UT TC-69 2020 free printable template

Show details

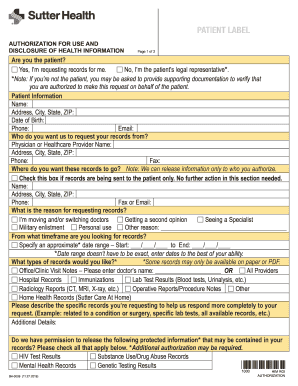

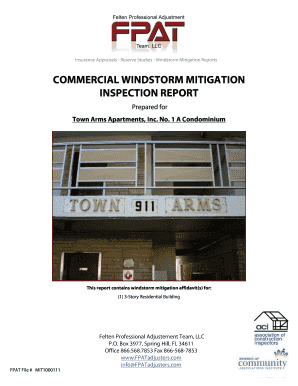

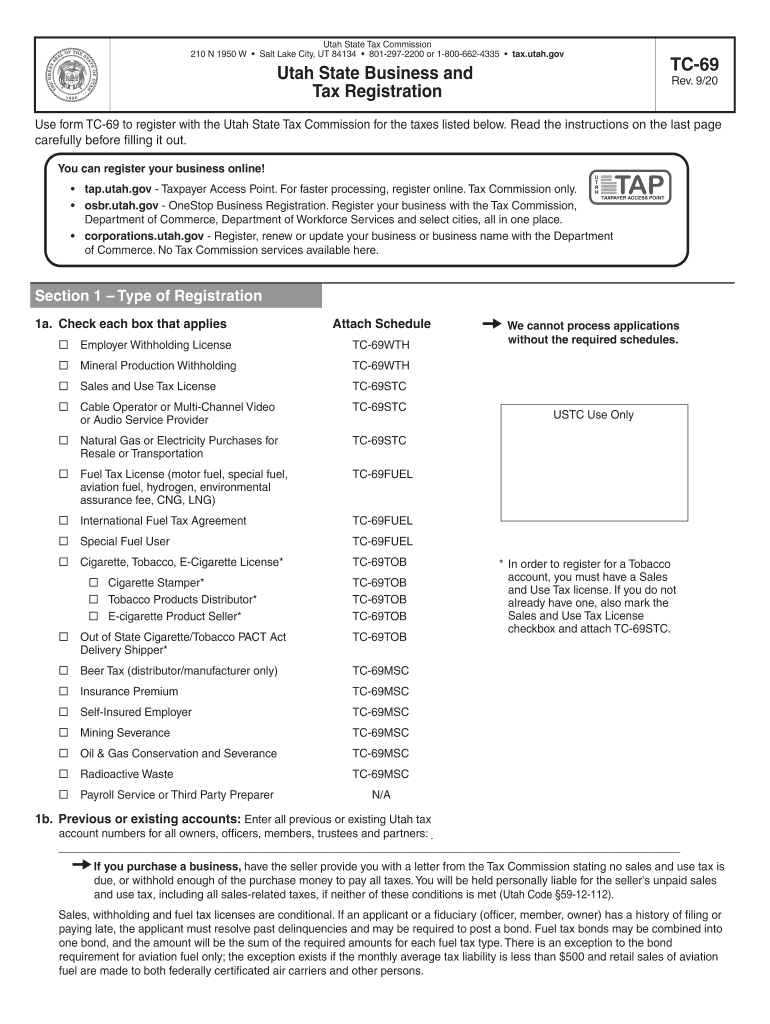

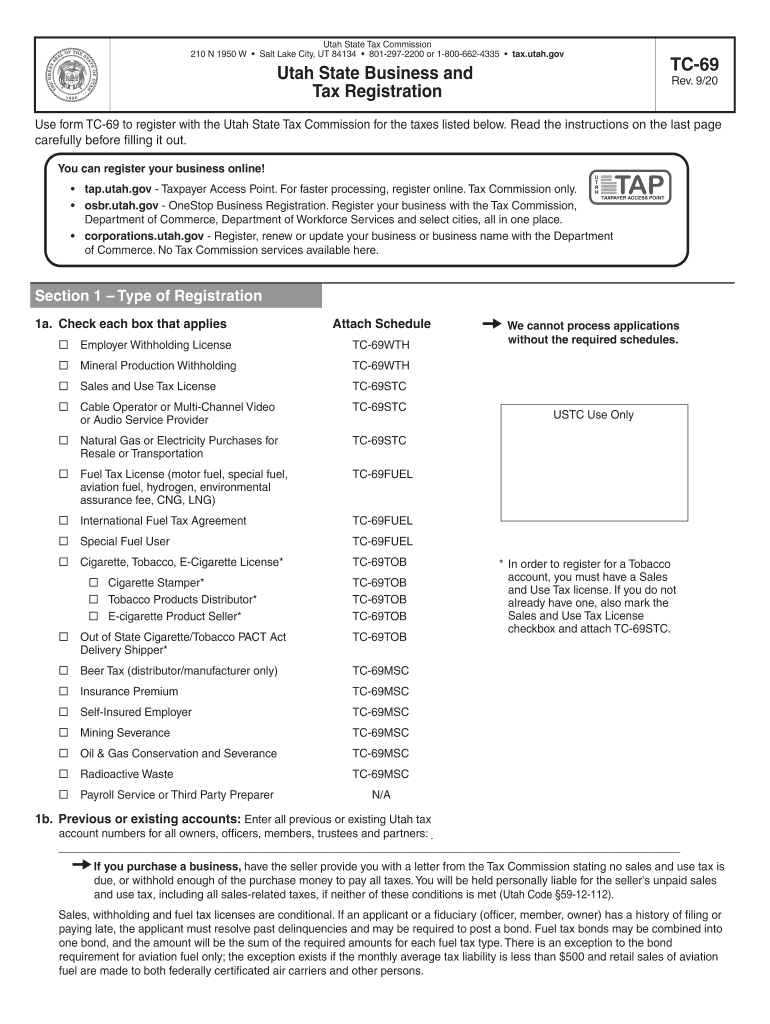

Print Formulae form Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134 8012972200 or 18006624335 tax.Utah.gov Utah State Business and Tax RegistrationTC69 Rev. 9/20Use form TC69 to register

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-69

Edit your UT TC-69 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-69 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-69 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-69. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-69

How to fill out UT TC-69

01

Start by downloading the UT TC-69 form from the official website or obtain a physical copy.

02

Begin filling out the header section with your personal information, including your name, address, and contact details.

03

Provide the relevant date on which you are submitting the form.

04

Fill out the specific sections regarding the nature of your request or application, ensuring that all required fields are completed.

05

Attach any necessary documentation that supports your request, if applicable.

06

Review the form thoroughly for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the completed UT TC-69 form either electronically or by mailing it to the appropriate address.

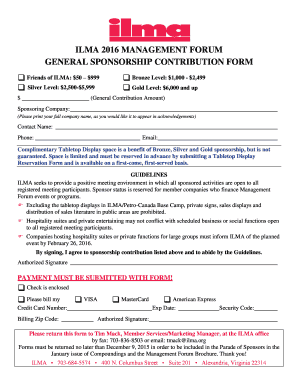

Who needs UT TC-69?

01

Individuals seeking to apply for permits related to their utility services.

02

Businesses that need to request changes or updates to their existing utility accounts.

03

Anyone who needs to report issues or discrepancies with their utility services.

Fill

form

: Try Risk Free

People Also Ask about

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Who is required to file Utah state tax return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

What taxes do I have to pay in Utah?

Utah has a very simple income tax system with just a single flat rate. All taxpayers in Utah pay a 4.85% state income tax rate, regardless of filing status or income tier. No cities in the Beehive State have local income taxes. Of course, Utah taxpayers also have to pay federal income taxes.

