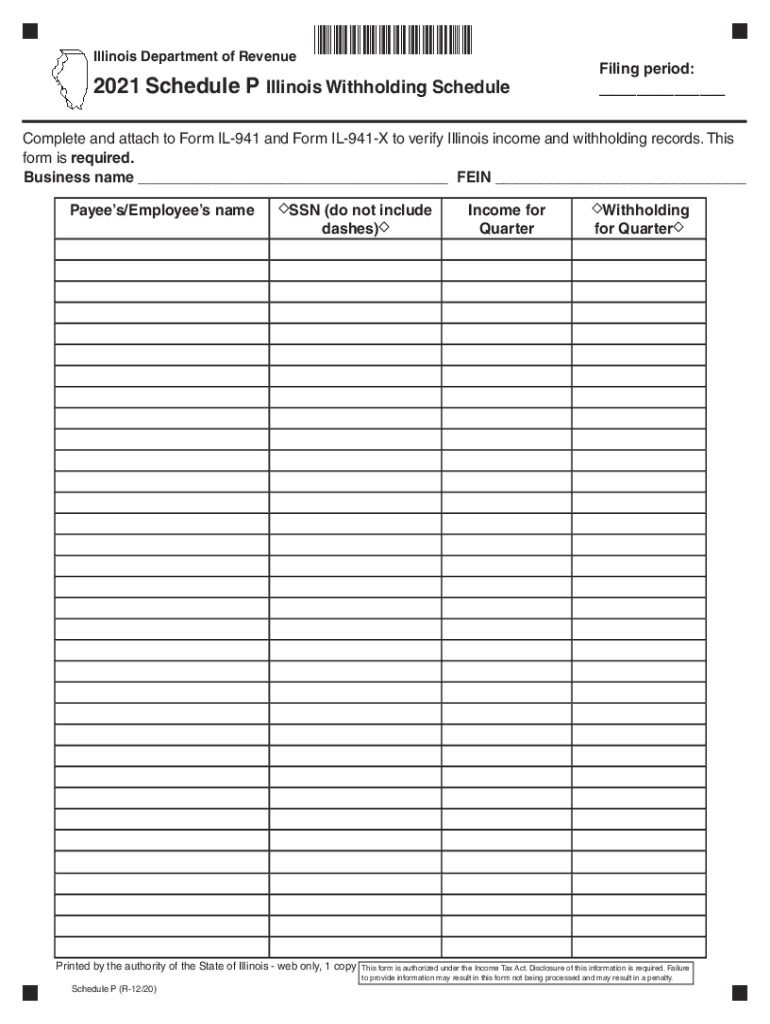

IL IL-941-X Schedule P 2021-2026 free printable template

Show details

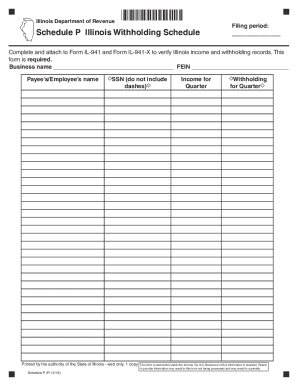

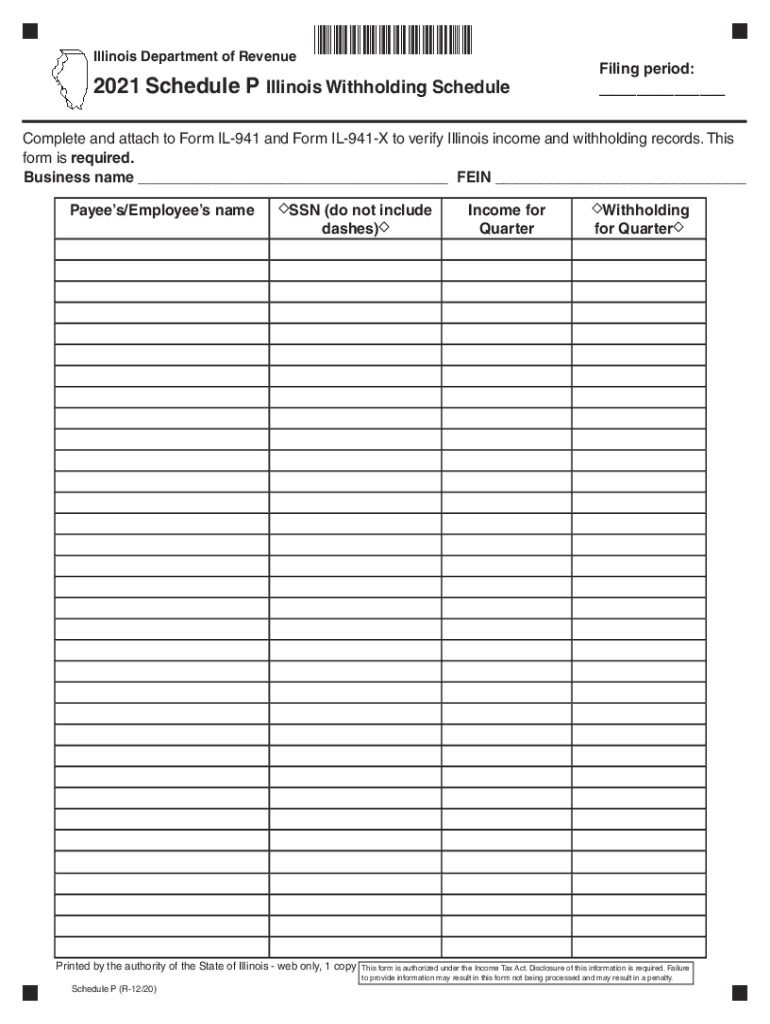

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.×72012211W×Illinois Department of Revenue2021 Schedule P Illinois Withholding ScheduleFiling

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL IL-941-X Schedule P

Edit your IL IL-941-X Schedule P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-941-X Schedule P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL IL-941-X Schedule P online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL IL-941-X Schedule P. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-941-X Schedule P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-941-X Schedule P

How to fill out IL IL-941-X Schedule P

01

Obtain the IL IL-941-X Schedule P form from the Illinois Department of Revenue website.

02

Fill in your business information, including the name, address, and FEIN.

03

Indicate the tax period for which you are filing the amended return.

04

Complete the sections that require you to report the original amounts, any changes, and the corrected amounts.

05

Ensure to provide a detailed explanation of the reasons for the corrections made.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form according to the instructions provided to the appropriate Illinois Department of Revenue address.

Who needs IL IL-941-X Schedule P?

01

Any business or individual who needs to amend a previously filed IL-941 form should file the IL IL-941-X Schedule P.

02

This includes those who need to correct errors in reported withholding amounts or make adjustments due to changes in payroll data.

Fill

form

: Try Risk Free

People Also Ask about

How is Illinois withholding tax calculated?

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent.

What is basic personal allowances Illinois?

For the 2021 tax year, it is $2,375 per exemption. If someone else can claim you as a dependent and your Illinios base income is $2,375 or less, your exemption allowance is $2,375. If income is greater than $2,375, your exemption allowance is 0. For prior tax years, see Form IL-1040 instructions for that year.

What form is the Illinois tax withholding?

You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your claimed allowances decreases, you must file a new Form IL-W-4 within 10 days.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is Illinois Schedule P?

