HI DoT HW-14 2019 free printable template

Show details

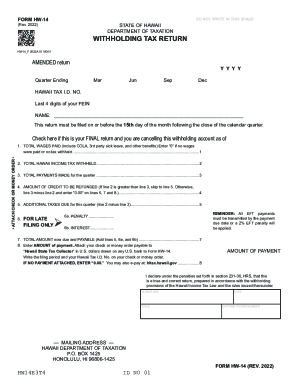

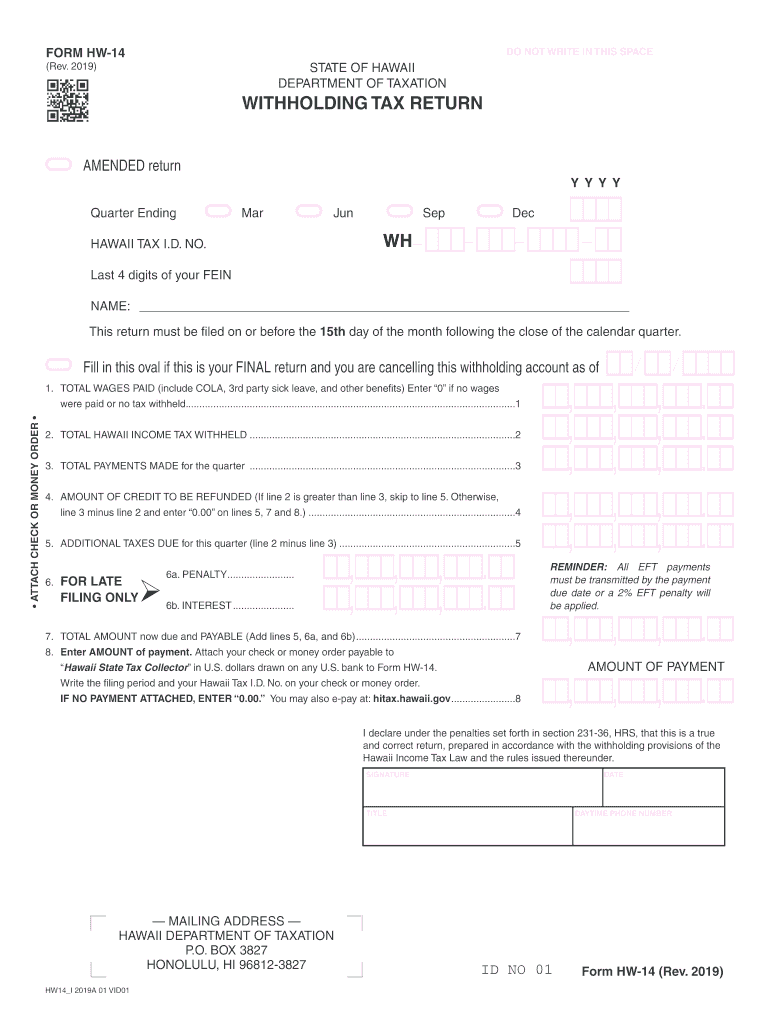

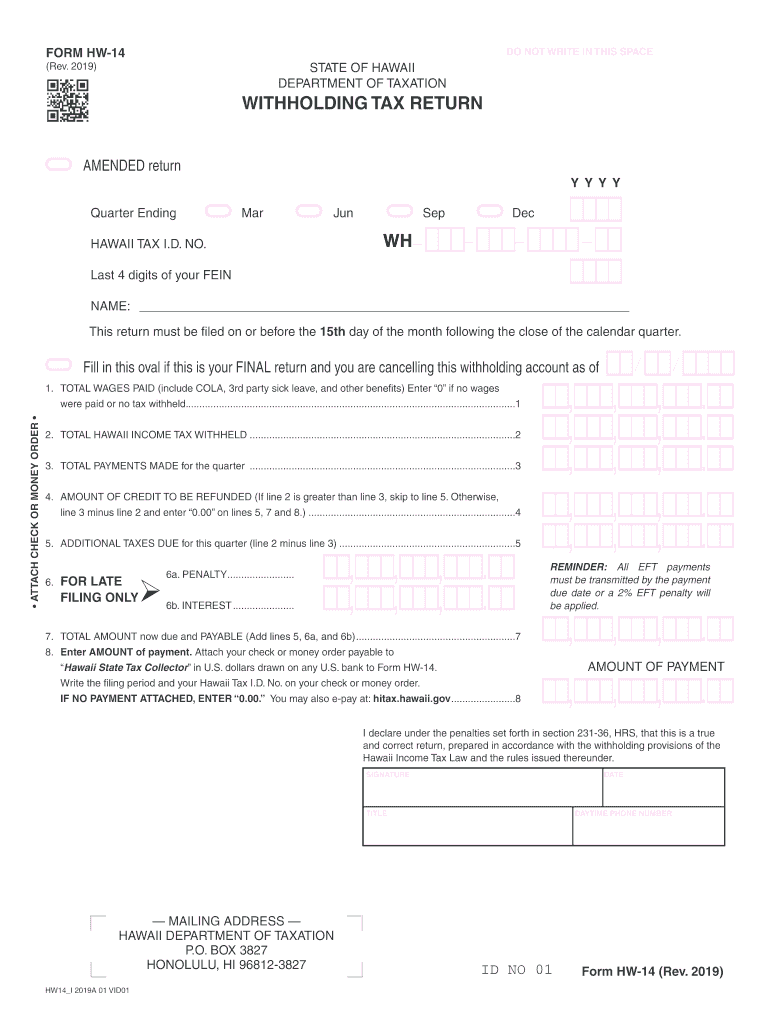

Attach your check or money order payable to Hawaii State Tax Collector in U.S. dollars drawn on any U.S. bank to Form HW-14. FORM HW-14 Rev. 2018 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA WITHHOLDING TAX RETURN Fill in this oval ONLY if this is an AMENDED return M M Y Y / Quarter Ending HAWAII TAX I. SIGNATURE DATE MAILING ADDRESS HAWAII DEPARTMENT OF TAXATION P. O. BOX 3827 HONOLULU HI 96812-3827 HW14I 2018A 01 VID01 TITLE DAYTIME PHONE NUMBER ID NO 01 Form HW-14....

pdfFiller is not affiliated with any government organization

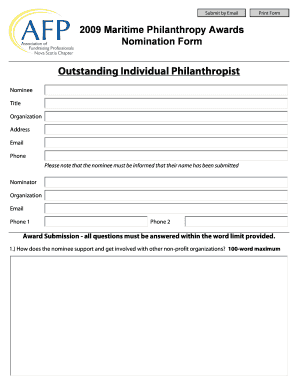

Get, Create, Make and Sign HI DoT HW-14

Edit your HI DoT HW-14 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT HW-14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT HW-14 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit HI DoT HW-14. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT HW-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT HW-14

How to fill out HI DoT HW-14

01

Obtain the HI DoT HW-14 form from the Hawaii Department of Transportation website or an office.

02

Fill in the date of the application at the top of the form.

03

Provide your legal name in the designated section.

04

Enter your mailing address, including city, state, and ZIP code.

05

Fill in your contact information, including a phone number and email address if applicable.

06

Specify the type of service or registration you are requesting.

07

Attach any required supporting documents as specified in the form instructions.

08

Review all entries for accuracy and completeness.

09

Sign and date the application at the bottom.

10

Submit the completed form by mail or in person at the designated office.

Who needs HI DoT HW-14?

01

Individuals applying for vehicle registration or titling in Hawaii.

02

Businesses seeking to register multiple vehicles or fleet operations.

03

Any party needing to request a specific service related to vehicles under the jurisdiction of the Hawaii Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

How do I register for Hawaii withholding tax?

Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

Is there a penalty for paying estimated taxes?

