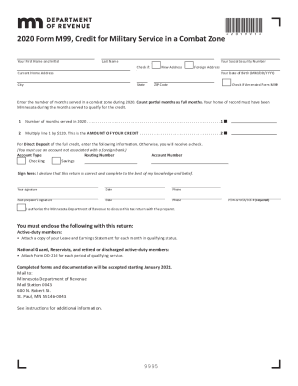

MN M99 2018 free printable template

Show details

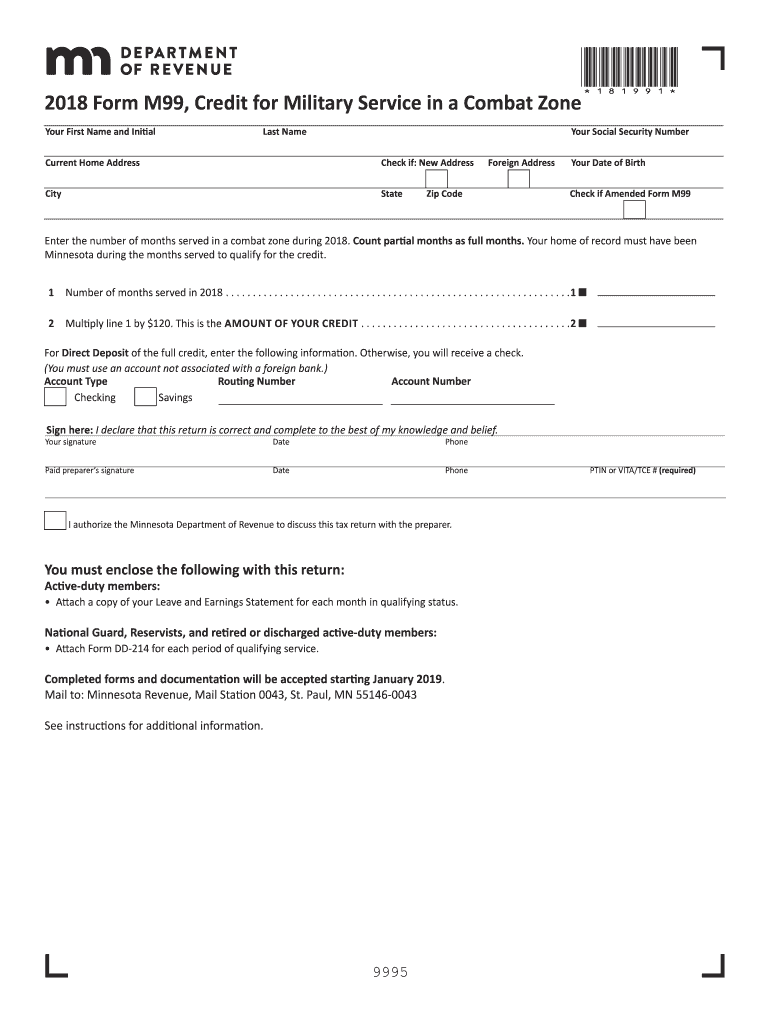

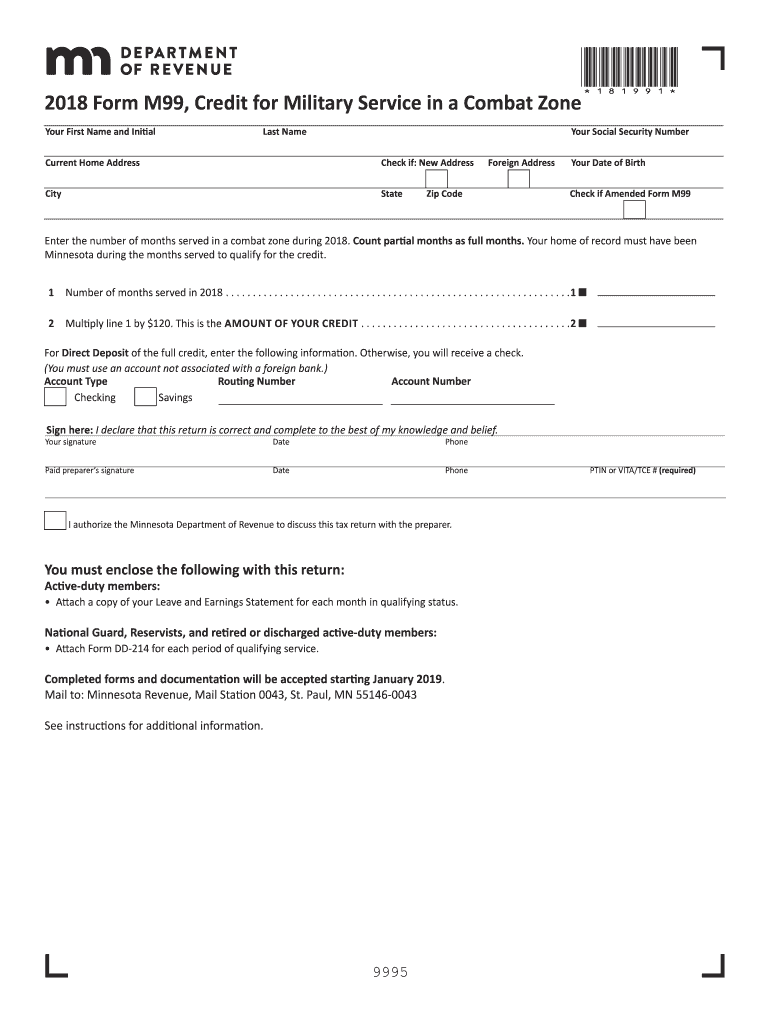

To Receive a Credit for Prior Years The 2018 Form M99 applies only to time served in a combat zone during 2018. How to Claim the Credit You must file Form M99 Credit for Military Service in a Combat Zone and attach the required documentation to receive the credit. Example If you served in a combat zone in 2014 you had to file your 2014 Form M99 by October 15 2018 to meet the 3 year June 1 2015 you spent 60 days in a combat zone. To claim the credit complete Form M23 Claim for a Refund for a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN M99

Edit your MN M99 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN M99 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN M99 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MN M99. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN M99 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN M99

How to fill out MN M99

01

Begin by obtaining the MN M99 form from the appropriate state agency or website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Review the instructions carefully to ensure you understand each section of the form.

04

Provide details about the specific purpose for which the MN M99 is being filed.

05

If applicable, include any supporting documents that are required as part of the submission.

06

Double-check your entries for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the form either online or via mail to the appropriate agency.

Who needs MN M99?

01

Individuals or organizations needing to report certain activities or changes as mandated by state regulations.

02

People seeking to clarify their status concerning specific administrative matters in Minnesota.

03

Businesses that are required to submit information regarding licensing or regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is a form M99?

You can file online or complete and mail Form M99, Credit for Military Service in a Combat Zone, for the year you served. You file Form M99 separately from your income tax return. To receive this credit, you must: Include required documentation (see “Documentation Needed” on this page) with your form.

What do I put for taxable combat pay?

Enlisted persons and warrant officers— Combat pay is nontaxable, and you should report zero for combat pay or special combat pay. Commissioned officers—Combat pay in excess of the highest enlisted person's pay (plus imminent danger/hostile fire pay) is taxable.

