TX TRS 278 2012 free printable template

Get, Create, Make and Sign TX TRS 278

Editing TX TRS 278 online

Uncompromising security for your PDF editing and eSignature needs

TX TRS 278 Form Versions

How to fill out TX TRS 278

How to fill out TX TRS 278

Who needs TX TRS 278?

Instructions and Help about TX TRS 278

Music hey welcome back guys, so today we are talking about the cash app and more specifically we're gonna talk about and go through the steps to set up a paycheck direct deposit to your cash app so like if your employer wants to pay you through direct deposit it doesn't necessarily have to go to a bank you can send it to your cash app which is kind of convenient so let's go ahead and get the started, so I've already opened up the app right here if you don't have cash app be sure to check the description below, and I'll leave my referral link there just click on it, and then you can sign up pretty easily and then once you've followed a couple of different steps then you get five bucks and I get five bucks as well, or you can just easily go to the app store and look for cash app, so I got the cash app it opens right now as you can see here this is the home screen and I want to let you know first off before you go any further in order to have a paycheck direct deposited into your cash app you do have to have already signed up and activated your cash app cash cart the Visa cash card if you don't have that yet go back and watch my other video how to order a cash app cash card and then that'll kind of walk you through the steps it's a pretty easy process but without that card you cannot set up direct deposit for your paycheck into cash app so here we are let's go ahead and assume that you've already gotten your cash app cash card, and we're going to set this up to get a direct deposit for your paycheck what you want to do is you want to go right here to the Settings tab which is this little icon right here on the top left you might have your picture there or a picture I didn't put my picture, so it just has that general little circle there, so I'm going to click there alright once you are in this screen that when you're going to want to do is scroll down to where it says funds so right there it says funds, and then you're going to click on the cash portion so this is Bitcoin your bank account credit card, but we're not gonna worry about that we just go to cash and then click there okay so once you're in this screen it's gonna show what balance you have in your cash app if you have any at all you can cash out or add cash not going to pay attention to that and then here is the cash card down here scroll down a little more alright so here we are so this is where you want to look for see how it says direct deposit, and then it shows the routing number and then part of the account number so what you're going to want to do is go ahead and click get account number all right so here we are we've clicked get account number, and then it's going to come up with this warning or informational page it says you can have your employer send paychecks directly to a direct deposit account which is attached to your cash app and there are some terms and agreements and more information there if you feel like reading that you're welcome to but then what you want to do is go...

People Also Ask about

How do I change my direct deposit on my Texas TRS?

Is TRS the same as 401 K?

How do I change my direct deposit from one bank to another?

What day of the month do Texas retired teachers get paid?

Can I take money out of my Texas TRS account?

Will retired teachers in Texas get a 13th check?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX TRS 278 to be eSigned by others?

How do I edit TX TRS 278 in Chrome?

How do I edit TX TRS 278 on an Android device?

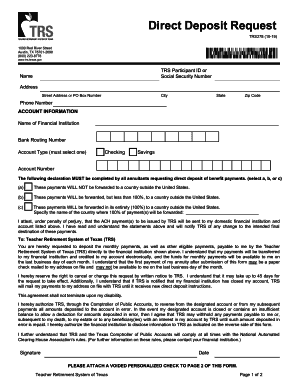

What is TX TRS 278?

Who is required to file TX TRS 278?

How to fill out TX TRS 278?

What is the purpose of TX TRS 278?

What information must be reported on TX TRS 278?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.