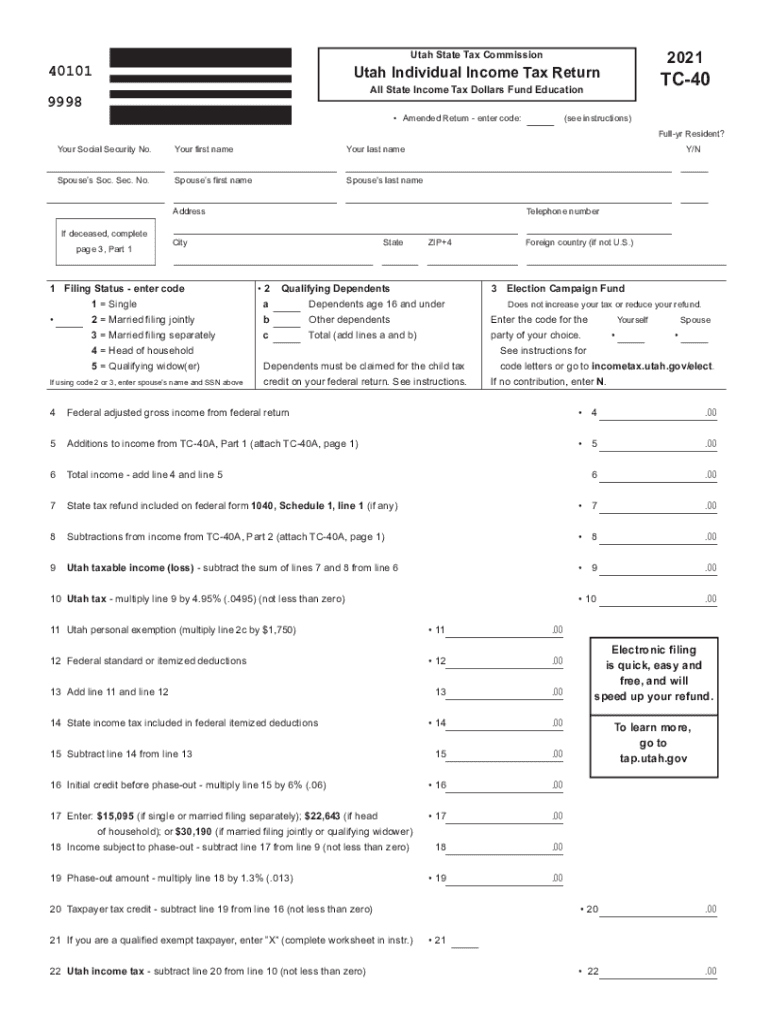

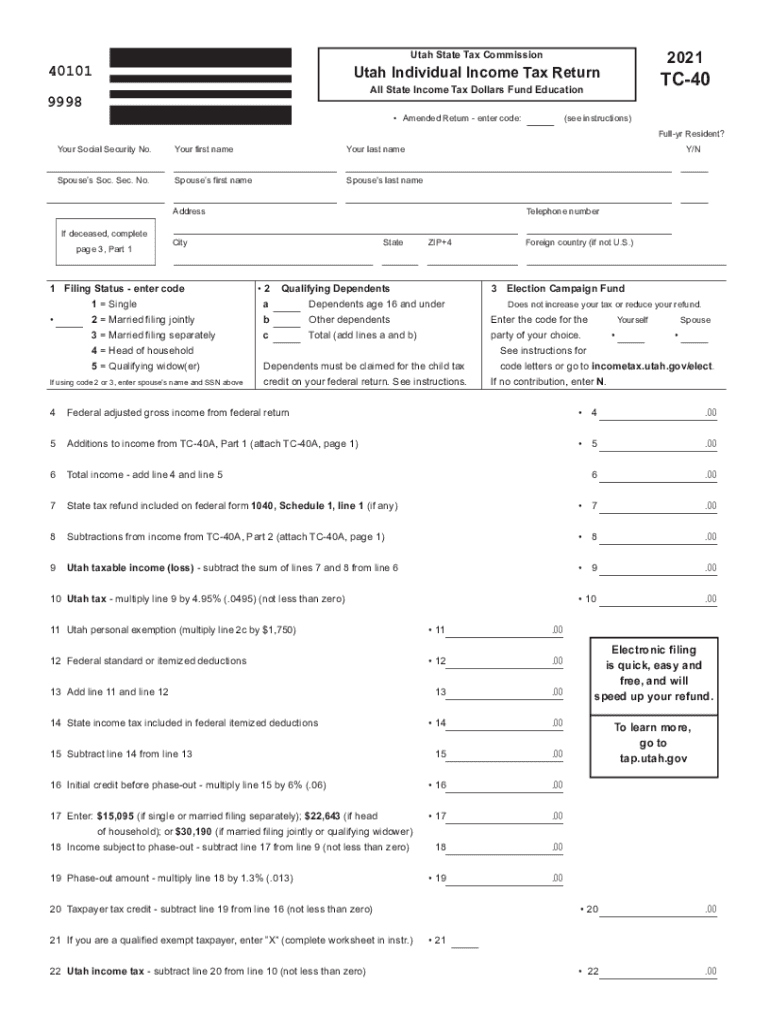

UT TC-40 2021 free printable template

Show details

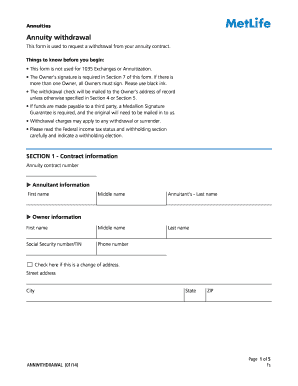

To learn more go to tap.utah. gov 40802 SSN Last name Pg. 2 24 Apportionable nonrefundable credits from TC-40A Part 3 attach TC-40A page 1 25 Full-year resident subtract line 24 from line 23 not less than zero Non or Part-year resident complete and enter the UTAH TAX from TC-40B line 37 26 Nonapportionable nonrefundable credits from TC-40A Part 4 attach TC-40A page 1 28 Voluntary contributions from TC-40 page 3 Part 4 attach TC-40 page 3 29 AMENDED RETURN ONLY - previous refund 30 Recapture...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-40

Edit your UT TC-40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-40 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UT TC-40. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-40

How to fill out UT TC-40

01

Download the UT TC-40 form from the official website.

02

Fill in your personal information at the top, including your name, address, and Social Security Number.

03

Indicate the tax period for which you are filing the TC-40.

04

List your income sources and amounts in the designated section.

05

Deduct any eligible expenses according to the guidelines provided.

06

Calculate your total taxable income.

07

Fill out the payment section based on your calculated tax.

08

Review and double-check all provided information for accuracy.

09

Sign and date the form at the bottom.

10

Submit the completed form according to the instructions provided (online or via mail).

Who needs UT TC-40?

01

Individuals who are residents of Utah and have earned income during the tax year.

02

Taxpayers who are required to file a state income tax return.

03

Those seeking to claim deductions or credits related to their income.

Fill

form

: Try Risk Free

People Also Ask about

What is UT local sales tax rate?

The Utah (UT) state sales tax rate is 4.7%. Depending on local jurisdictions, the total tax rate can be as high as 8.7%. Local-level tax rates may include a local option (up to 1% allowed by law), mass transit, rural hospital, arts and zoo, highway, county option (up to .

What is the income tax rate in Utah compared to California?

