UT TC-40 2023 free printable template

Show details

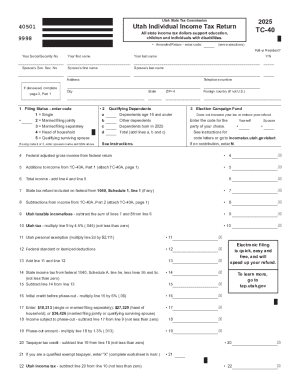

Clear form Utah State Tax Commission Utah Individual Income Tax Return 40301 TC-40 All state income tax dollars support education children and individuals with disabilities. Utah. gov for county codes and additional information. Mail RETURNS WITH PAYMENTS to Enter X Enter code 210 N 1950 W ALL OTHER Salt Lake City UT 84134-0266 RETURNS to Submit page ONLY if data entered. Attach completed schedule to your Utah Income Tax return.. Amended Return - enter code see instructions USTC ORIGINAL FORM...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-40

Edit your UT TC-40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-40 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-40. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-40

How to fill out UT TC-40

01

Begin by downloading or printing the UT TC-40 form from the appropriate state website.

02

Fill in your personal information at the top, including your name, address, and social security number.

03

Provide details about your vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the reason for the request by checking the corresponding box.

05

If applicable, include any relevant documentation that supports your claim or request.

06

Review your information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate state agency, either in person or via mail.

Who needs UT TC-40?

01

Individuals who need to claim a tax exemption on the sale or use of motor vehicles in Utah.

02

Anyone looking to request a sales tax refund for a vehicle that was purchased under certain conditions.

03

Taxpayers who are applying for a refund related to a vehicle trade-in or purchase.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1049 form used for?

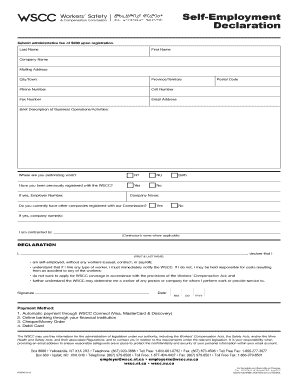

If you use this form to show your self-employment income: This is your sworn statement of income. You can ask another person to help you fill out this form, but that person also must sign this form. Use more sheets of paper if you need to.

Are the 2022 tax forms available?

Many IRS forms are now available for the 2022 tax year, which is what you'll need to file your taxes by the April 18, 2023, tax deadline.

Why can't I print my tax forms?

If you're unable to print out a form, it's because the form isn't ready to be filed yet. The form isn't ready for one of the following reasons: The IRS (for federal returns) or your state (for state returns) is still working on finalizing the form.

Where do I get Vermont tax forms?

Go to myVTax for more information. Line-by-line instructions for complex tax forms can be found next to the file.

Can you get tax forms at Canada Post?

Paper forms and return envelopes are still stocked at Canada Post outlets and Service Canada offices during tax time, starting in February and through April. Envelopes are free of charge, but you must pay for postage (the fee for which varies depends on how many pages you include in your return).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the UT TC-40 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your UT TC-40.

How do I edit UT TC-40 on an Android device?

You can make any changes to PDF files, such as UT TC-40, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out UT TC-40 on an Android device?

Use the pdfFiller app for Android to finish your UT TC-40. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is UT TC-40?

UT TC-40 is the individual income tax return form used in Utah for reporting income and calculating tax obligations.

Who is required to file UT TC-40?

Utah residents who earn income or meet certain thresholds are required to file UT TC-40, including individuals, heads of household, and married couples.

How to fill out UT TC-40?

To fill out UT TC-40, gather your income information, complete the personal information section, report income, claim deductions and credits, and calculate your total tax liability.

What is the purpose of UT TC-40?

The purpose of UT TC-40 is to allow residents of Utah to report their income and calculate their state income tax liability in compliance with state tax laws.

What information must be reported on UT TC-40?

Information that must be reported on UT TC-40 includes personal information, income sources, deductions, credits, and total tax due or refund amount.

Fill out your UT TC-40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.