UT TC-69 2018 free printable template

Show details

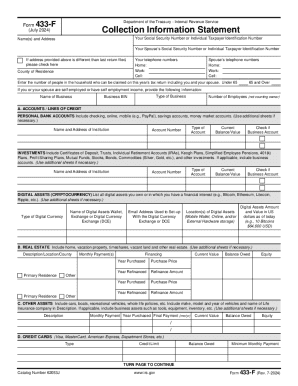

TC69UTAH STATE BUSINESS AND TAX REGISTRATION Rev. 12/18Utah State Tax Commission 210 North 1950 West Salt Lake City, UT 841343310 8012972200 18006624335 tax. Utah.general Instructions Use form TC69

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-69

Edit your UT TC-69 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-69 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-69 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UT TC-69. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-69

How to fill out UT TC-69

01

Obtain a copy of form UT TC-69 from the appropriate government website.

02

Fill in your personal information in the designated sections, including your name, address, and contact information.

03

Provide details regarding the property in question, including its address and any relevant tax information.

04

Clearly state the purpose for filing the UT TC-69, explaining the reason for your appeal or request.

05

Include any necessary supporting documents, such as receipts or previous tax assessments.

06

Review the completed form for accuracy and ensure all required fields are filled.

07

Submit the completed form according to the instructions provided, either online or via mail to the appropriate department.

Who needs UT TC-69?

01

Individuals or organizations that are seeking a property tax exemption or adjustment.

02

Property owners who believe their property has been assessed incorrectly.

03

Those filing an appeal against a tax assessment related to their property.

Fill

form

: Try Risk Free

People Also Ask about

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Who is required to file Utah state tax return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

What taxes do I have to pay in Utah?

Utah has a very simple income tax system with just a single flat rate. All taxpayers in Utah pay a 4.85% state income tax rate, regardless of filing status or income tier. No cities in the Beehive State have local income taxes. Of course, Utah taxpayers also have to pay federal income taxes.

Am I subject to Utah withholding?

General Information. You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

Does Utah have local income tax?

The state of Utah has a single personal income tax, with a flat rate of 4.85%. Sales taxes in Utah range from 4.85% to 9.05%, depending on local rates. Homeowners in Utah also pay exceptionally low property taxes, with an average effective rate of just 0.52%.

Is there city income tax in Utah?

Individual Income Taxes Individuals pay state income tax of 2.3% to 7.0% on income earned in or derived from operations in Utah. Credits for taxes paid in another state are limited to the effective rates as if earned in Utah. No local governments in Utah assess an income tax.

Where do I file my Utah state tax return?

Visit Us In Person Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737. 435-251-9520.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete UT TC-69 online?

pdfFiller has made it easy to fill out and sign UT TC-69. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in UT TC-69 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your UT TC-69, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the UT TC-69 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your UT TC-69 in minutes.

What is UT TC-69?

UT TC-69 is a form used in Utah to report the transfer of tangible personal property that is subject to sales tax. It serves as a declaration for reporting sales and use tax obligations.

Who is required to file UT TC-69?

Businesses and individuals who make taxable sales or transfers of tangible personal property in Utah are required to file UT TC-69 to report the applicable sales tax.

How to fill out UT TC-69?

To fill out UT TC-69, gather all necessary information about the transaction, enter details such as the seller's and buyer's information, describe the items sold, indicate the sales tax collected, and submit the form to the Utah State Tax Commission.

What is the purpose of UT TC-69?

The purpose of UT TC-69 is to ensure proper reporting and collection of sales and use taxes for tangible personal property transfers in the state of Utah.

What information must be reported on UT TC-69?

Information that must be reported on UT TC-69 includes the names and addresses of the buyer and seller, a description of the items sold, the sales price, the amount of sales tax collected, and the date of the transaction.

Fill out your UT TC-69 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-69 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.