MA M-8736 2018 free printable template

Show details

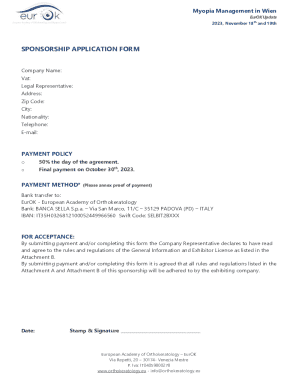

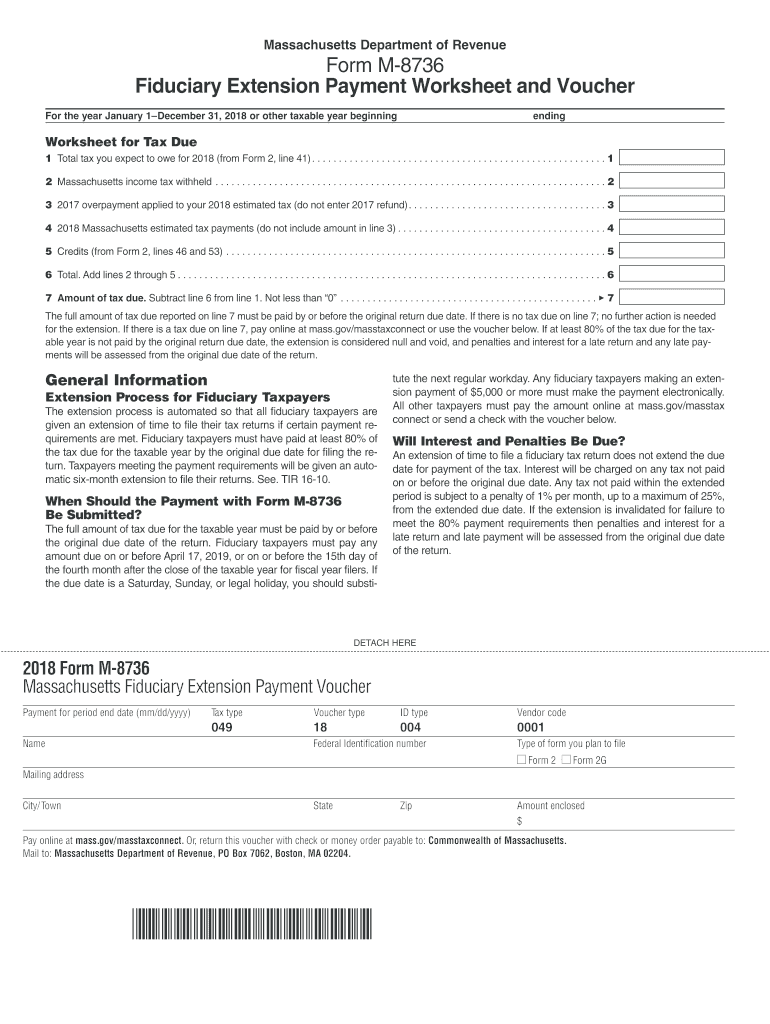

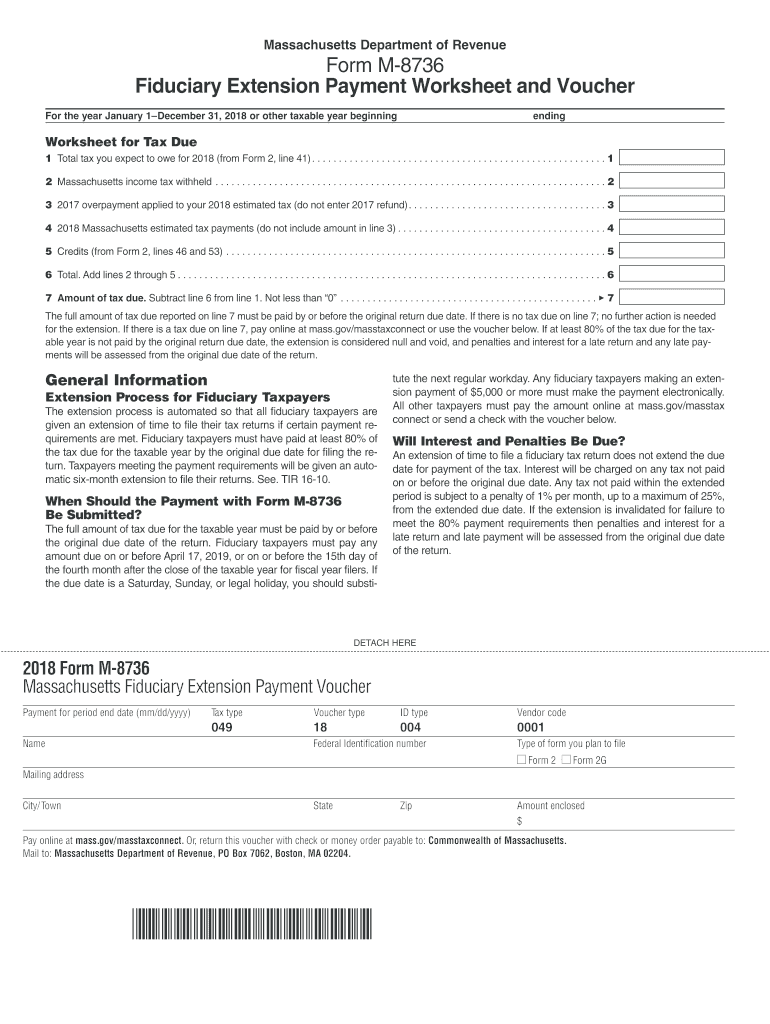

Gov/masstaxconnect or use the Form M-8736 voucher. If using the voucher be sure to cut where indicated. Keep this worksheet with your records. Do not submit the entire worksheet with the Form M-8736 payment voucher or your payment may be delayed. Mail the completed voucher with your payment to Massachusetts Department of Revenue PO Box 7062 Boston MA 02204. Mail to Massachusetts Department of Revenue PO Box 7062 Boston MA 02204. FORM M-8736 PAGE 2 How Do I Use this Worksheet and Voucher Use...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA M-8736

Edit your MA M-8736 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA M-8736 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA M-8736 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MA M-8736. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA M-8736 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA M-8736

How to fill out MA M-8736

01

Download the MA M-8736 form from the official Massachusetts Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Review the instructions provided on the form to ensure you understand the requirements.

05

Complete the relevant sections based on your income and tax situation.

06

If applicable, include any supporting documentation or schedules required by the form.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the completed form according to the instructions provided (either by mail or electronically).

Who needs MA M-8736?

01

Individuals and businesses in Massachusetts who are required to report specific tax information or claim credits on their tax return may need to fill out the MA M-8736 form.

02

Taxpayers who have received a notice from the Massachusetts Department of Revenue requesting the completion of this form must also fill it out.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for underpayment of Dor in Massachusetts?

The Massachusetts interest rate for underpayments is equal to the federal short-term rate (which can change quarterly) plus four percentage points, compounded daily.

How do I avoid a tax underpayment penalty in Massachusetts?

Underpayment penalty exceptions and waivers Your income tax due after credits and withholding is $400 or less. You are a qualified farmer or fisherman and paying your full amount due on/before March 1. You were a resident of Massachusetts for 12 months of the prior tax year and not liable for taxes.

What is the penalty for underpayment of Massachusetts income tax?

