AR AR4EC 2019 free printable template

Show details

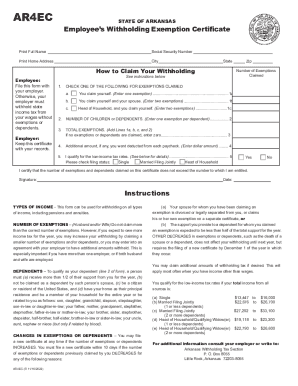

AR4ECSTATE OF ARKANSASEmployees Withholding Exemption CertificatePrint Full Name Social Security Number Print Home Address City State Zip How to Claim Your Withholding Employee: File this form with

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR AR4EC

Edit your AR AR4EC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR AR4EC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR AR4EC online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AR AR4EC. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR4EC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR AR4EC

How to fill out AR AR4EC

01

Gather all necessary financial documents.

02

Start by entering the required personal information in the designated sections.

03

Follow the instructions carefully for each section to input your income details.

04

Provide any deductions or credits that apply to your situation.

05

Review all sections for accuracy before submitting.

06

Submit the form electronically or print it out to send by mail.

Who needs AR AR4EC?

01

Individuals who have earned income and need to report it.

02

Self-employed individuals who are required to file taxes.

03

Those who are claiming deductions or credits for the tax year.

04

Residents of the area that requires the AR AR4EC form for local tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my Arkansas withholding tax ID number?

Find Your Arkansas Tax ID Numbers and Rates You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

What number should I use for withholding?

Most taxpayers will put a number on line 5 (indicated here by the red arrow) that will help your employer calculate how much federal income tax is to be withheld from your paycheck. That number is the number of allowances you are claiming and it's the one that gives taxpayers fits trying to get right.

What percentage of taxes are taken out of a paycheck in Arkansas?

Overview of Arkansas Taxes Gross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

What is the best amount to claim on w4?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Does Arkansas have local withholding tax?

There are no local income taxes imposed in Arkansas.

How do I pay withholding tax in Arkansas?

INCOME TAX WITHHOLDING Employers are required to remit monthly the full amount withheld from the wages of all employees. Payments are due on the 15th of the following month. Payments can be made by mail using the 941M form.

Does Arkansas have a W4 form?

In addition to the federal income tax withholding form, W4, each employee needs to fill out an Arkansas State income tax withholding form, AR4EC.

What is AR withholding?

Withholding on supplemental wages The Department suggests that employers advise their employees that the 4.9% withholding rate could, in some cases, be more than the income tax liability and cannot be recovered until the employee files the Arkansas personal income tax return.

Does Arkansas have a state withholding form?

Please call Financial Services – Payroll at 501-916-3318 for assistance with this form or if you have other questions.

How do I set up Arkansas withholding?

Send the state copies of your W-2s with the ARW-3 (Transmittal of Wage and Tax Statement) and the state copies of your 1099s along with a photocopy of your federal transmittal form 1096 to the address below by January 31st. The annual reconciliation (AR3MAR) is also required and due by February 28th.

Does Arkansas have state payroll taxes?

Arkansas Income Tax Withholding Arkansas law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Finance and Administration.

What is a normal tax withholding?

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.

How should I set up my withholdings?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

What is Arkansas state tax withholding?

The Department suggests that employers advise their employees that the 4.9% withholding rate could, in some cases, be more than the income tax liability and cannot be recovered until the employee files the Arkansas personal income tax return. (Withholding Tax, Employer's Instructions, p 4.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my AR AR4EC in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your AR AR4EC and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit AR AR4EC on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share AR AR4EC on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete AR AR4EC on an Android device?

Complete your AR AR4EC and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is AR AR4EC?

AR AR4EC is a form used by entities to report certain financial information to the state's tax authority.

Who is required to file AR AR4EC?

Entities that meet specific income thresholds or are required to report certain financial activities are mandated to file AR AR4EC.

How to fill out AR AR4EC?

To fill out AR AR4EC, you should gather the required financial documents, follow the form's instructions, and accurately input the relevant financial data.

What is the purpose of AR AR4EC?

The purpose of AR AR4EC is to ensure that businesses report their financial information accurately, helping the tax authority assess tax liabilities.

What information must be reported on AR AR4EC?

Information that must be reported on AR AR4EC includes total income, deductions, credits, and any pertinent financial figures required by state law.

Fill out your AR AR4EC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR ar4ec is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.