UT TC-69 2021 free printable template

Show details

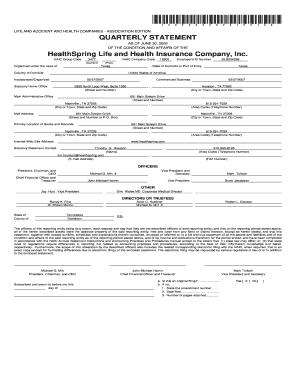

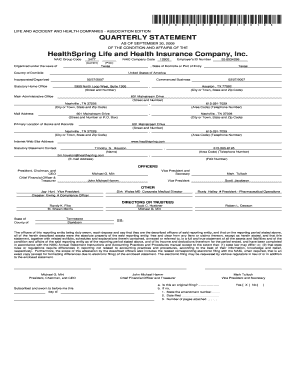

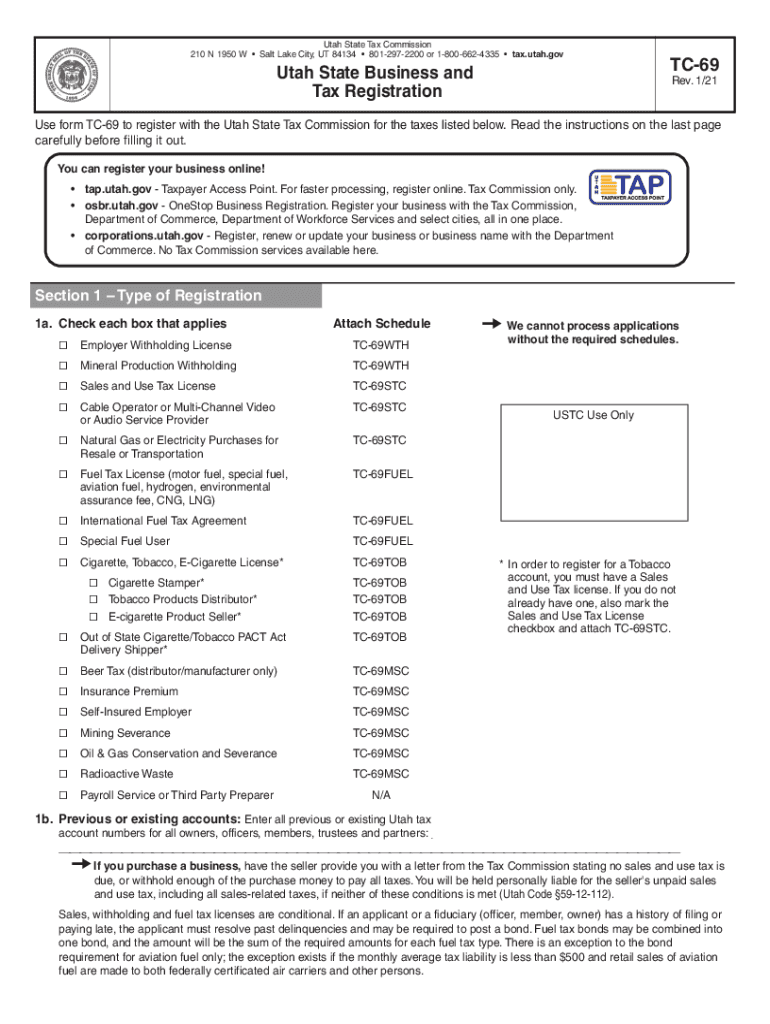

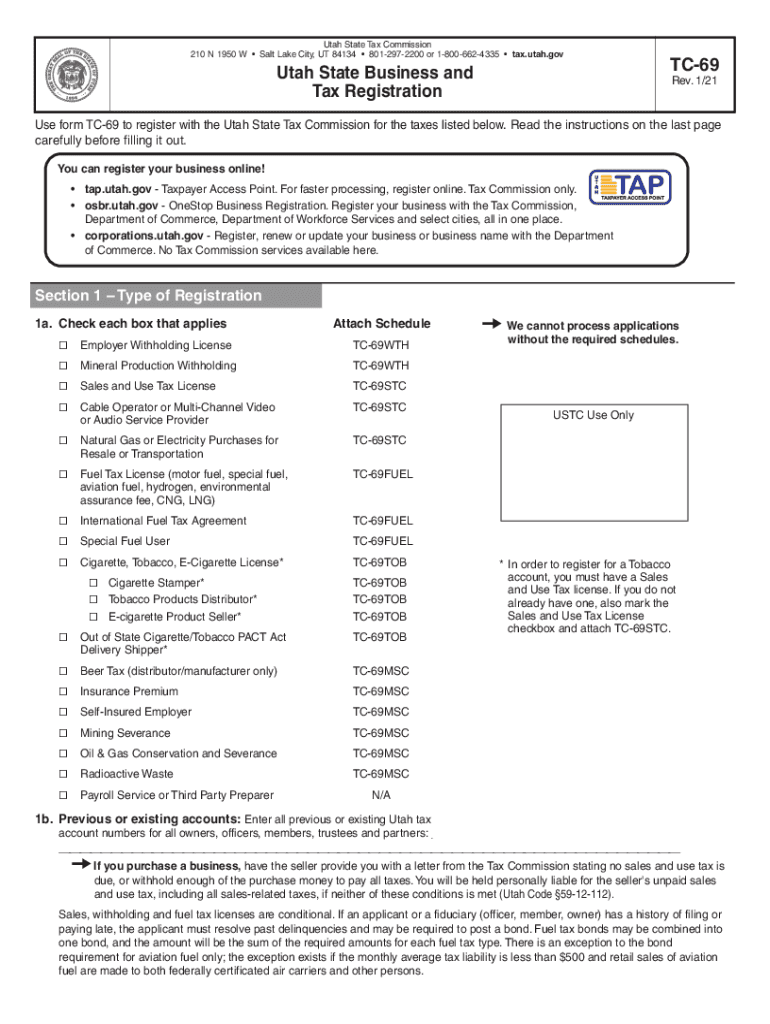

Print Formulae form Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134 8012972200 or 18006624335 tax.Utah.gov Utah State Business and Tax RegistrationTC69 Rev. 1/21Use form TC69 to register

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-69

Edit your UT TC-69 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-69 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-69 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-69. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-69

How to fill out UT TC-69

01

Step 1: Gather all necessary documentation related to the transaction.

02

Step 2: Begin filling out the UT TC-69 form by entering the date at the top of the form.

03

Step 3: Fill in the name and address of the seller in the designated section.

04

Step 4: Provide the buyer's name and address in the corresponding section.

05

Step 5: Enter the details of the property being transferred, including the address and legal description.

06

Step 6: Indicate the type of transaction (sale, gift, etc.) in the appropriate section.

07

Step 7: Fill in the sale price or value of the property.

08

Step 8: Sign and date the form at the bottom, ensuring all information is complete and accurate.

09

Step 9: Submit the completed form to the relevant authority along with any required fees.

Who needs UT TC-69?

01

Individuals or entities involved in the transfer of property in the state of Utah.

02

Sellers and buyers of real estate who need to document the transaction.

03

Real estate agents and attorneys representing clients in property transactions.

Fill

form

: Try Risk Free

People Also Ask about

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Who is required to file Utah state tax return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

What taxes do I have to pay in Utah?

Utah has a very simple income tax system with just a single flat rate. All taxpayers in Utah pay a 4.85% state income tax rate, regardless of filing status or income tier. No cities in the Beehive State have local income taxes. Of course, Utah taxpayers also have to pay federal income taxes.