The Massachusetts interest rate for underpayments is equal to the federal short-term rate (which can change quarterly) plus four percentage points, compounded daily.

How can I get an underpayment penalty waived?

The law allows the IRS to waive the penalty if: You didn't make a required payment because of a casualty event, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or.

What are exceptions to avoid underpayment penalty?

The IRS will waive your underpayment penalty if you: Didn't pay because of a casualty, disaster, or other unusual circumstance that would be unfair to impose the penalty, or. You retired (after reaching age 62) or became disabled in the current or prior tax year and: You had a reasonable cause for not making the payment.

Does MA accept federal extension?

Filing an extension with the IRS does not count as filing an extension for Massachusetts. An extension is an extension of time to file not to pay, any amount due will incur interest even if a valid extension is on file.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MA M-8736 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like MA M-8736, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute MA M-8736 online?

pdfFiller has made it simple to fill out and eSign MA M-8736. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the MA M-8736 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MA M-8736 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is MA M-8736?

MA M-8736 is a form used by Massachusetts taxpayers to report certain tax credits and adjustments related to their income tax.

Who is required to file MA M-8736?

Individuals who are eligible for specific tax credits or need to report certain adjustments to their state income tax are required to file MA M-8736.

How to fill out MA M-8736?

To fill out MA M-8736, you need to provide your personal information, details of the credits or adjustments being claimed, and any required supporting documentation as per the instructions for the form.

What is the purpose of MA M-8736?

The purpose of MA M-8736 is to allow taxpayers to formally claim tax credits or report specific adjustments, thereby ensuring accurate assessment of their tax liabilities.

What information must be reported on MA M-8736?

MA M-8736 requires reporting of the taxpayer's identity, type of tax credits or adjustments being claimed, and any required calculations or attachments as outlined in the form's instructions.

Fill out your MA M-8736 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA M-8736 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.