Moving from California to Utah also brings about some financial benefits. California tops the list with the highest income tax rate of 13.30%, whereas Utah has a flat income tax rate of 4.95%. Combined State and local sales tax rates for California come in at 8.82%. Utah's combined tax rate is 7.19%.

What is the state income tax in Utah vs California?

#2. California to Utah Means Lower Taxes California tops the list with the highest income tax rate of 13.30%, whereas Utah has a flat income tax rate of 4.95%. Combined State and local sales tax rates for California come in at 8.82%. Utah's combined tax rate is 7.19%.

Is it cheaper to live in Utah or California?

Cost of Living in Utah vs. California Overall the cost of living in California is 32.3% more expensive than Utah, and you don't get the traffic you do in CA! In addition, Los Angeles is 44.4% more expensive than Salt Lake City, Utah.

What is UT special tax?

Utah Sales Tax Rates The state sales tax rate in Utah is 4.85%, but local, county, and other special tax rates are added in nearly every zip code and municipality. At a minimum, the effective rate you will charge your customers will be 6.10% after adding a 1% general local sales tax and a 0.25% county option sales tax.

Which states have no income tax?

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the UT TC-40 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your UT TC-40 in seconds.

How can I edit UT TC-40 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing UT TC-40 right away.

How do I fill out UT TC-40 on an Android device?

Use the pdfFiller Android app to finish your UT TC-40 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is UT TC-40?

UT TC-40 is a tax form used by residents of Utah to report their individual income tax.

Who is required to file UT TC-40?

Residents of Utah who have a taxable income and meet certain income thresholds are required to file UT TC-40.

How to fill out UT TC-40?

To fill out UT TC-40, taxpayers must complete the form by providing personal information, income details, and applicable deductions, then calculate the total tax due.

What is the purpose of UT TC-40?

The purpose of UT TC-40 is to determine the amount of state income tax owed by residents of Utah based on their income and deductions.

What information must be reported on UT TC-40?

Information that must be reported on UT TC-40 includes personal identification details, income from various sources, deductions, credits, and the calculation of tax owed.

Fill out your UT TC-40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.