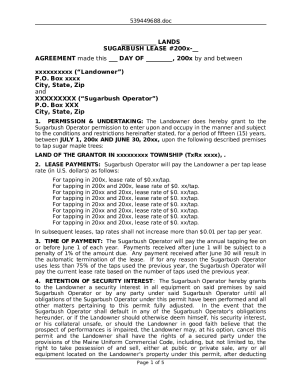

UT TC-40 2018 free printable template

Show details

To learn more go to tap.utah. gov 40802 SSN Last name Pg. 2 24 Apportionable nonrefundable credits from TC-40A Part 3 attach TC-40A page 1 25 Full-year resident subtract line 24 from line 23 not less than zero Non or Part-year resident complete and enter the UTAH TAX from TC-40B line 37 26 Nonapportionable nonrefundable credits from TC-40A Part 4 attach TC-40A page 1 28 Voluntary contributions from TC-40 page 3 Part 4 attach TC-40 page 3 29 AMENDED RETURN ONLY - previous refund 30 Recapture...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-40

Edit your UT TC-40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-40 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UT TC-40. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-40

How to fill out UT TC-40

01

Obtain the UT TC-40 form from the official website or local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details regarding your Texas tax filings and credits for the applicable tax year.

04

If applicable, list out any deductions you are claiming on the form.

05

Double-check the information you entered for accuracy.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed UT TC-40 form to the appropriate tax authority as instructed.

Who needs UT TC-40?

01

Individuals or businesses who are claiming certain Texas tax refunds or credits.

02

Taxpayers who need to report specific tax-related information to the state of Texas.

03

Anyone who is required to reconcile taxes paid with their tax liability in Texas.

Fill

form

: Try Risk Free

People Also Ask about

How long can the state of Utah collect back taxes?

The Utah State Tax Commission must assess a tax, fee, or charge within three years after the day on which a person files a return in order to commence a proceeding to collect the tax, fee, or charge.

Where do I file my Utah state tax return?

Visit Us In Person Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737. 435-251-9520.

Who must file Utah partnership return?

Filing Requirements A partnership or other entity treated as a partnership for federal tax purposes with any partners or members who are businesses, trusts, estates or nonresident individuals is required to file a TC-65.

Does Utah have an e file form?

Federal and State Returns E-filed Through a Paid Preparer Utah accepts the federal PIN as the electronic signature on an e-filed Utah return.

Do I have to file a Utah return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

Am I required to file a Utah state tax return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT TC-40 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your UT TC-40 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send UT TC-40 for eSignature?

When you're ready to share your UT TC-40, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the UT TC-40 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your UT TC-40 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

