TX TRS 278 2019 free printable template

Get, Create, Make and Sign TX TRS 278

How to edit TX TRS 278 online

Uncompromising security for your PDF editing and eSignature needs

TX TRS 278 Form Versions

How to fill out TX TRS 278

How to fill out TX TRS 278

Who needs TX TRS 278?

Instructions and Help about TX TRS 278

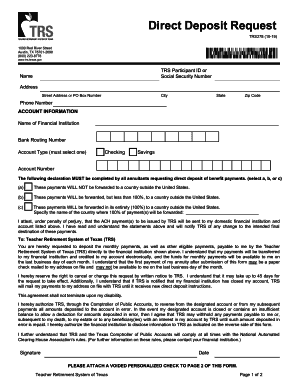

Hi I'm Adam Yarbrough Are you an active member thinking about retirement If so this video is for you, We are here to provide a general timeline of the retirement process and share the steps you need to take to ensure the process is as easy as possible Remember the countdown to retirement can start as much as a year prior to your actual planned retirement date, so you will first need to choose your retirement date This video breaks down planning for retirement into three major steps Lets get started Step One ten to twelve months prior to retirement If you are truly considering retirement log in to your Myths account to explore options with the retirement calculator After using the Myths retirement calculator if you're confident that retirement is in sight feel free to request a formal estimate To get an estimate complete and submit Form TRS 18 Request for Estimate of Retirement Benefits up to 12 months before your retirement date This form can be found on the Forms page of the TRS website at wwwtrstexasgov We will mail a retirement packet to your address of record within 60 days of receiving your Form TRS 18 During this time frame you may also want to Watch our Member Education and Financial Awareness videos Review your retirement options Attend a benefits presentation Purchase service credit or transfer credit and Schedule an appointment with a Benefits Counselor Step Two six months prior to retirement date Once you receive your retirement packet carefully review its contents The packet contains your retirement estimate and information on a number of forms and documents that need to be submitted to TRS There will be important deadlines listed in the packet The first and most important form in your packet is Form TRS 30 Application for Service Retirement You will use this form to Indicate your preferred retirement date Select your choice of retirement payment plan and Designate your beneficiary or beneficiaries TRS must verify your age at retirement In your packet you will have a TRS 13 Acceptable Proof of Age Documents which contains a list of documents that are accepted for proof of age It is very important that you write your participant ID or social security number on all proof of age documents that you submit Your retirement benefit is subject to federal income tax If you would like to specify income tax withholding for your annuity payment please submit Form TRS 228A Federal Income Tax Withholding Certificate Direct Deposit is the fastest way to receive your annuity payment every month We highly recommend that you consider this as an option for receiving your payment To do this complete and submit Form TRS 278 Direct Deposit Request Step three thirty to sixty days prior to retirement Don't forget to let your employer know that you are planning to retire and formally resign your position by your retirement date with TRS The Notice of Final Deposit before Retirement and School Official Certification of Salaries contains important information...

People Also Ask about

How long does it take to get first retirement check from TRS?

What happens to my retirement if I quit teaching?

Can I cash out my TRS Texas?

What happens to my TRS if I quit?

Are retired Texas teachers getting a raise in 2022?

Can I borrow from my Texas TRS account?

What happens to my TRS if I quit Texas?

Do TRS benefits increase with inflation?

What happens to TRS if I leave teaching Texas?

Can I take money out of my TRS account?

Can I still pay into my teachers pension if I leave teaching?

Can you cash out TRS early?

How long does it take for TRS to process retirement?

Do retired Texas teachers get a cost-of-living raise?

Will TRS retirees get a raise in 2022?

How long does TRS refund take?

Will TRS get a 13th check in 2023?

How can I get my TRS money?

Can TRS be taken as lump sum?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX TRS 278?

How do I execute TX TRS 278 online?

Can I edit TX TRS 278 on an Android device?

What is TX TRS 278?

Who is required to file TX TRS 278?

How to fill out TX TRS 278?

What is the purpose of TX TRS 278?

What information must be reported on TX TRS 278?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.