AR AR4EC 2021 free printable template

Show details

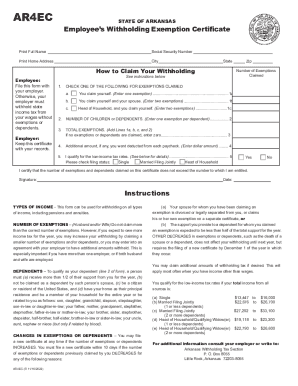

AR4ECSTATE OF ARKANSASEmployees Withholding Exemption CertificatePrint Full Asocial Security Numbering Home AddressCityStateHow to Claim Your Withholding

Employee:

File this form with

your employer.

Otherwise,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR AR4EC

Edit your AR AR4EC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR AR4EC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR AR4EC online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AR AR4EC. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR4EC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR AR4EC

How to fill out AR AR4EC

01

Gather necessary personal information including your name, address, and Social Security number.

02

Obtain any required financial documentation such as income statements, tax returns, and expense reports.

03

Carefully read the instructions provided with the AR AR4EC form to understand each section.

04

Complete each section of the form by entering the required information accurately.

05

Double-check the form for any errors or missing information before submission.

06

Sign and date the form as required.

07

Submit the completed form to the appropriate agency or department as instructed.

Who needs AR AR4EC?

01

Individuals who are applying for certain state benefits or entitlements.

02

Taxpayers who need to report specific financial information.

03

Persons seeking to verify eligibility for certain programs or services.

Fill

form

: Try Risk Free

People Also Ask about

What is an AR941A form?

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year. By February 28. File Form AR3MAR. File AR3MAR, Employers Annual Reconciliation of Income Tax Withheld for the previous calendar year.

How do I pay withholding tax in Arkansas?

INCOME TAX WITHHOLDING Employers are required to remit monthly the full amount withheld from the wages of all employees. Payments are due on the 15th of the following month. Payments can be made by mail using the 941M form.

How should I set up my withholdings?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

How to apply for an Arkansas withholding account?

To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form. Blank forms are available from the DFR website.

What are Arkansas payroll taxes?

Arkansas State Payroll Taxes The 2022 tax rates range from 2% on the low end to 5.5% on the high end. Employees who make more than $79,300 will hit the highest tax bracket. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

How do I set up a withholding account in Arkansas?

You set up your account by registering your business with the DFA either online or on paper. To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form.

Is there a new W-4 form for 2022?

The 2022 Form W-4, Employee's Withholding Certificate, has not yet been released by the IRS. As soon as a new form is released we will notify you. Until then, you may use the 2021 W-4 version to make any changes to your withholdings.

Which states have W-4 forms?

Updated federal W-4 Colorado* (employees can use either the federal W-4 or Colorado's state W-4 form) Delaware* (employees can use either the federal W-4 or Delaware's state W-4 form) Idaho. Minnesota. Montana. Nebraska. South Carolina.

What is the IRS supplemental tax rate for 2022?

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, is 6.2% each for the employer and employee, or 12.4% for both.

How do I get an Arkansas withholding tax number?

Register With the Department of Finance and Administration To register online, use the Arkansas Taxpayer Access Point (ATAP). If you register online you should receive your account number immediately. To register on paper, use Form AR-1R, Combined Business Tax Registration Form.

How do I set up payroll in Arkansas?

Running Payroll in Arkansas—Step-by-Step Instructions Step 1: Set up your business as an employer. Step 2: Register with the State of Arkansas. Set up your payroll process. Step 4: Collect employee payroll forms. Step 5: Collect, review, and approve time sheets. Step 6: Calculate payroll and pay employees.

How do I get my Arkansas withholding tax ID number?

Find Your Arkansas Tax ID Numbers and Rates You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

Does Arkansas have state payroll taxes?

Arkansas Income Tax Withholding Arkansas law requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Finance and Administration.

Does Arkansas have a W4 form?

In addition to the federal income tax withholding form, W4, each employee needs to fill out an Arkansas State income tax withholding form, AR4EC.

Does Arkansas have a W-4?

All new employees for your business must complete a federal Form W-4. New employees also should complete one of two related Arkansas forms: Form AR4EC, Employee's Withholding Exemption Certificate, or Form AR4ECSP,Employee's Special Withholding Exemption Certificate.

Does Arkansas have a state withholding form?

Please call Financial Services – Payroll at 501-916-3318 for assistance with this form or if you have other questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AR AR4EC to be eSigned by others?

Once your AR AR4EC is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the AR AR4EC in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your AR AR4EC right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete AR AR4EC on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your AR AR4EC by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is AR AR4EC?

AR AR4EC is a form used in Arkansas for reporting certain tax information, typically related to employer tax obligations.

Who is required to file AR AR4EC?

Employers in Arkansas who have employees and are subject to state income tax withholding are required to file AR AR4EC.

How to fill out AR AR4EC?

To fill out AR AR4EC, gather all necessary employee wage and tax information, complete the form according to the provided instructions, and ensure accurate reporting of withheld taxes.

What is the purpose of AR AR4EC?

The purpose of AR AR4EC is to report the amount of state income tax withheld from employee wages to the state of Arkansas.

What information must be reported on AR AR4EC?

AR AR4EC requires reporting information including total wages paid, total state tax withheld, and details about the employer and employees.

Fill out your AR AR4EC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR ar4ec is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.