AR AR4EC 2020 free printable template

Show details

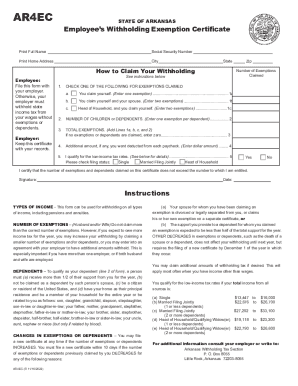

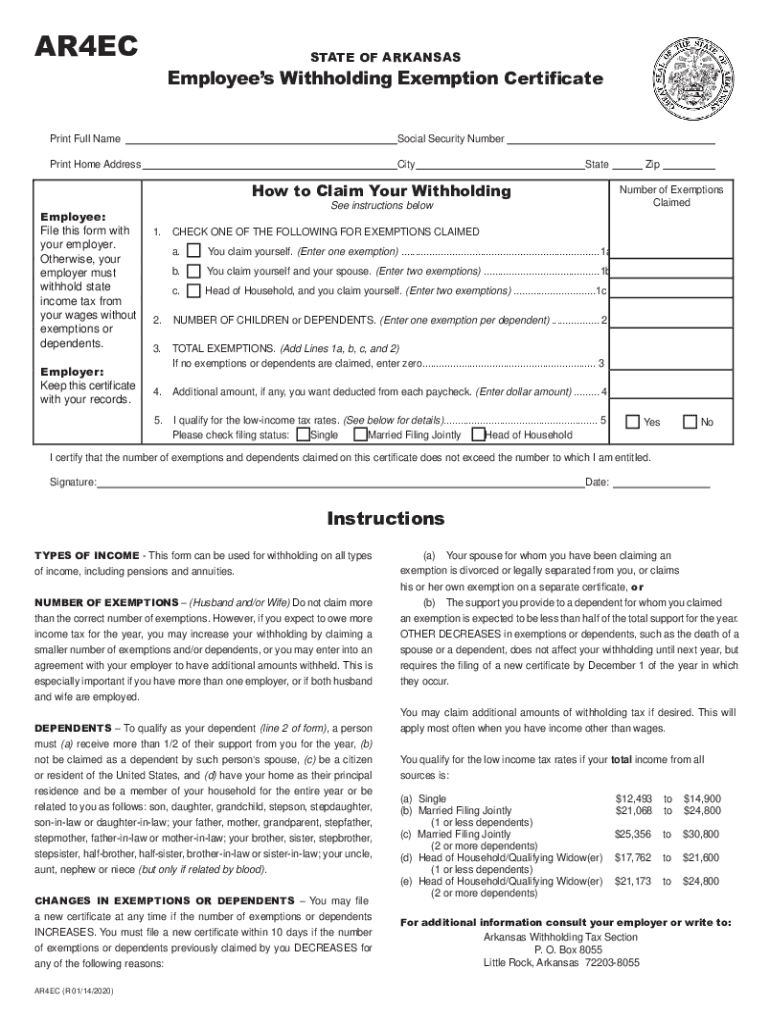

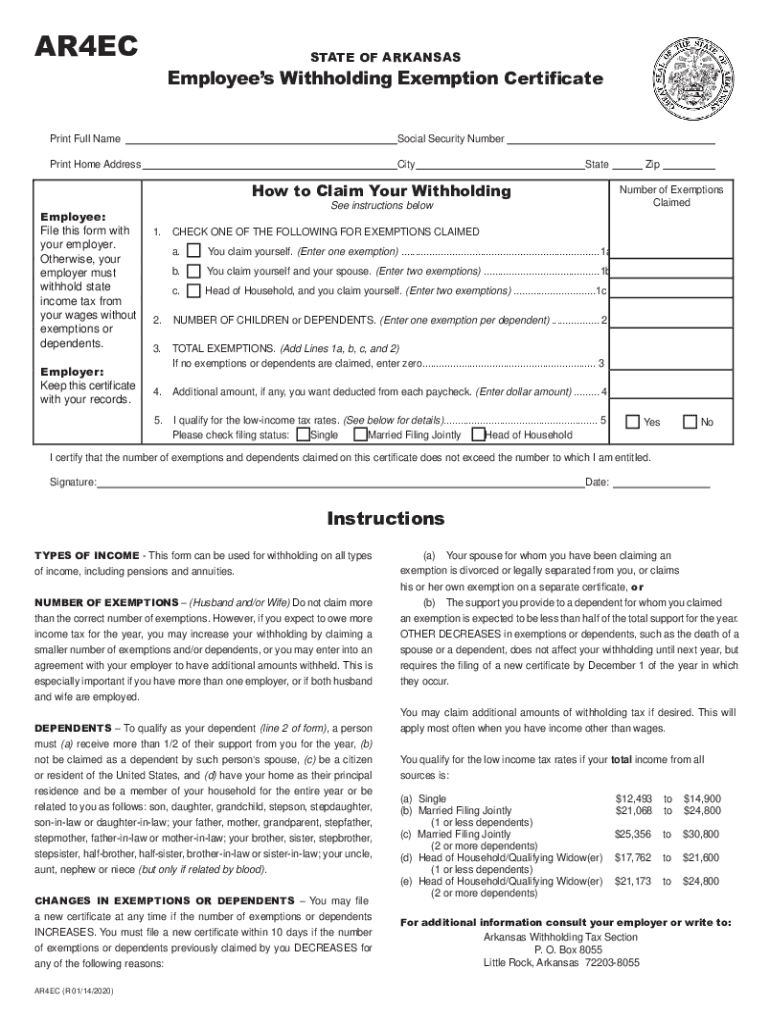

AR4ECSTATE OF ARKANSASEmployees Withholding Exemption CertificatePrint Full Asocial Security Numbering Home AddressCityStateHow to Claim Your Withholding

Employee:

File this form with

your employer.