What is Illinois Schedule P? Illinois (IL) has a new quarterly reporting requirement where the underlying tax record data must be reported along with the quarterly IL-941. It is expected to impact anyone who performs state withholding in IL.

What is IL-941?

You must file Form IL-941 if you paid amounts subject to Illinois withholding income tax (either required or by voluntary agreement), such as: • Wages and other employee compensation including bonus, overtime, and commission pay, usually reported to the recipient on a Form W-2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IL IL-941-X Schedule P without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like IL IL-941-X Schedule P, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send IL IL-941-X Schedule P for eSignature?

IL IL-941-X Schedule P is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit IL IL-941-X Schedule P on an Android device?

You can edit, sign, and distribute IL IL-941-X Schedule P on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IL IL-941-X Schedule P?

IL IL-941-X Schedule P is a form used by employers in Illinois to report adjustments to previously filed Illinois Withholding Income Tax Forms, specifically the IL-941.

Who is required to file IL IL-941-X Schedule P?

Employers who need to amend or correct their prior Illinois withholding tax filings are required to file the IL IL-941-X Schedule P.

How to fill out IL IL-941-X Schedule P?

To fill out IL IL-941-X Schedule P, employers should provide their identification information, indicate the tax period being amended, detail the adjustments being made, and provide any required supporting information.

What is the purpose of IL IL-941-X Schedule P?

The purpose of IL IL-941-X Schedule P is to allow employers to correct or amend previous withholding tax reports to ensure accurate tax liabilities and compliance with Illinois tax laws.

What information must be reported on IL IL-941-X Schedule P?

Information that must be reported on IL IL-941-X Schedule P includes the employer's identification information, the original amounts reported, the corrected amounts, and a detailed explanation of the adjustments being made.

Fill out your IL IL-941-X Schedule P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-941-X Schedule P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.