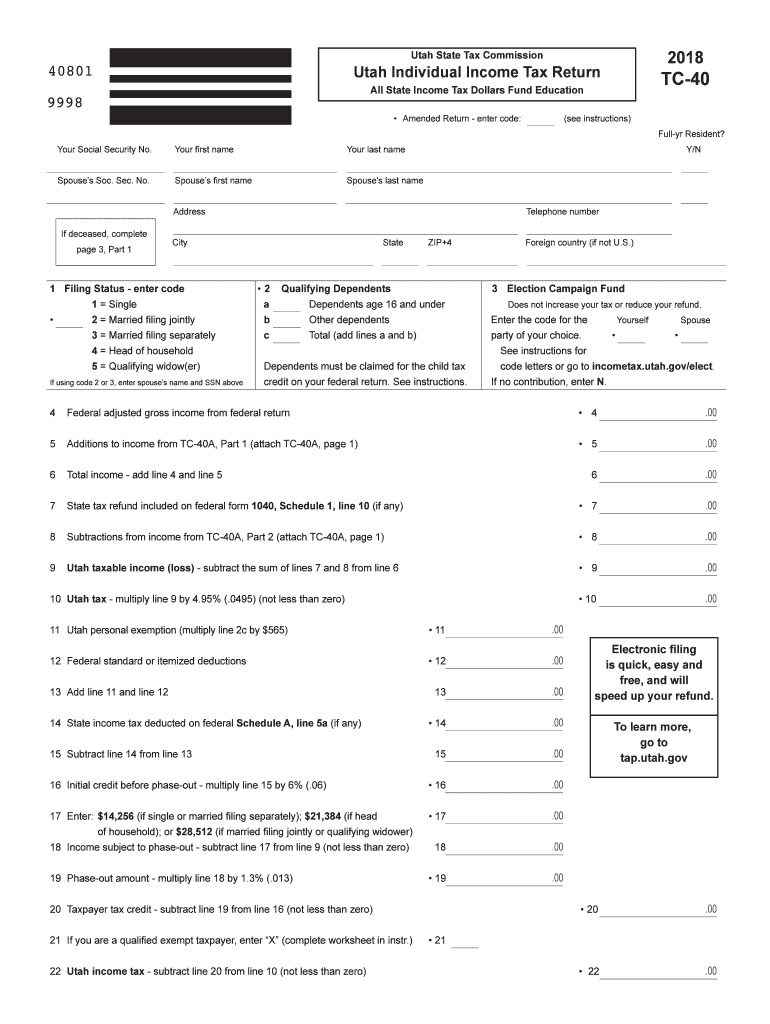

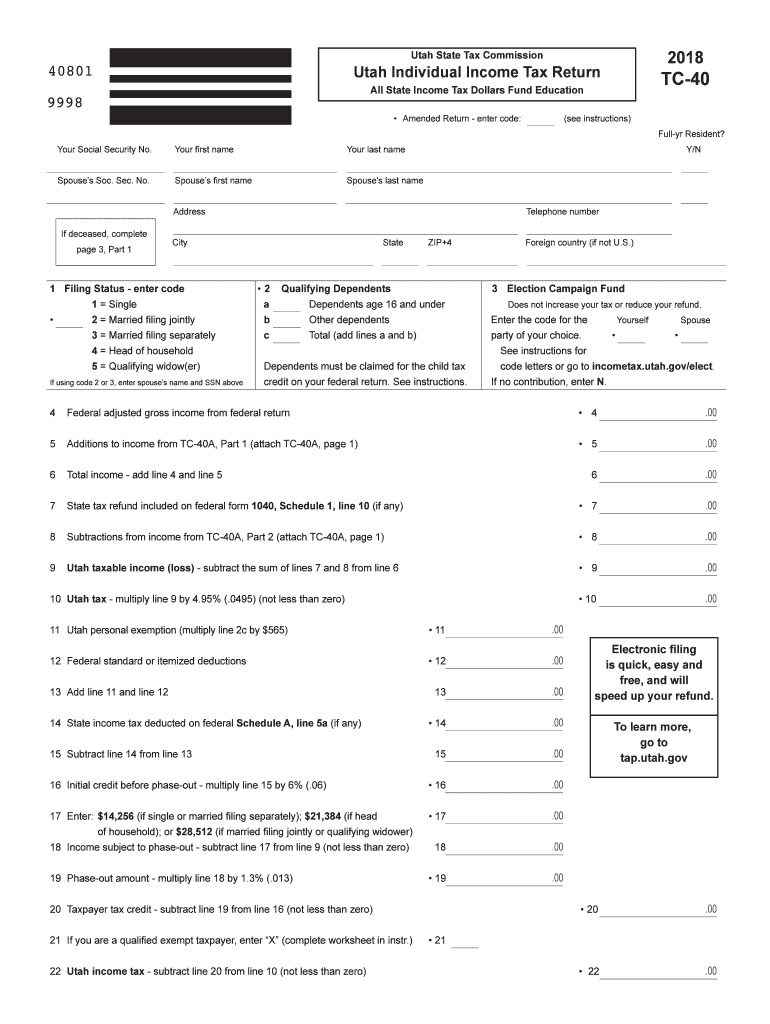

What is UT TC-40?

UT TC-40 is the state tax return form used by residents of Utah to report their income and calculate their state income tax liability.

Who is required to file UT TC-40?

Residents of Utah who have a certain amount of taxable income or who meet specific filing requirements are required to file UT TC-40.

How to fill out UT TC-40?

To fill out UT TC-40, taxpayers should gather their income documents, use the form to report their income, claim any deductions or credits, and calculate their tax due or refund.

What is the purpose of UT TC-40?

The purpose of UT TC-40 is to enable Utah residents to report their income and fulfill their state tax obligations.

What information must be reported on UT TC-40?

Information that must be reported on UT TC-40 includes total income, deductions, tax credits, and other relevant financial data necessary for calculating state tax liability.

Fill out your UT TC-40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.