Otherwise,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR AR4EC

Edit your AR AR4EC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR AR4EC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AR AR4EC online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AR AR4EC. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR4EC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR AR4EC

How to fill out AR AR4EC

01

Begin by gathering all necessary personal and financial information.

02

Fill in your personal details including your name, address, and contact information.

03

Provide information about your income, including any wages, benefits, or other sources.

04

Detail any deductions or credits you may be eligible for.

05

Double-check all entries for accuracy.

06

Follow any additional instructions provided with the form.

07

Submit the form by the deadline, keeping a copy for your records.

Who needs AR AR4EC?

01

Individuals who are required to file a tax return.

02

Taxpayers seeking to report their income and claim any eligible deductions.

03

Those looking to apply for tax credits or benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is an AR941A form?

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year. By February 28. File Form AR3MAR. File AR3MAR, Employers Annual Reconciliation of Income Tax Withheld for the previous calendar year.

How do I pay withholding tax in Arkansas?

INCOME TAX WITHHOLDING Employers are required to remit monthly the full amount withheld from the wages of all employees. Payments are due on the 15th of the following month. Payments can be made by mail using the 941M form.

How should I set up my withholdings?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

How to apply for an Arkansas withholding account?

To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form. Blank forms are available from the DFR website.

What are Arkansas payroll taxes?

Arkansas State Payroll Taxes The 2022 tax rates range from 2% on the low end to 5.5% on the high end. Employees who make more than $79,300 will hit the highest tax bracket. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

How do I set up a withholding account in Arkansas?

You set up your account by registering your business with the DFA either online or on paper. To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form.

Is there a new W-4 form for 2022?

The 2022 Form W-4, Employee's Withholding Certificate, has not yet been released by the IRS. As soon as a new form is released we will notify you. Until then, you may use the 2021 W-4 version to make any changes to your withholdings.

Which states have W-4 forms?

Updated federal W-4 Colorado* (employees can use either the federal W-4 or Colorado's state W-4 form) Delaware* (employees can use either the federal W-4 or Delaware's state W-4 form) Idaho. Minnesota. Montana. Nebraska. South Carolina.

What is the IRS supplemental tax rate for 2022?

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, is 6.2% each for the employer and employee, or 12.4% for both.

How do I get an Arkansas withholding tax number?

Register With the Department of Finance and Administration To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form.

How do I set up payroll in Arkansas?

Running Payroll in Arkansas—Step-by-Step Instructions Step 1: Set up your business as an employer. Step 2: Register with the State of Arkansas. Set up your payroll process. Step 4: Collect employee payroll forms. Step 5: Collect, review, and approve time sheets. Step 6: Calculate payroll and pay employees.

How do I get my Arkansas withholding tax ID number?

Find Your Arkansas Tax ID Numbers and Rates You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

Does Arkansas have state payroll taxes?

Arkansas Income Tax Withholding Arkansas law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Finance and Administration.

Does Arkansas have a W4 form?

In addition to the federal income tax withholding form, W4, each employee needs to fill out an Arkansas State income tax withholding form, AR4EC.

Does Arkansas have a W-4?

All new employees for your business must complete a federal Form W-4. New employees also should complete one of two related Arkansas forms: Form AR4EC, Employee's Withholding Exemption Certificate, or Form AR4ECSP,Employee's Special Withholding Exemption Certificate.

Does Arkansas have a state withholding form?

Please call Financial Services – Payroll at 501-916-3318 for assistance with this form or if you have other questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in AR AR4EC?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your AR AR4EC to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the AR AR4EC in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your AR AR4EC in seconds.

Can I create an eSignature for the AR AR4EC in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your AR AR4EC right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is AR AR4EC?

AR AR4EC is a form used in the state of Arkansas for reporting entities engaged in the business of receiving and paying out funds for services, including audits and other related financial activities.

Who is required to file AR AR4EC?

Any business entity that receives or pays out funds for services in the state of Arkansas is required to file AR AR4EC.

How to fill out AR AR4EC?

To fill out AR AR4EC, you need to provide detailed information about the entity, including its name, address, tax identification number, and specifics about the funds received and paid out during the reporting period.

What is the purpose of AR AR4EC?

The purpose of AR AR4EC is to ensure that entities operating within Arkansas comply with state regulations regarding financial reporting and to facilitate the tracking of taxable transactions.

What information must be reported on AR AR4EC?

AR AR4EC requires reporting of the entity's identifying information, total amounts received and paid out, the nature of services provided, and any other relevant financial information as specified by the state's guidelines.

Fill out your AR AR4EC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR ar4ec is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.