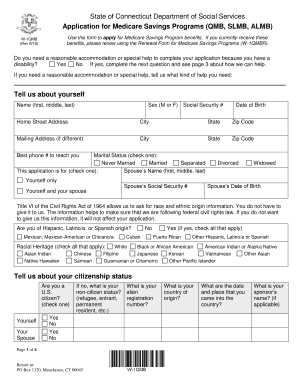

State of Connecticut Department of Social Services Medicare Savings Program (CMB, SLAB, ALMA) W1QMB (Rev. 8/09) Basic Information Please give us the following information about you: Your Name: First

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT W-1QMB

Edit your CT W-1QMB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT W-1QMB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT W-1QMB online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT W-1QMB. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT W-1QMB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT W-1QMB

How to fill out CT W-1QMB

01

Obtain the CT W-1QMB form from the Connecticut Department of Social Services website or your local DSS office.

02

Fill in your personal details at the top, including your name, address, and Social Security number.

03

Provide information about your household size and income to determine eligibility.

04

Indicate if you have any assets, as this may affect your qualification for the program.

05

Sign and date the form to verify the information provided is accurate.

06

Submit the completed form to the local DSS office either by mail or in person.

Who needs CT W-1QMB?

01

Individuals who are enrolled in the Medicare program and have a limited income.

02

Residents of Connecticut who seek assistance with Medicare Part B premiums.

03

Those who may qualify for the Qualified Medicare Beneficiary (QMB) program.

Fill

form

: Try Risk Free

People Also Ask about

Does Social Security count as income for QMB?

Does Social Security count as income for QMB? Yes, Social Security is considered income. If your monthly Social Security check exceeds $1,235 a month for an individual, you will not qualify for the Qualified Medicare Beneficiary (QMB) program in most states.

What is the QMB limit in CT?

Qualified Medicare Beneficiary (QMB): The income limit for QMB is $2,245.04 a month if single and $3,032.07 a month if married. QMB pays for Part A and B cost sharing and Part B premiums. If a beneficiary is required to pay Part A premiums, QMB pays for them, too.

What is the QMB program in Connecticut?

The QMB program works with both Medicare and a Medicare Advantage plans. It will pay the deductibles and co-pays of Medicare Part A and B up to the Medicaid approved rate.

What is the QMB limit in CT 2023?

QMB – this level of extra help pays your Part B premium, all Medicare deductibles and co-insurance. Income levels for QMB are as follows: Individual, $2,390 of gross income per month, couples, $3,220 per month.

What are the income limits for Medicare 2023?

In 2023, your costs for Medicare Parts B and D are based on income reported on your 2021 tax return. You won't pay any extra for Part B or Part D if you earned $97,000 or less as an individual or $194,000 or less if you are a joint filer.

What is the income limit for QMB in CT?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT W-1QMB without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your CT W-1QMB into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get CT W-1QMB?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CT W-1QMB. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the CT W-1QMB electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CT W-1QMB in minutes.

What is CT W-1QMB?

CT W-1QMB is a form used in Connecticut for reporting the wages and tips of employees, particularly those eligible for the Qualified Medicare Beneficiary program.

Who is required to file CT W-1QMB?

Employers who pay wages to employees, especially those who are eligible for the Qualified Medicare Beneficiary program, are required to file CT W-1QMB.

How to fill out CT W-1QMB?

To fill out CT W-1QMB, employers must provide accurate information regarding employee wages, tips, and any tax withholdings, ensuring all required fields are completed before submission.

What is the purpose of CT W-1QMB?

The purpose of CT W-1QMB is to report wage and tax information for employees to the state of Connecticut, ensuring proper compliance with state tax regulations.

What information must be reported on CT W-1QMB?

CT W-1QMB must report the employee's name, social security number, total wages, tips received, and any tax withholdings for the reporting period.

Fill out your CT W-1QMB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT W-1qmb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.