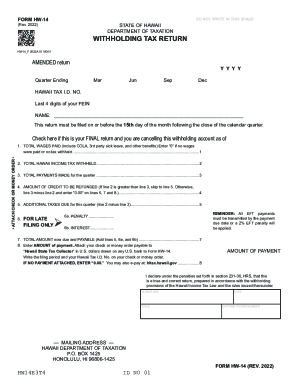

HI DoT HW-14 2010 free printable template

Show details

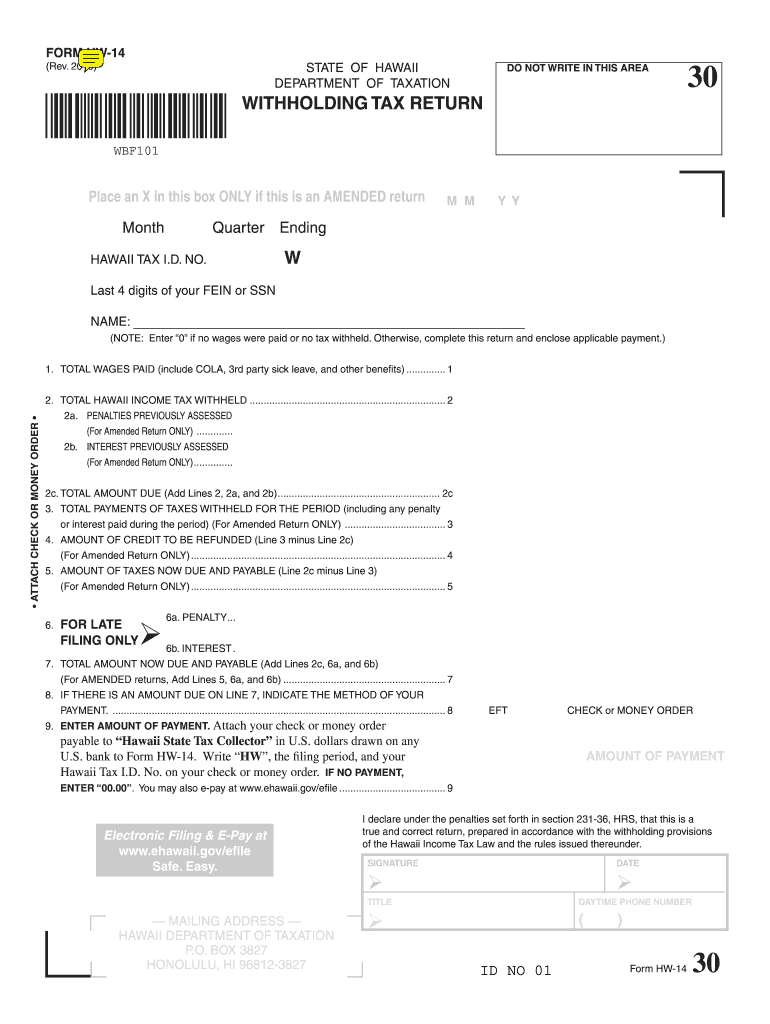

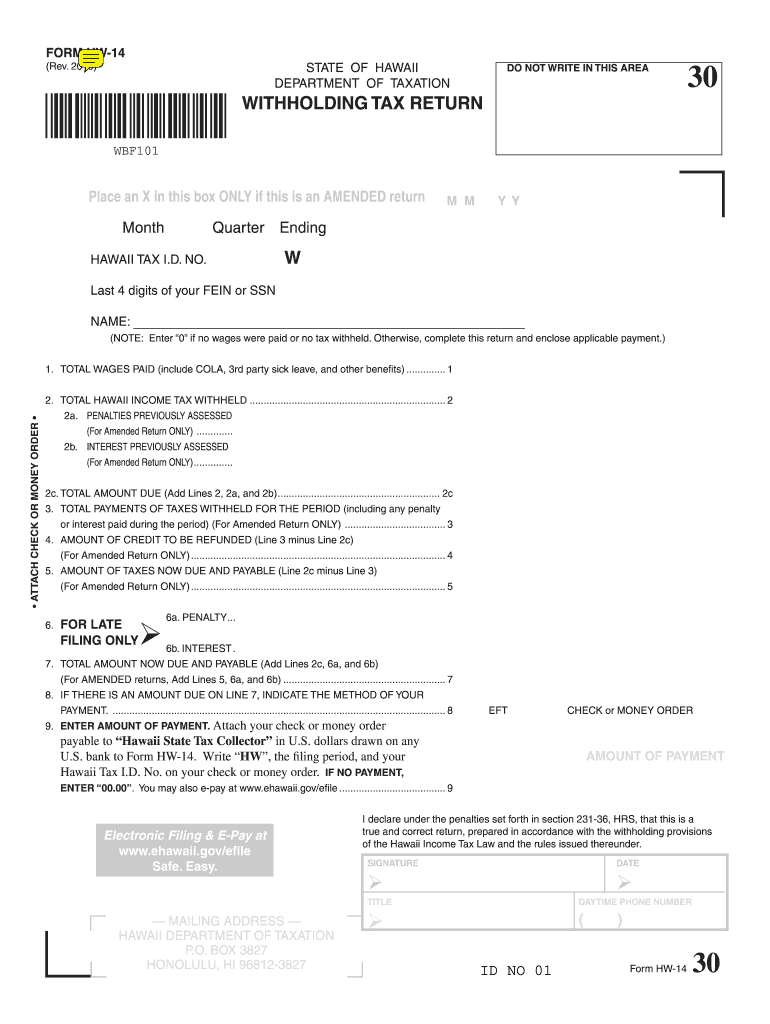

Attach your check or money order payable to Hawaii State Tax Collector in U.S. dollars drawn on any U.S. bank to Form HW-14. SIGNATURE DATE TITLE MAILING ADDRESS HAWAII DEPARTMENT OF TAXATION P. O. BOX 3827 HONOLULU HI 96812-3827 DAYTIME PHONE NUMBER ID NO 01 Form HW-14. 0 or higher with this form. FORM HW-14 Rev. 2010 DO NOT WRITE IN THIS AREA STATE OF HAWAII DEPARTMENT OF TAXATION WITHHOLDING TAX RETURN Clear Form WBF101 Place an X in this box ONLY if this is an AMENDED return M M Y Y...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT HW-14

Edit your HI DoT HW-14 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT HW-14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI DoT HW-14 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT HW-14. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT HW-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT HW-14

How to fill out HI DoT HW-14

01

Gather necessary information such as vehicle VIN, insurance details, and owner information.

02

Download the HI DoT HW-14 form from the official website or obtain a paper copy.

03

Fill out the 'Owner Information' section with your name and address.

04

Provide your vehicle's 'Description' including make, model, year, and VIN.

05

Complete the 'Insurance' section, including the name of the insurance company and policy number.

06

Check the box indicating whether the vehicle is operational or non-operational.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate Department of Transportation office either in person or via mail.

Who needs HI DoT HW-14?

01

Individuals who own a vehicle in Hawaii.

02

Those who are registering a vehicle for the first time.

03

Car owners updating their vehicle registration.

04

Anyone transferring ownership of a vehicle in Hawaii.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file an extension for Hawaii state taxes?

If you are certain that you cannot file your Hawaii return by the deadline, you do not need to file for an extension. You will automatically receive a 6-month extension of time to file your return (not to pay).

Can an employer get in trouble for not withholding federal taxes?

