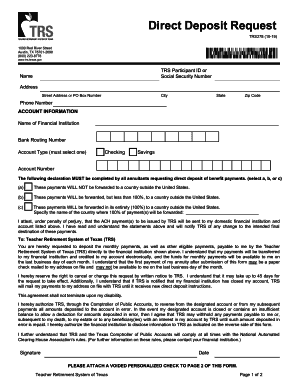

TX TRS 278 2016 free printable template

Show details

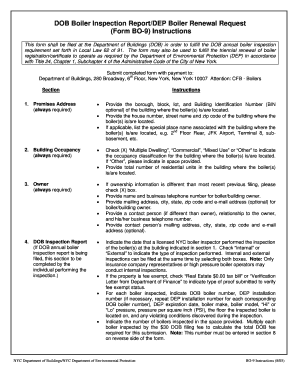

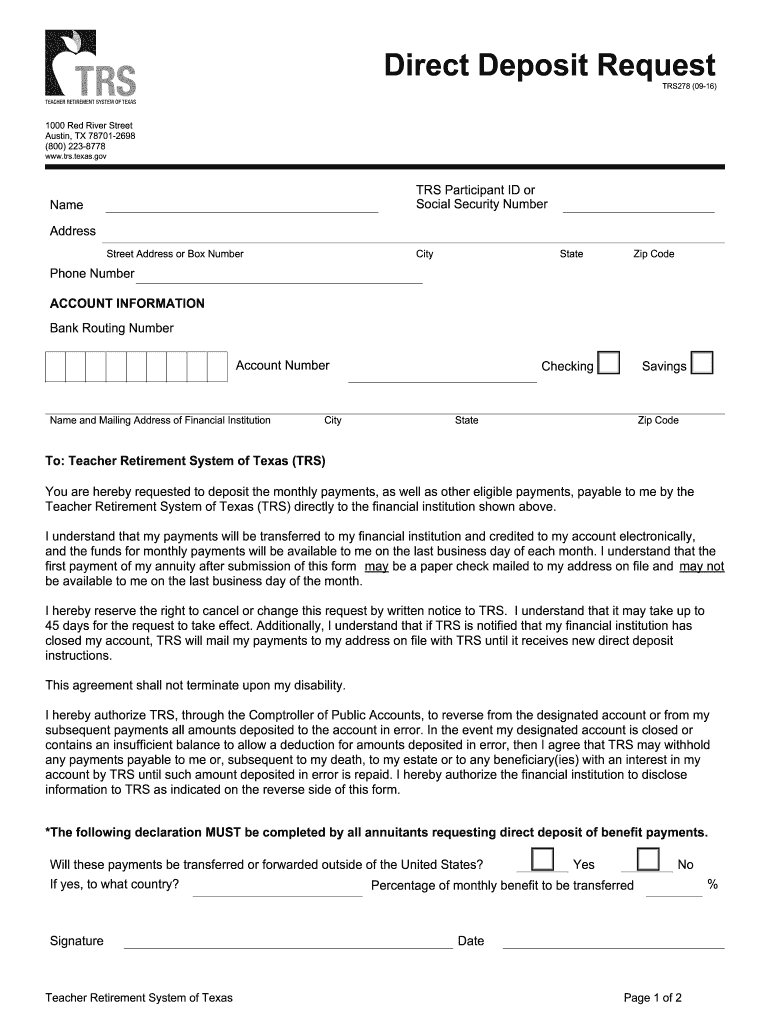

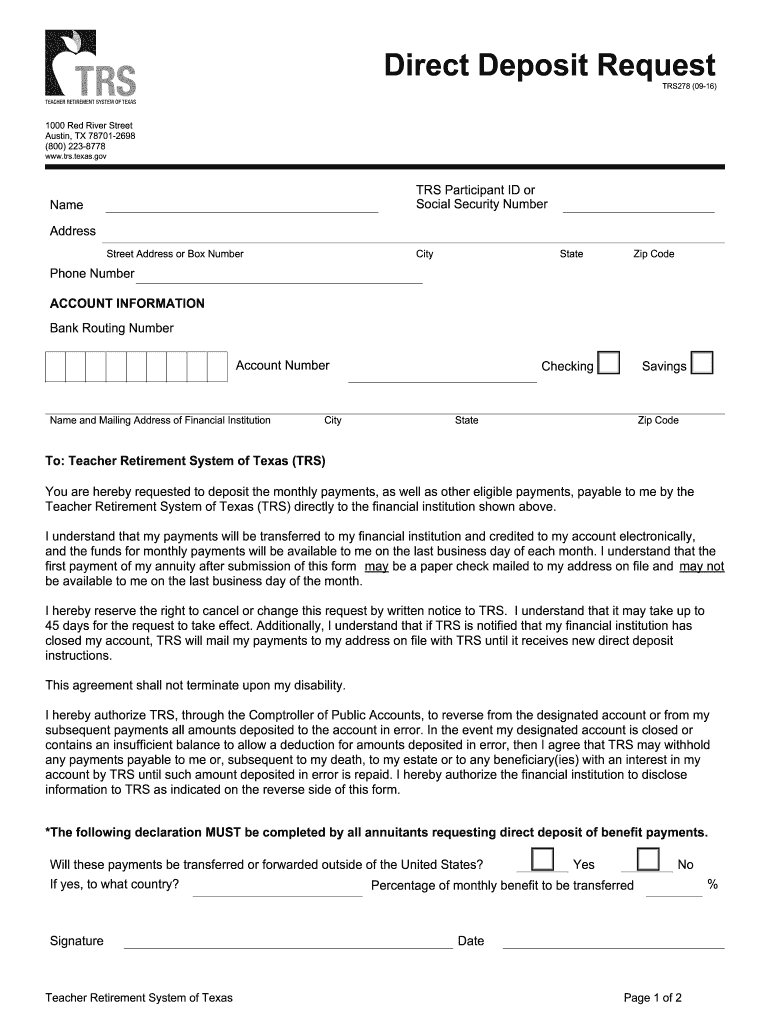

Trs. state. tx. us DIRECT DEPOSIT REQUEST Name Address Social Security No. Street Address or Box Number City State Zip Code Telephone No. ACCOUNT INFORMATION Bank Routing Number checking Account number Name and Mailing Address of Financial Institution savings Must check one To Teacher Retirement System of Texas TRS You are hereby requested to deposit the monthly payments as well as other eligible payments payable to me by the Teacher Retirement S...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TRS 278

Edit your TX TRS 278 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TRS 278 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX TRS 278 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX TRS 278. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TRS 278 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TRS 278

How to fill out TX TRS 278

01

Start by downloading the TX TRS 278 form from the official Texas TRS website.

02

Fill in your personal information in the designated fields, including your name, address, and contact information.

03

Provide your Social Security Number or Employee Identification Number if required.

04

Indicate the type of leave you are requesting and the dates it covers.

05

Complete the reason for your leave in the specified section.

06

Review any required documentation that may need to accompany the form, such as medical certificates or supporting documents.

07

Sign and date the form to certify that all information provided is accurate.

08

Submit the completed TX TRS 278 form to your employer or the designated TRS office.

Who needs TX TRS 278?

01

Individuals who are employees under the Texas Teacher Retirement System.

02

Employees seeking to request a leave of absence.

03

Educators and staff members looking to ensure their retirement service credit is maintained during a leave period.

Fill

form

: Try Risk Free

People Also Ask about

How many years do I need to retire with TRS in Texas?

To be eligible for normal-age service retirement, you must meet one of the following conditions: you are age 65 with at least five years of service credit, or • you meet the Rule of 80 (your age and years of service credit total at least 80) and you have at least five years of service credit.

How does Texas TRS retirement work?

Pension: TRS Retirement Your monthly TRS contributions, as well as contributions from the state and your employer, help fund your future TRS retirement. Upon retirement, you would receive a monthly annuity for life. There are no automatic increases to your annuity once you have retired.

