MA DoR M-990T 2015 free printable template

Show details

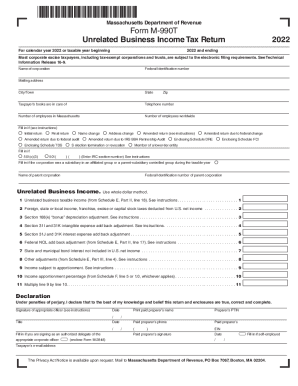

Rev. 3/15 2015 FORM M-990T PAGE 2 cont d. 17 Loss carryover deduction from Schedule NOL. 3 17 20 Credit recapture enclose Credit Recapture Schedule and/or additional tax on installment sales. Massachusetts Department of Revenue Form M-990T Unrelated Business Income Tax Return For calendar year 2015 or taxable period beginning and ending Name of company Federal Identification number Mailing address City/Town State Zip Phone number Name of treasurer Fill in if a Taxpayer Disclosure Statement is...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR M-990T

Edit your MA DoR M-990T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR M-990T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR M-990T online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA DoR M-990T. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-990T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR M-990T

How to fill out MA DoR M-990T

01

Obtain the MA DoR M-990T form from the Massachusetts Department of Revenue website.

02

Fill in your tax year at the top of the form.

03

Complete Section A with your organization's identifying information, including name and address.

04

Fill out Section B to report the organization’s income and expenses.

05

Complete Section C for information on tax-exempt status and specific deductions.

06

Calculate the tax liability in Section D, if applicable.

07

Review the form for accuracy and completeness.

08

Sign and date the form in the designated area.

09

Submit the form by the due date to the appropriate address listed on the form.

Who needs MA DoR M-990T?

01

Organizations in Massachusetts that are exempt from federal income tax but generate unrelated business taxable income (UBTI).

02

Non-profit organizations that must report their UBTI to the state.

03

Entities such as charities, educational institutions, and other tax-exempt organizations that engage in business activities.

Instructions and Help about MA DoR M-990T

Fill

form

: Try Risk Free

People Also Ask about

What is Form 990 or 990T?

Form 990T: A Quick & Easy Breakdown If you hold assets in a self-directed IRA or HSA account and you haven't done so already, you'll soon be grappling with a Form 990T (Form 990-T) for this tax season. A 990T is the form IRA holders must use to report their retirement account assets.

Is a 990-T required?

990-EZ, or 990-PF and have a gross income of $1,000 or more from unrelated business income for the tax year must e-file Form 990-T.

Who is responsible for filing 990T?

Per the IRS Instructions for Form 990-T, the IRA custodian is responsible for annually analyzing and filing Form 990-T on behalf of the account owner.

What are the filing requirements for 990T?

990-EZ, or 990-PF and have a gross income of $1,000 or more from unrelated business income for the tax year must e-file Form 990-T.

Who fills out the 990T?

An employees' trust defined in section 401(a), an IRA (including SEPs and SIMPLEs), a Roth IRA, a Coverdell ESA, or an Archer MSA must file Form 990-T by the 15th day of the 4th month after the end of its tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MA DoR M-990T online?

With pdfFiller, you may easily complete and sign MA DoR M-990T online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit MA DoR M-990T on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MA DoR M-990T from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete MA DoR M-990T on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MA DoR M-990T. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MA DoR M-990T?

MA DoR M-990T is the Massachusetts Department of Revenue form used by organizations to report unrelated business income and calculate the state tax owed on that income.

Who is required to file MA DoR M-990T?

Organizations that have gross unrelated business income of $1,000 or more in a tax year are required to file MA DoR M-990T.

How to fill out MA DoR M-990T?

To fill out MA DoR M-990T, organizations need to provide details on their unrelated business income, calculate the applicable tax, and complete the form according to the instructions provided by the Massachusetts Department of Revenue.

What is the purpose of MA DoR M-990T?

The purpose of MA DoR M-990T is to ensure that organizations pay tax on income generated from activities that are not related to their exempt purposes.

What information must be reported on MA DoR M-990T?

MA DoR M-990T requires reporting of gross unrelated business income, expenses related to that income, and any applicable deductions to calculate the taxable amount.

Fill out your MA DoR M-990T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR M-990t is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.