Penalties. Failure to do so will get the attention of the IRS and can result in civil and even criminal penalties. Sometimes the failure to pay is an oversight or a lack of understanding of what legal duties exist.

How to fill out a HW 4 form?

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

What is form HW 14?

(b) Form HW-14. (1) In general. Pursuant to sections 235-62 and 235-63, HRS, every employer required to file a return of income tax withheld from wages shall file Form HW-14 or forms prescribed by the department, accompanied by payment of the tax withheld.

What is Hawaii's filing requirements?

ing to Hawaii Instructions for Form N-11, the following individuals must file a Hawaii return: “Every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business."

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send HI DoT HW-14 for eSignature?

Once you are ready to share your HI DoT HW-14, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit HI DoT HW-14 online?

The editing procedure is simple with pdfFiller. Open your HI DoT HW-14 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in HI DoT HW-14 without leaving Chrome?

HI DoT HW-14 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is HI DoT HW-14?

HI DoT HW-14 is a form used by businesses and organizations in Hawaii to report hazardous waste activities and management practices.

Who is required to file HI DoT HW-14?

Any business or organization that generates, transports, treats, stores, or disposes of hazardous waste in Hawaii is required to file HI DoT HW-14.

How to fill out HI DoT HW-14?

To fill out HI DoT HW-14, individuals must provide accurate information regarding their hazardous waste activities, including waste types, quantities, and management methods, and submit it according to the guidelines provided by the Hawaii Department of Health.

What is the purpose of HI DoT HW-14?

The purpose of HI DoT HW-14 is to ensure compliance with state and federal hazardous waste regulations and to promote safe and responsible management of hazardous waste materials.

What information must be reported on HI DoT HW-14?

On HI DoT HW-14, information that must be reported includes the generator's details, types and quantities of hazardous waste generated, treatment and disposal methods, and any other relevant hazardous waste management practices.

Fill out your HI DoT HW-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT HW-14 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.