How long do you have to be vested in Texas TRS?

What is vesting and how do I vest? TRS Vesting with TRS means you have the right to a lifetime annuity and that your account will continue to earn interest, even if you are no longer an active, contributing member. To be vested requires that you earn five years of service credit.

How do I withdraw money from TRS Texas?

Obtain the Application for Refund form (TRS 6) and Special Tax Notice Regarding Rollover Options under TRS from the TRS website or by calling the TRS Automated Telephone System at 1-800-223-8778. Read and complete the Application for Refund form (TRS 6), sign the form, and have it notarized.

Can I collect Texas teacher retirement and Social Security?

Yes! If you are drawing Social Security when you retire, or when you start drawing Social Security in the future, you should be certain that Social Security knows the amount of your TRS payment.

How do I file for retirement in Texas?

You can apply: Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Call ahead to make an appointment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX TRS 278 for eSignature?

Once you are ready to share your TX TRS 278, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find TX TRS 278?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific TX TRS 278 and other forms. Find the template you need and change it using powerful tools.

How do I execute TX TRS 278 online?

Filling out and eSigning TX TRS 278 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is TX TRS 278?

TX TRS 278 is a financial disclosure form required by the Texas Ethics Commission for state officers and employees to report their personal financial interests and income.

Who is required to file TX TRS 278?

State officers and employees who hold certain positions within Texas state government, including elected officials and high-ranking appointed officials, are required to file the TX TRS 278.

How to fill out TX TRS 278?

To fill out TX TRS 278, you need to gather your financial information, including income, assets, and liabilities, and complete the form by listing this information in the appropriate sections, ensuring accuracy and completeness before submission.

What is the purpose of TX TRS 278?

The purpose of TX TRS 278 is to promote transparency and accountability in government by ensuring that state officers and employees disclose their financial interests and potential conflicts of interest.

What information must be reported on TX TRS 278?

On TX TRS 278, individuals must report information such as sources of income, real estate assets, stocks and bonds, liabilities, and any other financial interests that may present a conflict of interest.

Fill out your TX TRS 278 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TRS 278 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.