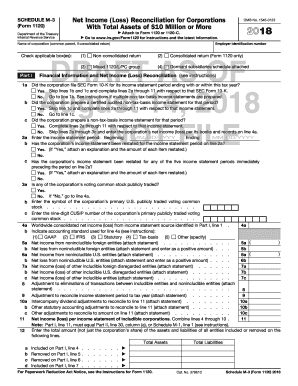

IL IL-941-X Schedule P 2018 free printable template

Show details

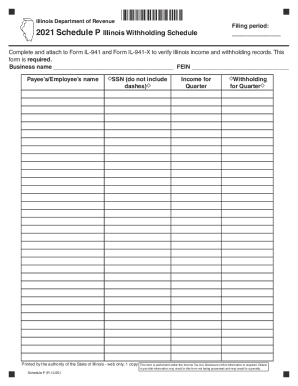

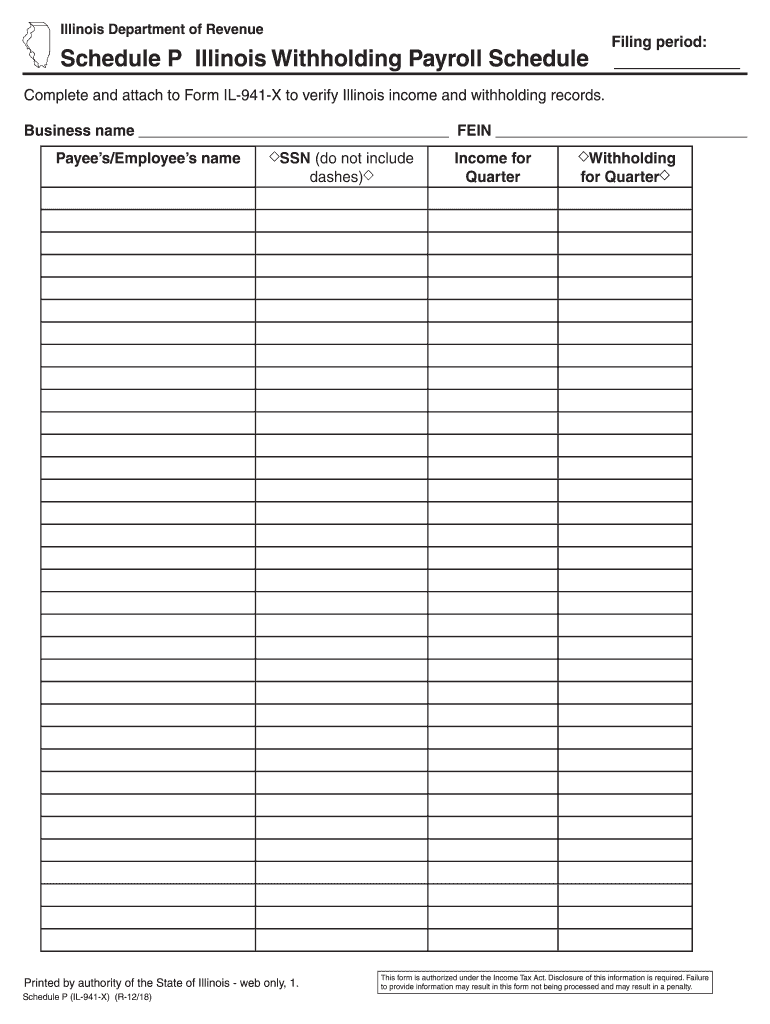

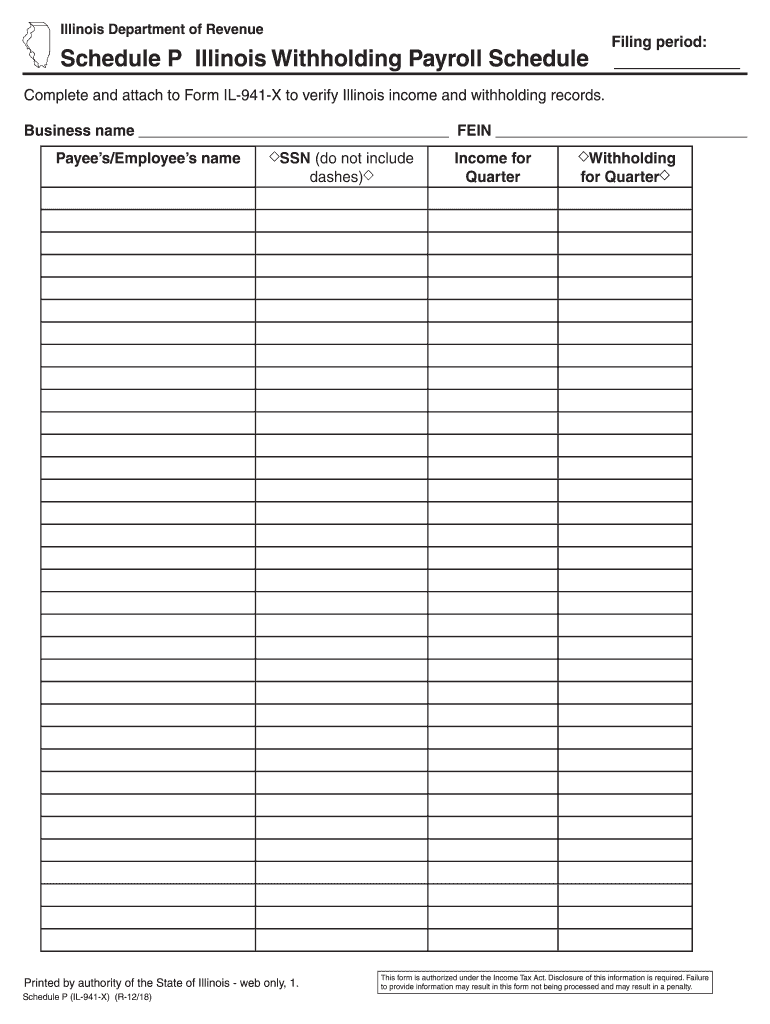

Illinois Department of RevenueSchedule P Illinois Withholding Payroll ScheduleFiling period: Complete and attach to Form IL941X to verify Illinois income and withholding records. Business name VEIN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL IL-941-X Schedule P

Edit your IL IL-941-X Schedule P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-941-X Schedule P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL IL-941-X Schedule P online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL IL-941-X Schedule P. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-941-X Schedule P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-941-X Schedule P

How to fill out IL IL-941-X Schedule P

01

Obtain the IL IL-941-X Schedule P form from the Illinois Department of Revenue website or your tax professional.

02

Enter your business name, address, and Employer Identification Number (EIN) at the top of the form.

03

Specify the tax period for which you are filing the adjustment in the appropriate section.

04

Review the previously filed IL-941 forms and the payments made to determine the necessary adjustments.

05

Complete section A for the type of adjustments you're making (increased or decreased amounts).

06

Clearly indicate the reasons for your adjustments in the designated area.

07

Provide the corrected amount for each line item as necessary.

08

Calculate the total adjustments and ensure that they reflect correctly throughout the form.

09

Sign and date the form, certifying that the information provided is accurate to the best of your knowledge.

10

Submit the completed IL IL-941-X Schedule P to the Illinois Department of Revenue by mail or online, as instructed.

Who needs IL IL-941-X Schedule P?

01

Businesses and employers in Illinois that need to correct previously filed IL-941 forms regarding their withholding tax liabilities.

02

Any entity that has made mistakes in reporting, underreported or overreported amounts on their IL-941 withholding tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 941 Schedule B 2023?

The IRS Form 941 Schedule B for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

What is the difference between IL-501 and IL-941?

Illinois withholding income tax payments are made on Form IL-501, Withholding Payment Coupon, and Illinois withholding is reported on Form IL-941, Illinois Withholding Income Tax Return.

What are the quarterly tax dates for 2023?