What is taxable combat pay on 1040?

Combat pay is income earned while stationed in a designated combat zone in service to the U.S. military. Combat pay is nontaxable for most service members, and all service members can exclude at least some of their combat pay from their taxable income.

What are the current combat zones?

Current Recognized Combat Zones Jordan, Kyrgyzstan, Pakistan, Tajikistan, and Uzbekistan (as of September 19, 2001) Philippines (from January 9, 2002 through September 30, 2015) Djibouti (as of July 1, 2002) Yemen (as of April 10, 2002) Somalia and Syria (as of January 1, 2004)

Does Minnesota tax military pay?

Calculation of Minnesota's individual income tax starts with federal taxable income. As a result, military pay that is exempt from taxation at the federal level, such as combat pay and hazardous duty pay, is also exempt at the state level.

Is combat pay taxable on 1040 fafsa?

This is question 88e on the Free Application for Federal Student Aid (FAFSA®) PDF. Enlisted persons and warrant officers— Combat pay is entirely nontaxable, and your parent(s) should report zero for combat pay or special combat pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MN M99 in Gmail?

MN M99 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit MN M99 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MN M99 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete MN M99 on an Android device?

Use the pdfFiller app for Android to finish your MN M99. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MN M99?

MN M99 is a specific form used for reporting income and tax information in the state of Minnesota.

Who is required to file MN M99?

Taxpayers who have received income that is subject to Minnesota state tax are required to file the MN M99.

How to fill out MN M99?

To fill out MN M99, individuals must provide accurate information regarding their income, deductions, and tax credits as specified in the form's guidelines.

What is the purpose of MN M99?

The purpose of MN M99 is to ensure that taxpayers report their income correctly and pay the appropriate amount of state taxes.

What information must be reported on MN M99?

MN M99 requires reporting of total income, any deductions, tax credits, and other relevant financial information as outlined in the form.

Fill out your MN M99 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN m99 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.