Am I subject to Utah withholding?

General Information. You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

Does Utah have local income tax?

The state of Utah has a single personal income tax, with a flat rate of 4.85%. Sales taxes in Utah range from 4.85% to 9.05%, depending on local rates. Homeowners in Utah also pay exceptionally low property taxes, with an average effective rate of just 0.52%.

Is there city income tax in Utah?

Individual Income Taxes Individuals pay state income tax of 2.3% to 7.0% on income earned in or derived from operations in Utah. Credits for taxes paid in another state are limited to the effective rates as if earned in Utah. No local governments in Utah assess an income tax.

Where do I file my Utah state tax return?

Visit Us In Person Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737. 435-251-9520.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UT TC-69 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your UT TC-69 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get UT TC-69?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the UT TC-69 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the UT TC-69 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is UT TC-69?

UT TC-69 is a tax form used by individuals and businesses in Utah to report and claim certain tax credits and adjustments.

Who is required to file UT TC-69?

Any taxpayer in Utah who is eligible for tax credits or adjustments that must be reported requires filing UT TC-69.

How to fill out UT TC-69?

To fill out UT TC-69, you need to provide your personal information, report income and expenses, and calculate the tax credits or adjustments being claimed.

What is the purpose of UT TC-69?

The purpose of UT TC-69 is to allow taxpayers to report tax-related information necessary for calculating their tax liabilities and claiming credits.

What information must be reported on UT TC-69?

Information that must be reported on UT TC-69 includes taxpayer identification details, income amounts, deductions, and details regarding any credits or adjustments being claimed.

Fill out your UT TC-69 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-69 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.