For 2022, use Estimated Tax for Individuals (Form 540-ES) when paying by mail. 1st quarter payment deadline: April 18, 2023. 2nd quarter payment deadline: June 15, 2023. 3rd quarter payment deadline: September 15, 2023. 4th quarter payment deadline: January 17, 2024.

What are the form 941 quarterly due dates?

Form 941 is generally due by the last day of the month following the end of the quarter. For example, you're required to file Form 941 by April 30 for wages you pay during the first quarter, January through March.

What are the Form 941 quarterly due dates 2023?

Forms Filed Quarterly with Due Dates of April 30, July 31, October 31, and January 31 (for the fourth quarter of the previous calendar year)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IL IL-941-X Schedule P?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the IL IL-941-X Schedule P in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete IL IL-941-X Schedule P on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IL IL-941-X Schedule P. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out IL IL-941-X Schedule P on an Android device?

Use the pdfFiller Android app to finish your IL IL-941-X Schedule P and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IL IL-941-X Schedule P?

IL IL-941-X Schedule P is an amendment form used to correct previously filed Illinois withholding tax returns, specifically to report changes to the amounts initially reported.

Who is required to file IL IL-941-X Schedule P?

Employers who have filed an IL-941 return and need to amend their reported figures to reflect accurate withholding amounts are required to file IL IL-941-X Schedule P.

How to fill out IL IL-941-X Schedule P?

To fill out IL IL-941-X Schedule P, you should provide your business information, the correct amounts for the periods being amended, and any explanations for the changes. Follow the instructions specific to the form for detailed guidance.

What is the purpose of IL IL-941-X Schedule P?

The purpose of IL IL-941-X Schedule P is to allow businesses to correct errors made in previously filed IL-941 returns for withholding taxes, thereby ensuring accurate reporting and compliance.

What information must be reported on IL IL-941-X Schedule P?

The information that must be reported includes the employer's identification details, the original amounts reported, the amended amounts, any adjustments for overpayments or underpayments, and explanations for the changes made.

Fill out your IL IL-941-X Schedule P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-941-X Schedule P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.