IL IL-941-X Schedule P 2019 free printable template

Show details

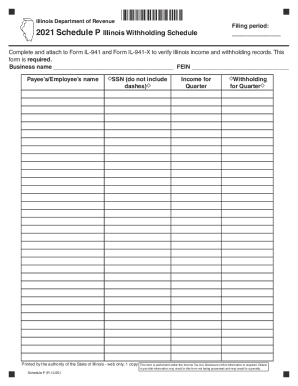

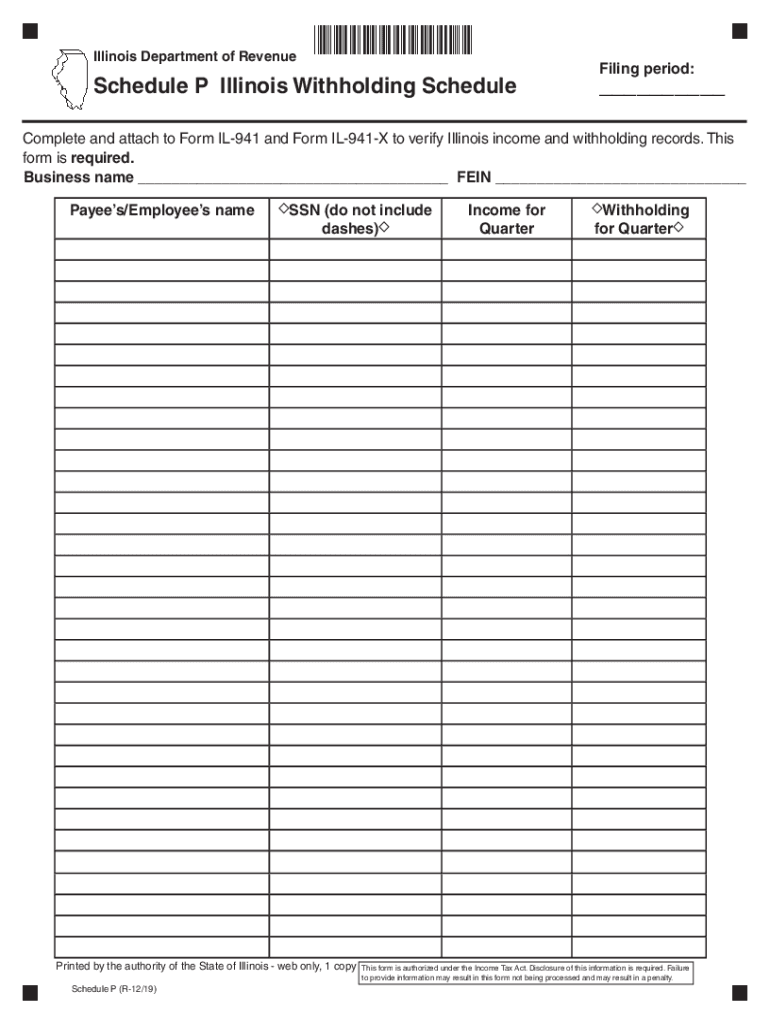

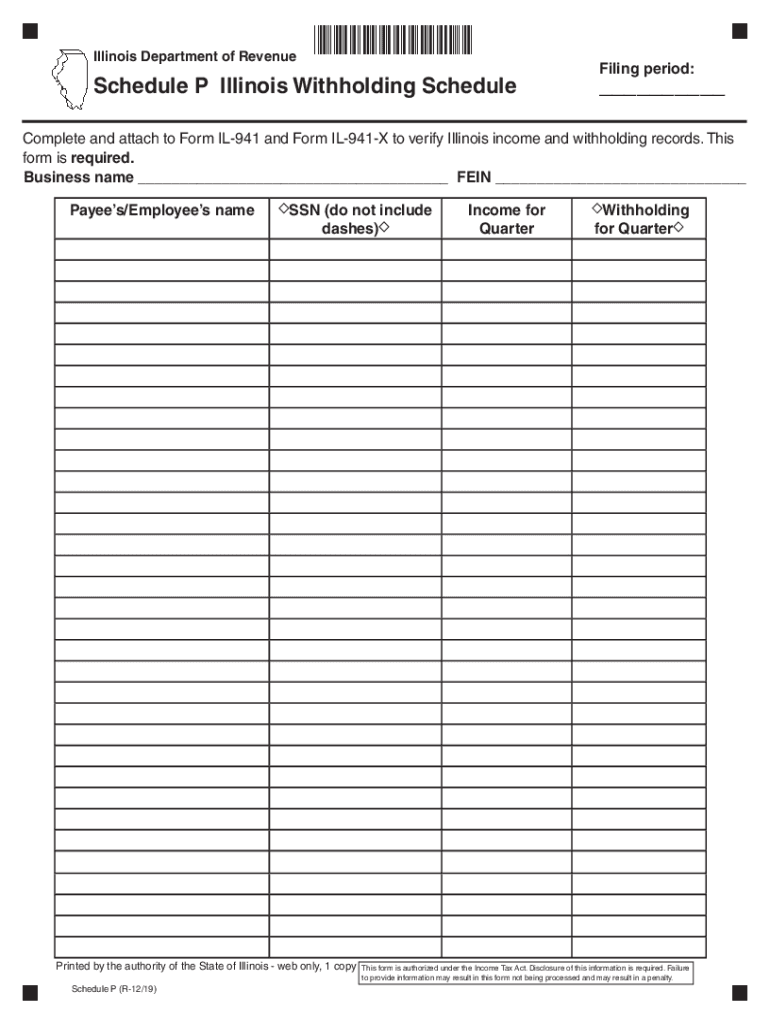

Illinois Department of RevenueSchedule P Illinois Withholding Payroll ScheduleFiling period: Complete and attach to Form IL941X to verify Illinois income and withholding records. Business name VEIN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL IL-941-X Schedule P

Edit your IL IL-941-X Schedule P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-941-X Schedule P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL IL-941-X Schedule P online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL IL-941-X Schedule P. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-941-X Schedule P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-941-X Schedule P

How to fill out IL IL-941-X Schedule P

01

Begin by obtaining the IL IL-941-X Schedule P form from the Illinois Department of Revenue website.

02

Fill in your name, address, and identification number at the top of the form.

03

Review your original IL-941 form and identify the lines that need correcting.

04

In the appropriate sections, enter the corrected figures directly related to your original submission.

05

If you're making an adjustment, clearly indicate the reason for the correction in the provided area.

06

Ensure that all calculations are accurate and that totals are properly updated based on the corrections.

07

Sign and date the form when you have completed the necessary fields.

08

Submit the completed IL-941-X Schedule P to the Illinois Department of Revenue, following their submission guidelines.

Who needs IL IL-941-X Schedule P?

01

Any taxpayer who needs to amend their previously submitted IL-941 form for payroll tax withholding adjustments in Illinois.

Fill

form

: Try Risk Free

People Also Ask about

How is Illinois withholding tax calculated?

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent.

What is basic personal allowances Illinois?

For the 2021 tax year, it is $2,375 per exemption. If someone else can claim you as a dependent and your Illinios base income is $2,375 or less, your exemption allowance is $2,375. If income is greater than $2,375, your exemption allowance is 0. For prior tax years, see Form IL-1040 instructions for that year.

What form is the Illinois tax withholding?

