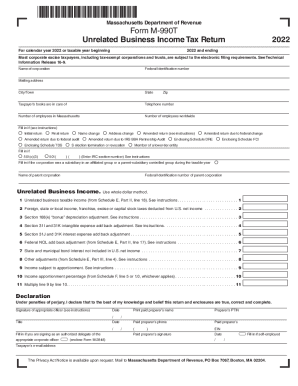

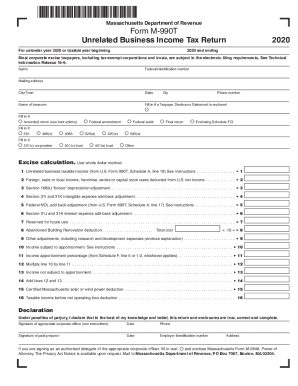

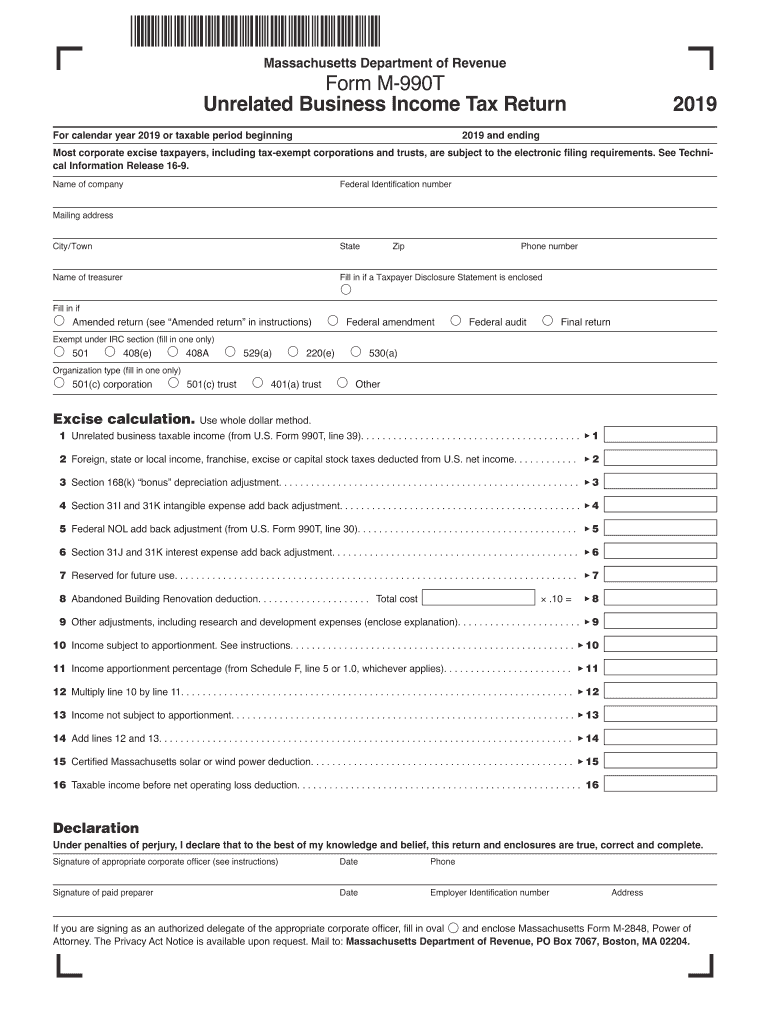

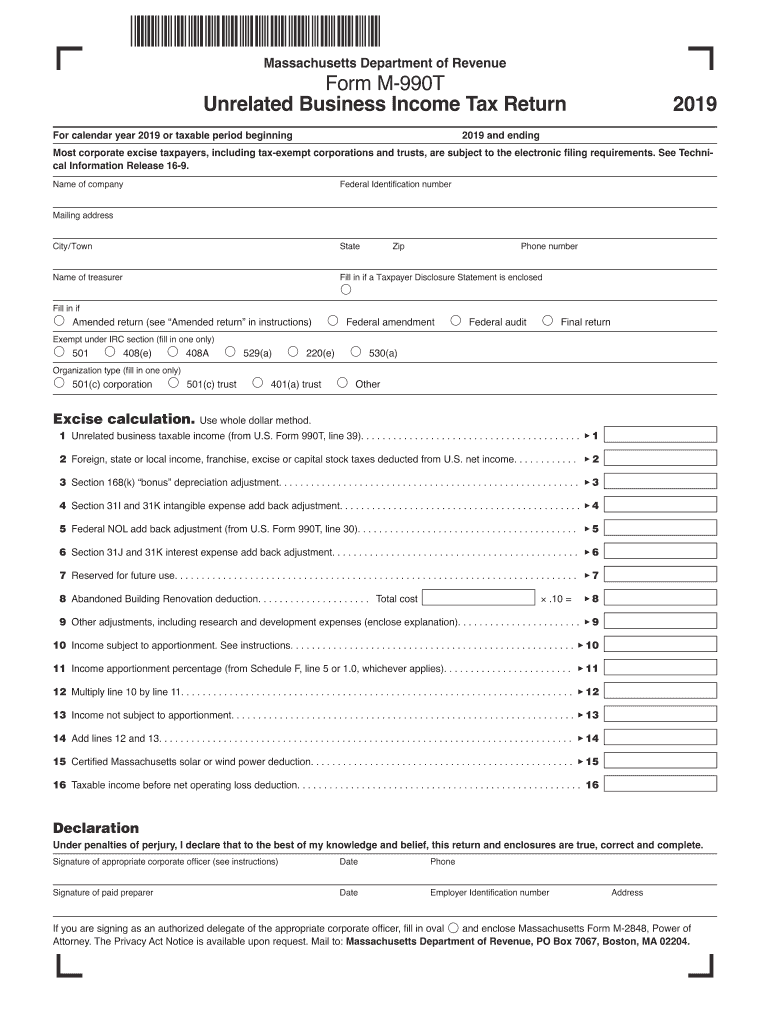

MA DoR M-990T 2019 free printable template

Show details

2017 FORM M-990T PAGE 2 cont d. 17 Loss carryover deduction from Schedule NOL. 3 17 20 Credit recapture enclose Credit Recapture Schedule and/or additional tax on installment sales. Massachusetts Department of Revenue Form M-990T Unrelated Business Income Tax Return For calendar year 2017 or taxable period beginning and ending Name of company Federal Identification number Mailing address City/Town State Zip Phone number Name of treasurer Fill in if a Taxpayer Disclosure Statement is enclosed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR M-990T

Edit your MA DoR M-990T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR M-990T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR M-990T online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA DoR M-990T. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-990T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR M-990T

How to fill out MA DoR M-990T

01

Gather necessary documents: Ensure you have all required financial statements and supporting documents.

02

Obtain the form: Download the MA DoR M-990T form from the Massachusetts Department of Revenue website.

03

Fill out the form: Complete the sections including identification, revenue, expenses, and tax calculation as per the instructions provided on the form.

04

Double-check entries: Verify that all figures are accurate and that the form is completed thoroughly.

05

Submit the form: Send the completed M-990T form to the Massachusetts Department of Revenue by the due date, along with any required payments.

Who needs MA DoR M-990T?

01

Non-profit organizations operating in Massachusetts that have unrelated business income.

02

Organizations required to file taxes on their unrelated business income.

Instructions and Help about MA DoR M-990T

Fill

form

: Try Risk Free

People Also Ask about

Who must file IL 990?

Filing requirements are a resident or qualified to do business in the state of Illinois and are required to file U.S. Form 990-T (regardless of net income or loss).

What triggers UBIT?

The most common causes for this type of taxes are retirement accounts invested in businesses that generate income classified as “business income” associated with LLCs or partnerships. Another primary income that can trigger UBIT is real estate purchased within the tax-exempt IRA that is debt-financed.

How do I know if I have Ubti?

