MA DoR M-990T 2013 free printable template

Show details

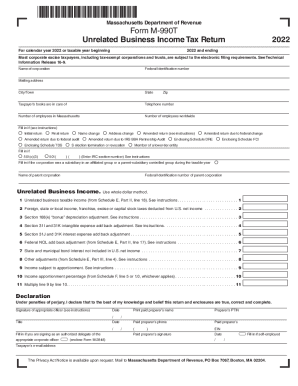

For calendar year 2013 or taxable year beginning Form M-990T Unrelated Business Income Tax Return Massachusetts Department of Revenue 2013 and ending Name of company Federal Identification number Mailing address City/Town Name of treasurer Is a Taxpayer Disclosure Statement enclosed Yes State No Excise Calculation Foreign state or local income franchise excise or capital stock taxes deducted from U.S. net income.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR M-990T

Edit your MA DoR M-990T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR M-990T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR M-990T online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA DoR M-990T. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-990T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR M-990T

How to fill out MA DoR M-990T

01

Begin by downloading the MA DoR M-990T form from the official website.

02

Provide your organization's name, address, and Federal Employer Identification Number (FEIN) at the top of the form.

03

Indicate the type of organization by checking the appropriate box (e.g., non-profit, charitable, etc.).

04

Fill out the financial information section detailing income, expenses, and net assets for the applicable year.

05

Include a summary of your organization's activities and purpose.

06

Sign and date the form at the bottom and provide your title within the organization.

07

Submit the completed form either online or by mailing it to the appropriate Massachusetts Department of Revenue address.

Who needs MA DoR M-990T?

01

Organizations that are tax-exempt in Massachusetts and are required to report annual financial information to maintain their tax-exempt status.

02

Non-profit organizations, charitable organizations, and other entities that need to file for compliance with state tax laws.

Instructions and Help about MA DoR M-990T

Fill

form

: Try Risk Free

People Also Ask about

Is there a standard deduction for Massachusetts in 2023?

Massachusetts does not have a standard deduction.

How many exemptions should I claim Massachusetts?

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

How do I know if I need to file 990-T?

Who Has to Use It? Your IRA administrator is included in the persons and entities who must file a 990T: “Trustees [custodians] for the following trusts that have $1,000 or more of unrelated trade or business gross income” must file 990Ts.

Who fills out the 990T?

An employees' trust defined in section 401(a), an IRA (including SEPs and SIMPLEs), a Roth IRA, a Coverdell ESA, or an Archer MSA must file Form 990-T by the 15th day of the 4th month after the end of its tax year.

What is Form 990 or 990T?

Form 990T: A Quick & Easy Breakdown If you hold assets in a self-directed IRA or HSA account and you haven't done so already, you'll soon be grappling with a Form 990T (Form 990-T) for this tax season. A 990T is the form IRA holders must use to report their retirement account assets.

What are the filing requirements for 990T?

990-EZ, or 990-PF and have a gross income of $1,000 or more from unrelated business income for the tax year must e-file Form 990-T.

Is Social Security taxable in Massachusetts?

Income items included in federal taxable income but not Massachusetts taxable income. Social Security benefits are not included in Massachusetts income. For federal purposes, these benefits may be included in federal gross income depending on income thresholds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MA DoR M-990T directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your MA DoR M-990T and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit MA DoR M-990T in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing MA DoR M-990T and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit MA DoR M-990T on an Android device?

You can edit, sign, and distribute MA DoR M-990T on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is MA DoR M-990T?

MA DoR M-990T is a tax form used by certain organizations in Massachusetts to report unrelated business income and to calculate the tax owed on that income.

Who is required to file MA DoR M-990T?

Organizations that have generated unrelated business income, including non-profits and tax-exempt entities, are required to file MA DoR M-990T.

How to fill out MA DoR M-990T?

To fill out MA DoR M-990T, organizations must provide information regarding their unrelated business income, expenses, and calculate the applicable tax as per the instructions provided on the form.

What is the purpose of MA DoR M-990T?

The purpose of MA DoR M-990T is to ensure that organizations pay taxes on their unrelated business income, which helps maintain the integrity of tax exemptions granted to non-profit entities.

What information must be reported on MA DoR M-990T?

MA DoR M-990T requires reporting of unrelated business income, related expenses, tax calculations, and any other required disclosures as specified by the Massachusetts Department of Revenue.

Fill out your MA DoR M-990T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR M-990t is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.