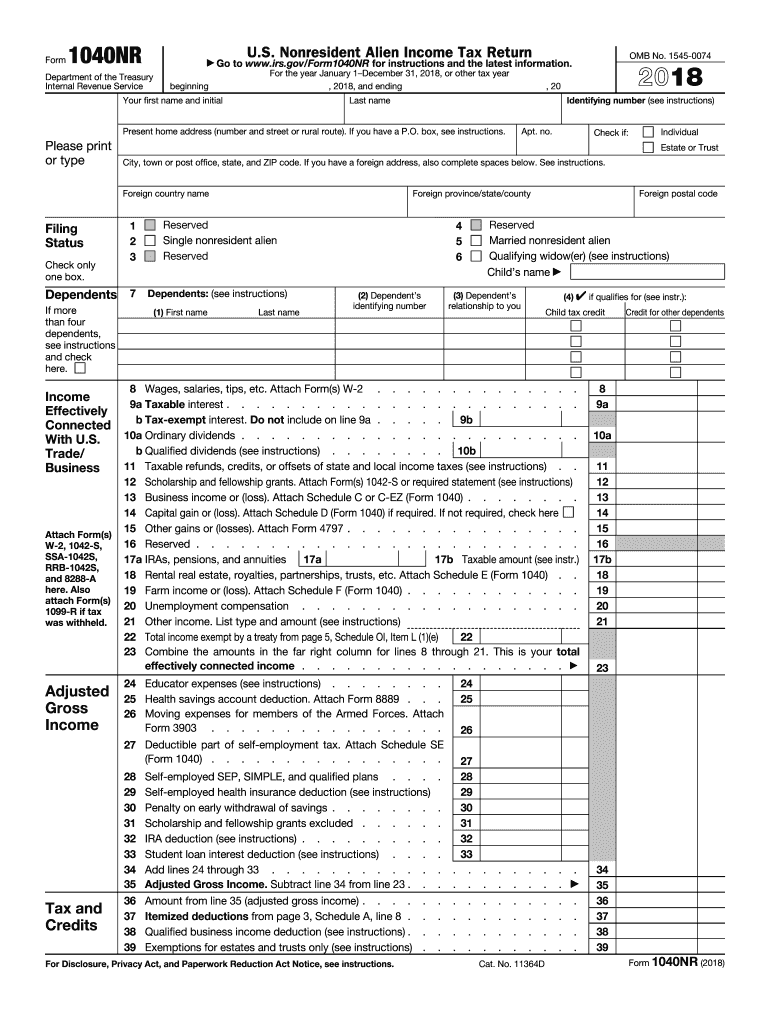

What is form 1040NR?

Form 1040NR, also known as the U.S. Nonresident Alien Income Tax Return, is an IRS form filed by nonresident aliens engaged in trade or business within the U.S. regardless of whether they have earned income from it or not. The form must also be filed if the individual’s income is exempt from U.S. tax under a tax treaty.

Who should file form 1040NR 2018?

Form 1040-NR must be filed by:

- A nonresident alien who carried out trade or business activities in the U.S.

- A representative of a deceased person who carried out trade or business activities in the U.S.

- A representative of a trust or an estate that has to file the form

More detailed information on who must file 1040NR can be found on the IRS’s official website.

What information do you need when you file form 1040NR?

In order to fill out 1040NR properly, you will need to provide the following information:

- Your name

- Filing status (single, married filing separately, or qualifying widow/-er)

- Your identifying number

- Your home address

- Dependents’ names, identifying numbers, etc.

- Details about income connected with U.S. trade or business

How do I fill out the form 1040NR in 2019?

You can also easily complete 1040NR online and have it sent via USPS. To fill out form 1040NR, take the following steps:

- Click Get Form to open 1040NR in pdfFiller.

- Fill out and sign the form.

- Click the Done button and Send via USPS.

- Fill in the mailing information.

- Select the delivery terms.

- Click the Send button.

The form will be printed and delivered to the post office shortly by pdfFiller.

Please check the form 1040NR instructions on the IRS website in case you have additional questions regarding the filing process.

Is form 1040NR accompanied by other forms?

Filing other forms together with 1040NR is optional and depends on your specific case. You may have to complete the following documents:

- Form 8833 - for those nonresident aliens who want to claim tax treaty benefits on a certain type of income

- Form 8840 - for those who want to claim closer connection exception to the substantial presence test

- Form 8843 - for those who want to exclude days present in the U.S. for the purposes of the substantial presence test

- Form 8938 - for those who want to report some specified financial assets outside of the U.S.

When is form 1040NR due?

Generally, form 1040NR must be filed by April 15 following the end of the tax year. This year, the due date for filing 1040NR is April 18, 2022.

Where do I send form 1040NR?

You can either e-file 1040NR or mail it to the IRS. Check the IRS website to learn how and where to file 1040NR. If you mail the form, please note that the addresses for individual senders differ from those for estates and trusts.

For individuals who do not enclose payments, the address for mailing form 1040-NR is: Department of the Treasury Internal Revenue Service

Austin, TX 73301-0215

Individuals enclosing a payment should mail form 1040-NR to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

Estates and trusts which do not enclose a payment should mail the form to:

Department of the Treasury Internal Revenue Service

Kansas City, MO 64999

Estates and trusts enclosing a payment should mail it to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303