To determine if you've earned UBTI, review the following details on your Form K-1: UBTI from operating results of the MLP or LP (typically reported on line 20-V of Form K-1). Ordinary gains (MLPs only) generated from the liquidation of the partnership interest are 100% reportable as UBTI on Form 990-T.

What are examples of unrelated business income?

Examples of unrelated business income may include: Advertising. Bar and restaurant sales. Camping income. Inventory sales. Lawful gambling, including some forms of bingo. Parking income. Partnership income.

What is not considered business income?

Generally, rents and royalties, regardless of the source, are nonbusiness income and thus are not eligible for the Business Income Deduction. However, rent and royalty income generated as part of a trade or business or by property that is an integral part of a trade or business operation may be business income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MA DoR M-990T?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the MA DoR M-990T in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the MA DoR M-990T in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MA DoR M-990T.

How do I complete MA DoR M-990T on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MA DoR M-990T, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is MA DoR M-990T?

MA DoR M-990T is a tax form used in Massachusetts for organizations that are subject to the unrelated business income tax (UBIT). It is specifically for filing excess unrelated business income and paying the related taxes.

Who is required to file MA DoR M-990T?

Organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code but earn unrelated business income are required to file MA DoR M-990T.

How to fill out MA DoR M-990T?

To fill out MA DoR M-990T, organizations must gather their financial records, calculate their unrelated business income, fill in the appropriate sections of the form with their income and deductions, and submit the form to the Massachusetts Department of Revenue.

What is the purpose of MA DoR M-990T?

The purpose of MA DoR M-990T is to collect taxes on unrelated business income earned by tax-exempt organizations, ensuring compliance with state tax regulations.

What information must be reported on MA DoR M-990T?

MA DoR M-990T requires the reporting of the organization’s unrelated business income, expenses related to that income, any applicable deductions, and the calculation of the resulting tax liability.

Fill out your MA DoR M-990T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR M-990t is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.