HI DoT HW-14 2018 free printable template

Show details

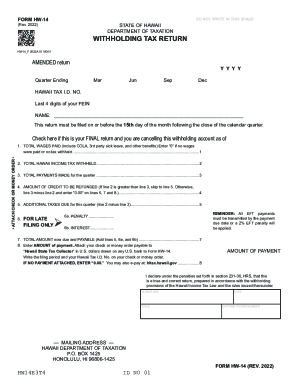

Attach your check or money order payable to Hawaii State Tax Collector in U.S. dollars drawn on any U.S. bank to Form HW-14. FORM HW-14 Rev. 2018 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA WITHHOLDING TAX RETURN Fill in this oval ONLY if this is an AMENDED return M M Y Y / Quarter Ending HAWAII TAX I. SIGNATURE DATE MAILING ADDRESS HAWAII DEPARTMENT OF TAXATION P. O. BOX 3827 HONOLULU HI 96812-3827 HW14I 2018A 01 VID01 TITLE DAYTIME PHONE NUMBER ID NO 01 Form HW-14....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT HW-14

Edit your HI DoT HW-14 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT HW-14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT HW-14 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit HI DoT HW-14. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT HW-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT HW-14

How to fill out HI DoT HW-14

01

Gather the necessary information about the vehicle and the owner.

02

Start with the title section, providing the vehicle's identification details.

03

Fill out the owner’s information accurately, including name and address.

04

Enter any lienholder information if applicable.

05

Complete the vehicle details, including make, model, year, and license plate number.

06

Review any additional sections for warranty or safety information.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate department.

Who needs HI DoT HW-14?

01

Individuals registering a motor vehicle in Hawaii.

02

Owners transferring a vehicle's title.

03

Businesses involved in vehicle sales or transfers.

04

Residents needing to report a change of ownership.

Fill

form

: Try Risk Free

People Also Ask about

How much is Hawaii and federal income tax?

Your Income Taxes Breakdown TaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows • Dec 23, 2021

What is the 2022 tax table?

There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status.

What is the state income tax rate in Hawaii?

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

Does Hawaii have state withholding tax?

Hawaii law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Taxation. Every employer that has one or more employees in Hawaii must withhold income tax from the wages of both resident and nonresident employees for services performed in Hawaii.

How do I pay Hawaii withholding tax?

All withholding taxpayers need to file returns quarterly (due April 15, July 15, October 15, and January 15) using Form HW-14. If changes need to be made to a return already submitted, please file an amended return for that filing period.

What is Hawaii tax ID number?

The Hawaii Tax ID number starts with the letters 'GE' followed by 12 digits. It's different from a Social Security number (SSN) or employer identification number (EIN) and is used to identify each Hawaii tax account.

What is HW 14 in Hawaii?

All filers must file a return (Form HW-14) for each quarter. The quarters recognized by the Department of Taxation are: 1st - January to March; 2nd - April to June; 3rd - July to September; and 4th - October to December. A return must be filed even if you do not have any wages to report for the period.

What is the number for withholding tax?

For more information, please call our Taxpayer Assistance Center at 1-888-745-3886. When determining your withholding allowances, you must consider your personal situation: — Do you claim allowances for dependents or blindness?

Do I have to pay taxes after withholding?

Form W-4 is used to make sure that the employer is withholding the correct amount of funds for federal taxes. If less than the correct amount is withheld, you will owe money (and maybe an underpayment penalty) when filing your tax return, and if too much money is withheld, you will usually get a refund.

Does Hawaii have a state withholding form?

Yes. The state of Hawaii requires additional forms to file along with Form W2. Hawaii has an additional requirement of Form HW-3 (Annual reconciliation of Income tax withheld)to be sent only if there is a state tax withholding.

How do I find my Hawaii withholding number?

If you already have a Hawaii Withholding Account Number, you can look this up online or on any previous correspondence from the Hawaii Department of Taxation. If you're unsure, contact the agency at 808-587-4242.

How do I pay my Hawaii state taxes?

Hawaii Tax Online (HTO) Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, review letters, manage your accounts, and conduct other common transaction online with DOTAX. Filing taxes and making debit payments through this system is free.

What is Hawaii state income tax 2022?

Hawaii Tax Rates, Collections, and Burdens Hawaii has a graduated individual income tax, with rates ranging from 1.40 percent to 11.00 percent. Hawaii also has a 4.40 to 6.40 percent corporate income tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my HI DoT HW-14 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your HI DoT HW-14 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send HI DoT HW-14 for eSignature?

Once your HI DoT HW-14 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit HI DoT HW-14 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your HI DoT HW-14, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is HI DoT HW-14?

HI DoT HW-14 is a form used in Hawaii to report hazardous waste activities and compliance with local environmental regulations.

Who is required to file HI DoT HW-14?

Businesses and organizations that generate, treat, store, or dispose of hazardous waste in Hawaii are required to file HI DoT HW-14.

How to fill out HI DoT HW-14?

To fill out HI DoT HW-14, individuals must provide information such as the generator's details, types and quantities of hazardous waste generated, and any treatment or disposal methods used.

What is the purpose of HI DoT HW-14?

The purpose of HI DoT HW-14 is to ensure compliance with hazardous waste regulations and to track the management of hazardous waste in the state of Hawaii.

What information must be reported on HI DoT HW-14?

Required information on HI DoT HW-14 includes the company's name, address, generator ID, waste descriptions, quantities, handling practices, and any relevant documentation regarding waste management.

Fill out your HI DoT HW-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT HW-14 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.