Am I subject to Utah withholding?

General Information. You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

Does Utah have local income tax?

The state of Utah has a single personal income tax, with a flat rate of 4.85%. Sales taxes in Utah range from 4.85% to 9.05%, depending on local rates. Homeowners in Utah also pay exceptionally low property taxes, with an average effective rate of just 0.52%.

Is there city income tax in Utah?

Individual Income Taxes Individuals pay state income tax of 2.3% to 7.0% on income earned in or derived from operations in Utah. Credits for taxes paid in another state are limited to the effective rates as if earned in Utah. No local governments in Utah assess an income tax.

Where do I file my Utah state tax return?

Visit Us In Person Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737. 435-251-9520.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UT TC-69 for eSignature?

Once your UT TC-69 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete UT TC-69 online?

pdfFiller has made it easy to fill out and sign UT TC-69. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete UT TC-69 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UT TC-69 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

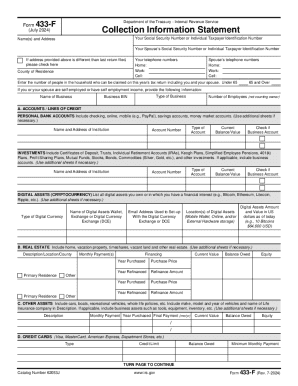

What is UT TC-69?

UT TC-69 is a tax form used in Utah for reporting certain tax-related information.

Who is required to file UT TC-69?

Any taxpayer who meets specific criteria set by the Utah State Tax Commission is required to file UT TC-69.

How to fill out UT TC-69?

To fill out UT TC-69, you need to provide accurate financial information as required, including income details and relevant deductions, and follow the instructions provided with the form.

What is the purpose of UT TC-69?

The purpose of UT TC-69 is to collect essential tax information for the proper assessment and collection of taxes in the state of Utah.

What information must be reported on UT TC-69?

Information such as taxpayer identification, income figures, deductions, and credits must be reported on UT TC-69.

Fill out your UT TC-69 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-69 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.