You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your claimed allowances decreases, you must file a new Form IL-W-4 within 10 days.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is Illinois Schedule P?

What is Illinois Schedule P? Illinois (IL) has a new quarterly reporting requirement where the underlying tax record data must be reported along with the quarterly IL-941. It is expected to impact anyone who performs state withholding in IL.

What is IL-941?

You must file Form IL-941 if you paid amounts subject to Illinois withholding income tax (either required or by voluntary agreement), such as: • Wages and other employee compensation including bonus, overtime, and commission pay, usually reported to the recipient on a Form W-2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL IL-941-X Schedule P?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific IL IL-941-X Schedule P and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in IL IL-941-X Schedule P without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing IL IL-941-X Schedule P and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit IL IL-941-X Schedule P on an Android device?

You can make any changes to PDF files, like IL IL-941-X Schedule P, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IL IL-941-X Schedule P?

IL IL-941-X Schedule P is a form used by employers to amend previously filed IL-941 returns related to Illinois withholding tax.

Who is required to file IL IL-941-X Schedule P?

Employers who need to correct errors in their previously filed IL-941 returns must file the IL IL-941-X Schedule P.

How to fill out IL IL-941-X Schedule P?

To fill out IL IL-941-X Schedule P, employers should provide the necessary corrections to their withholding amounts and any relevant information from the original IL-941 return being amended.

What is the purpose of IL IL-941-X Schedule P?

The purpose of IL IL-941-X Schedule P is to enable employers to correct mistakes in their earlier IL-941 filings and ensure accurate reporting of Illinois withholding tax.

What information must be reported on IL IL-941-X Schedule P?

Information that must be reported on IL IL-941-X Schedule P includes the corrected amounts of Illinois income tax withheld, the tax year, and details related to the errors being amended.

Fill out your IL IL-941-X Schedule P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-941-X Schedule P is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.