If you don't pay enough tax through withholding and estimated tax payments, you may be charged a penalty. You also may be charged a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.

What is the penalty for estimated tax in Hawaii?

The underpayment penalty is computed on a monthly basis. This means the penalty is imposed on the amount of the underpayment of estimated tax at the rate of 2/3% (. 00667) a month or part of a month.

What is the tax penalty for underpayment in Hawaii?

The penalty is figured for the period of underpayment determined under section 235-97(f), HRS. The penalty at the rate of 8% a year is imposed on the amount of the under- payment of estimated tax at the rate of 2/3 of 1% a month or part of a month. A monthly factor of . 00667 is used on the form.

What does it mean to be subject to withholding?

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W–4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify HI DoT HW-14 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your HI DoT HW-14 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send HI DoT HW-14 to be eSigned by others?

Once your HI DoT HW-14 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the HI DoT HW-14 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your HI DoT HW-14.

What is HI DoT HW-14?

HI DoT HW-14 is a hazardous waste disposal form used in Hawaii to report the generation, transport, and disposal of hazardous waste.

Who is required to file HI DoT HW-14?

Any individual or entity that generates, transports, or disposes of hazardous waste in Hawaii is required to file HI DoT HW-14.

How to fill out HI DoT HW-14?

To fill out HI DoT HW-14, one must provide detailed information about the type and quantity of hazardous waste, the generator's information, waste disposal methods, and any related documentation as required by the state regulations.

What is the purpose of HI DoT HW-14?

The purpose of HI DoT HW-14 is to ensure compliance with state hazardous waste regulations and to track the management of hazardous waste in Hawaii.

What information must be reported on HI DoT HW-14?

Required information on HI DoT HW-14 includes the generator's name and address, the type and quantity of hazardous waste, the method of disposal, and any relevant permits or documentation.

Fill out your HI DoT HW-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT HW-14 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.